Tennessee Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed

Description

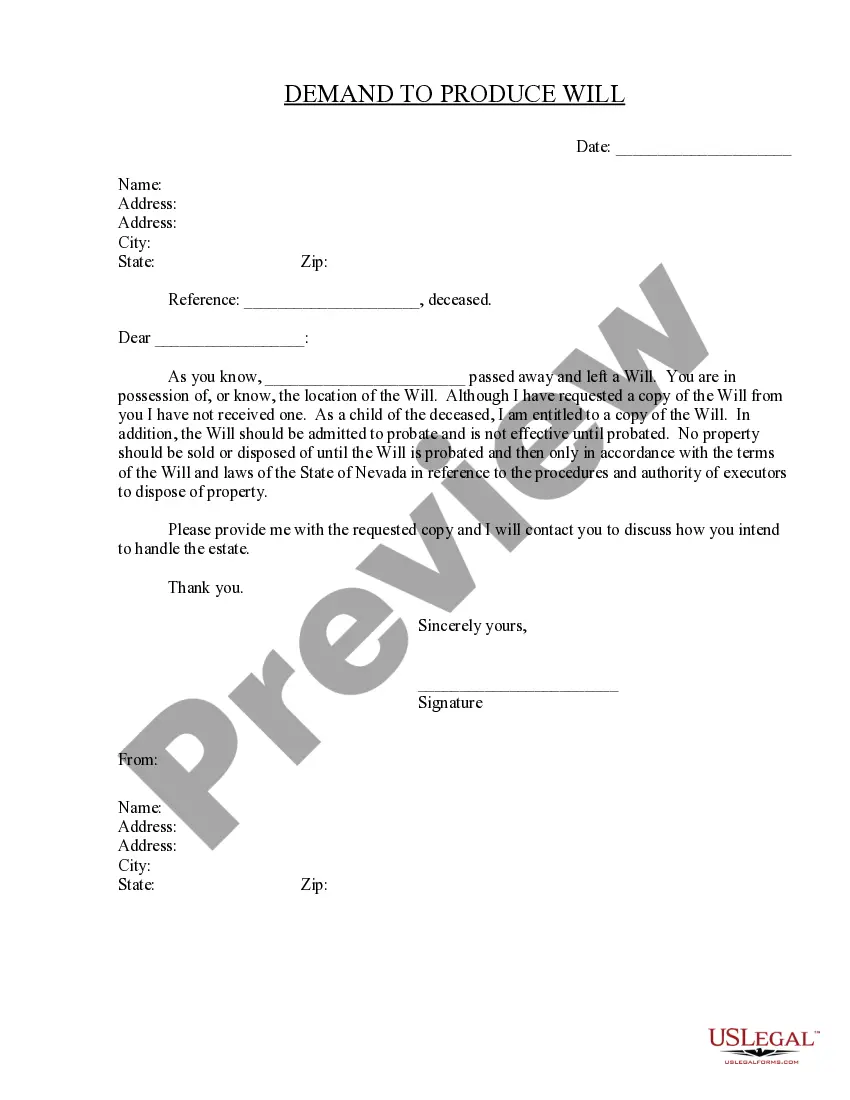

How to fill out Amended Stock Exchange Agreement By SJW Corp, Roscoe Moss Co, And RMC Shareholders - Detailed?

Finding the right authorized document template might be a struggle. Needless to say, there are a lot of templates available on the net, but how can you get the authorized kind you need? Take advantage of the US Legal Forms internet site. The support gives 1000s of templates, such as the Tennessee Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed, that you can use for organization and private requirements. Every one of the kinds are checked out by professionals and fulfill federal and state requirements.

In case you are currently listed, log in for your account and click the Obtain switch to find the Tennessee Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed. Utilize your account to search throughout the authorized kinds you might have acquired formerly. Check out the My Forms tab of your account and obtain yet another backup from the document you need.

In case you are a brand new user of US Legal Forms, here are easy directions so that you can adhere to:

- Very first, make certain you have selected the correct kind for your city/region. You may look through the shape making use of the Preview switch and study the shape information to guarantee it will be the right one for you.

- If the kind is not going to fulfill your requirements, take advantage of the Seach industry to obtain the correct kind.

- Once you are sure that the shape would work, go through the Purchase now switch to find the kind.

- Opt for the costs program you desire and enter the essential details. Build your account and pay money for your order utilizing your PayPal account or charge card.

- Pick the data file file format and down load the authorized document template for your device.

- Total, modify and produce and indication the acquired Tennessee Amended Stock Exchange Agreement by SJW Corp, Roscoe Moss Co, and RMC Shareholders - Detailed.

US Legal Forms is the greatest collection of authorized kinds where you can find different document templates. Take advantage of the service to down load appropriately-made papers that adhere to condition requirements.