The Tennessee issuance of common stock in connection with acquisition refers to the process of issuing shares of common stock by a company based in Tennessee as part of an acquisition or merger transaction. This method allows the acquiring company to offer its own stock as a form of consideration in exchange for acquiring another company. Keywords: Tennessee, issuance, common stock, connection, acquisition, merger, transaction, acquiring company, consideration. Types of Tennessee Issuance of Common Stock in Connection with Acquisition: 1. Straight Stock-for-Stock Exchange: In this type of acquisition, the acquiring company offers its common stock to the shareholders of the target company in exchange for their shares. The ratio at which the exchange occurs is determined based on the relative valuation of the two companies. 2. Stock Swap: A stock swap is a type of acquisition where the acquiring company exchanges its common stock for the target company's common stock. The exchange ratio is determined based on the negotiated terms of the acquisition. 3. Partial Stock Purchase: In certain cases, the acquiring company may opt to acquire only a portion of the target company's common stock. This can be done by negotiating a percentage of shares to be purchased in exchange for the issuing of common stock. 4. Reverse Acquisition: In a reverse acquisition scenario, the target company becomes the acquiring company, and its shareholders are issued common stock of the acquiring company. This method allows the target company to gain control of the acquiring company using its own shares. 5. Stock-Only Acquisition: A stock-only acquisition refers to a scenario where the acquisition is completed solely using the acquiring company's common stock as consideration. No other forms of payment or consideration are involved in such cases. 6. Merger with Stock Consideration: In a merger transaction, the acquiring company and the target company merge to form a new entity. In this case, the issuance of common stock is used as consideration for the shareholders of both companies, who become shareholders of the newly formed entity. It is important to note that the specific types and methods of Tennessee issuance of common stock in connection with acquisitions may vary based on the terms negotiated between the acquiring company and the target company during the acquisition process.

Tennessee Issuance of Common Stock in Connection with Acquisition

Description

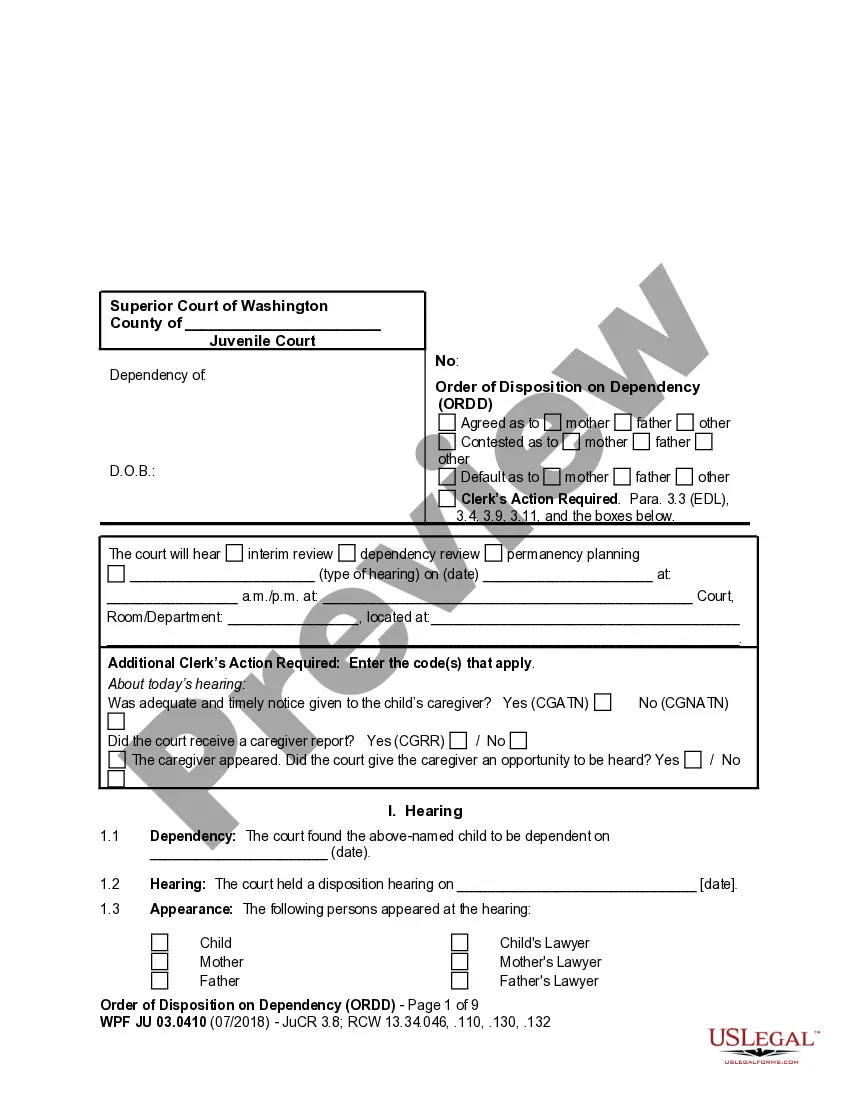

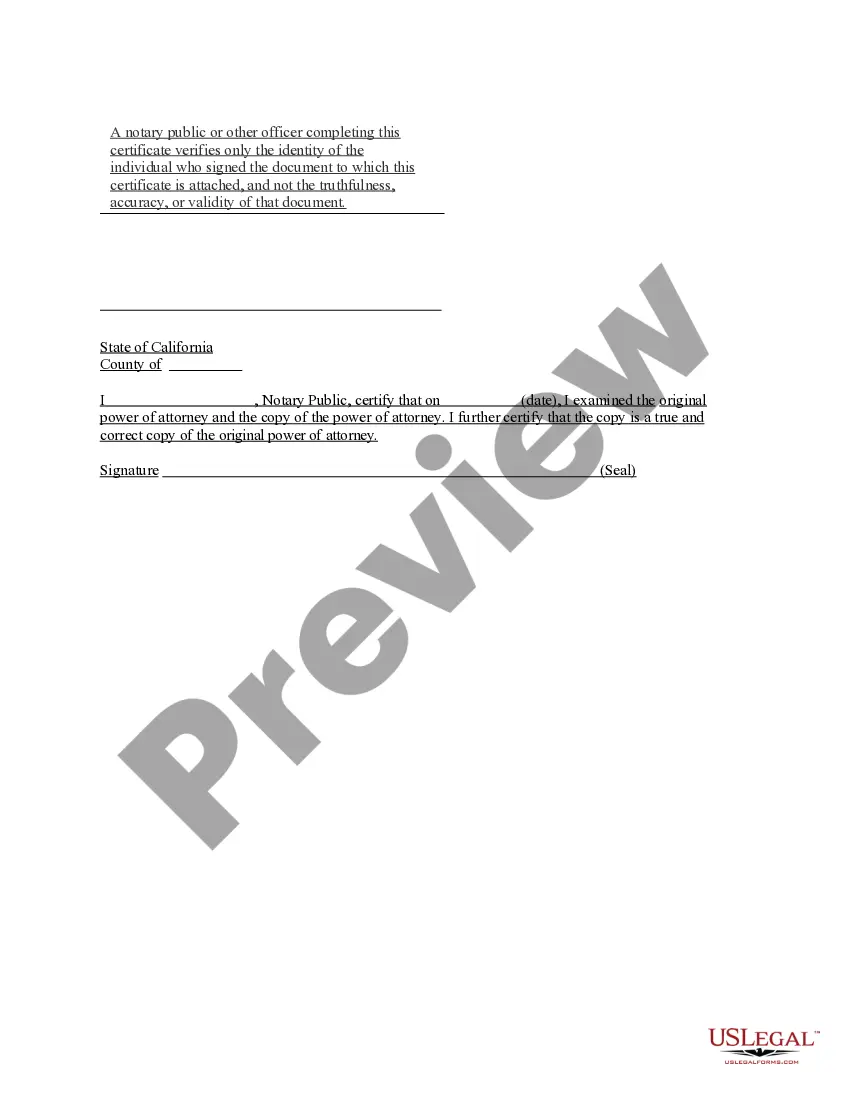

How to fill out Tennessee Issuance Of Common Stock In Connection With Acquisition?

Choosing the best legal record template can be a struggle. Of course, there are a lot of web templates available on the net, but how would you obtain the legal kind you want? Utilize the US Legal Forms website. The services gives a large number of web templates, for example the Tennessee Issuance of Common Stock in Connection with Acquisition, that can be used for company and personal demands. Each of the varieties are checked by experts and satisfy federal and state requirements.

If you are previously signed up, log in in your profile and then click the Obtain switch to have the Tennessee Issuance of Common Stock in Connection with Acquisition. Utilize your profile to search through the legal varieties you may have ordered formerly. Go to the My Forms tab of the profile and obtain one more version from the record you want.

If you are a whole new consumer of US Legal Forms, listed below are basic instructions that you should stick to:

- Very first, be sure you have chosen the right kind for your town/area. It is possible to look over the form utilizing the Preview switch and look at the form explanation to guarantee this is the right one for you.

- When the kind does not satisfy your expectations, make use of the Seach industry to obtain the appropriate kind.

- When you are certain that the form is proper, select the Acquire now switch to have the kind.

- Pick the costs plan you want and enter in the needed information and facts. Create your profile and buy the order making use of your PayPal profile or bank card.

- Select the data file formatting and download the legal record template in your product.

- Comprehensive, modify and print and signal the obtained Tennessee Issuance of Common Stock in Connection with Acquisition.

US Legal Forms is definitely the largest collection of legal varieties that you can find numerous record web templates. Utilize the company to download expertly-manufactured documents that stick to express requirements.

Form popularity

FAQ

Hear this out loud PauseA control share amendment (the Control Share Amendment). An amendment increasing the number of votes needed to prevail in a contested trustee election to a majority of the outstanding shares (the Majority Amendment).

To issue stock in a corporation, you can use a simple bill of sale. Stock is issued to fund the corporation?in the Articles of Incorporation, the corporation sets the number of shares the corporation is authorized to issue. The corporation then decides how many shares of stock it will initially issue.

Hear this out loud Pause"Control share acquisition" means the direct or indirect acquisition, other than in an excepted acquisition, by any person of beneficial ownership of shares of a public corporation that, except for this article, would have voting rights and would, when added to all other shares of such public corporation which then ...

Here are the steps to issue shares in a corporation: Decide how much capital to raise. ... Decide the number of shares to be issued. ... Decide corporation will be public or private. ... Set value for each share. ... Choose the type of stock. ... Prepare a shareholder agreement. ... Issue stock certificates.