Tennessee Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. The Golf Technology Holding, Inc. has put forward a proposal to the state of Tennessee, seeking approval for the adoption of their Stock Option and Long-Term Incentive Plan. This proposed plan aims to provide incentives to the company's employees and executives, promoting their alignment with the long-term growth and success of the business. Tennessee will play a crucial role in deciding the fate of this plan and its potential impact on both the company and its workforce. The proposed Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. focuses on rewarding employees with valuable stock options, giving them the opportunity to purchase company shares at a predetermined price, usually lower than the market value. These stock options serve as a financial incentive that aligns the interests of employees with the long-term goals of the organization. It also serves as a retention tool, encouraging employees to stay committed and motivated to contribute to the company's growth. Additionally, this plan aims to establish a long-term incentive program to motivate and reward top-performing executives within The Golf Technology Holding, Inc. By offering significant performance-based bonuses and other incentives tied to the company's financial performance and shareholder value, the plan seeks to attract and retain talented executives who can drive the company's growth and success. It is important to note that the Tennessee Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. may have different variations or amendments in its structure, depending on the specific details of the plan put forth by the company. These variations could include different eligibility criteria, vesting periods, performance metrics, and other terms and conditions designed to ensure effective implementation and alignment with the company's overall strategy. Tennessee, as a key decision-maker, will need to carefully evaluate the potential benefits and drawbacks of adopting this plan. Supporters of the proposal argue that it will incentivize employees to share in the success of The Golf Technology Holding, Inc., fostering a stronger sense of ownership and loyalty. Additionally, they believe that attracting and retaining top executive talent is vital for the overall growth and competitiveness of the company. On the other hand, opponents of the plan may voice concerns about potential dilution of existing shareholders' value, as the issuance of stock options may increase the number of outstanding shares in the market. They may also argue that excessive incentives could lead to short-term thinking among executives, sacrificing long-term sustainability for immediate financial gains. Ultimately, the decision Tennessee makes regarding the proposal to approve the adoption of The Golf Technology Holding, Inc.'s Stock Option and Long-Term Incentive Plan will have far-reaching implications for both the company and its workforce. It will shape the future incentives offered to employees and executives, impacting their motivation, loyalty, and commitment to the organization.

Tennessee Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc.

Description

How to fill out Tennessee Proposal To Approve Adoption Of Stock Option And Long-Term Incentive Plan Of The Golf Technology Holding, Inc.?

If you have to total, down load, or print lawful document web templates, use US Legal Forms, the biggest assortment of lawful kinds, that can be found on the web. Use the site`s easy and convenient look for to obtain the papers you need. Various web templates for company and personal uses are categorized by types and states, or keywords. Use US Legal Forms to obtain the Tennessee Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. with a number of click throughs.

If you are currently a US Legal Forms buyer, log in for your accounts and click the Down load option to have the Tennessee Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc.. You can even access kinds you formerly downloaded within the My Forms tab of the accounts.

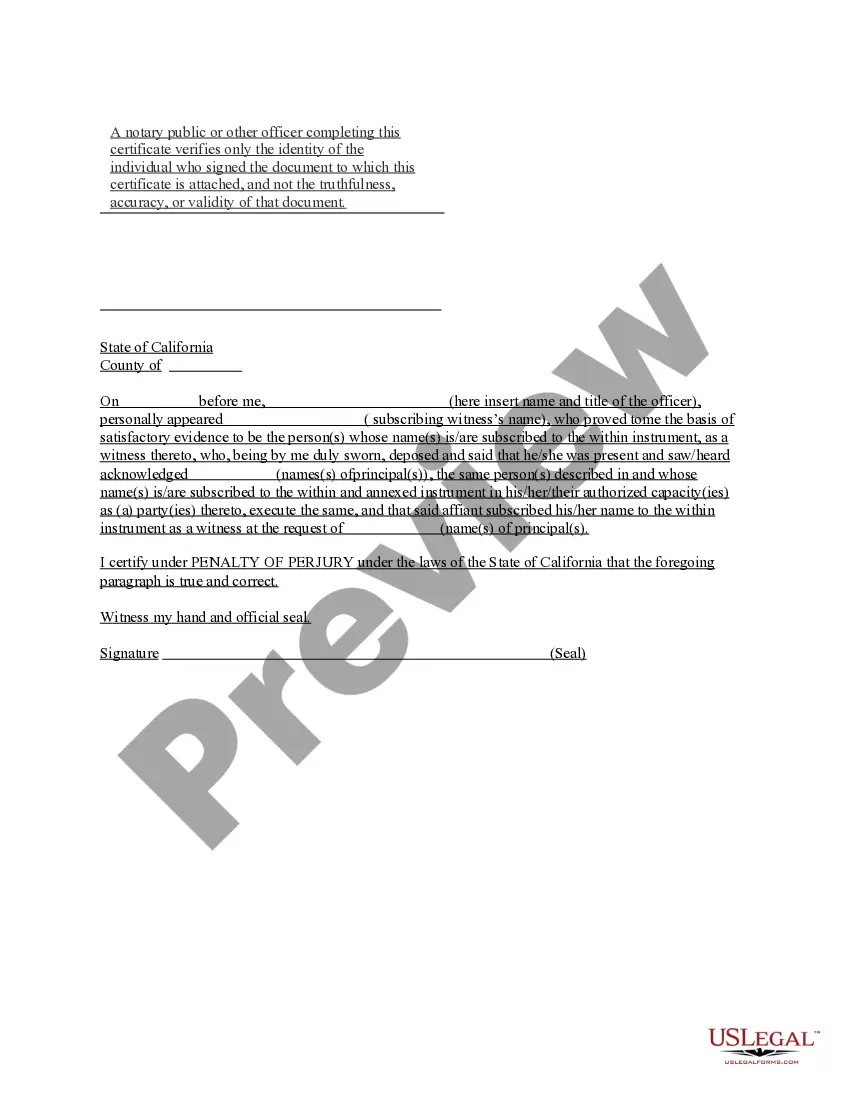

If you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for that correct city/land.

- Step 2. Utilize the Preview option to examine the form`s articles. Don`t forget about to read through the description.

- Step 3. If you are not happy together with the develop, make use of the Lookup field on top of the display screen to discover other models of your lawful develop design.

- Step 4. Once you have located the shape you need, select the Acquire now option. Pick the rates prepare you choose and add your references to sign up on an accounts.

- Step 5. Process the purchase. You should use your charge card or PayPal accounts to finish the purchase.

- Step 6. Select the file format of your lawful develop and down load it on your own product.

- Step 7. Comprehensive, modify and print or indicator the Tennessee Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc..

Every lawful document design you acquire is your own permanently. You may have acces to each and every develop you downloaded inside your acccount. Go through the My Forms segment and pick a develop to print or down load yet again.

Be competitive and down load, and print the Tennessee Proposal to Approve Adoption of Stock Option and Long-Term Incentive Plan of The Golf Technology Holding, Inc. with US Legal Forms. There are millions of specialist and express-distinct kinds you can utilize for the company or personal requires.

Form popularity

FAQ

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

Once you have a plan in place, you can simply make amendments to increase the number of shares in the option pool on an as-needed basis. The initial plan and any expansions must be approved by your board of directors and then by shareholders.

With the offering company's stocks to the employees, the ?rm achieves two objectives? to offer incentives to the employees and to motivate them to worl-c hard to contribute towards the increment of the value of the stocks owned by them. This way a stock option plan provides an incentive for executives.

ESOs are a form of equity compensation granted by companies to their employees and executives. Like a regular call option, an ESO gives the holder the right to purchase the underlying asset?the company's stock?at a specified price for a finite period of time.