Tennessee Approval of Ambase Corporation's Stock Incentive Plan

Description

How to fill out Approval Of Ambase Corporation's Stock Incentive Plan?

It is possible to invest hrs online looking for the legitimate document web template that fits the federal and state needs you will need. US Legal Forms supplies a huge number of legitimate types that are evaluated by professionals. You can easily down load or print out the Tennessee Approval of Ambase Corporation's Stock Incentive Plan from our service.

If you currently have a US Legal Forms profile, you may log in and click the Acquire switch. Following that, you may comprehensive, revise, print out, or signal the Tennessee Approval of Ambase Corporation's Stock Incentive Plan. Every legitimate document web template you acquire is yours for a long time. To get another copy associated with a acquired type, proceed to the My Forms tab and click the related switch.

Should you use the US Legal Forms internet site for the first time, keep to the simple guidelines below:

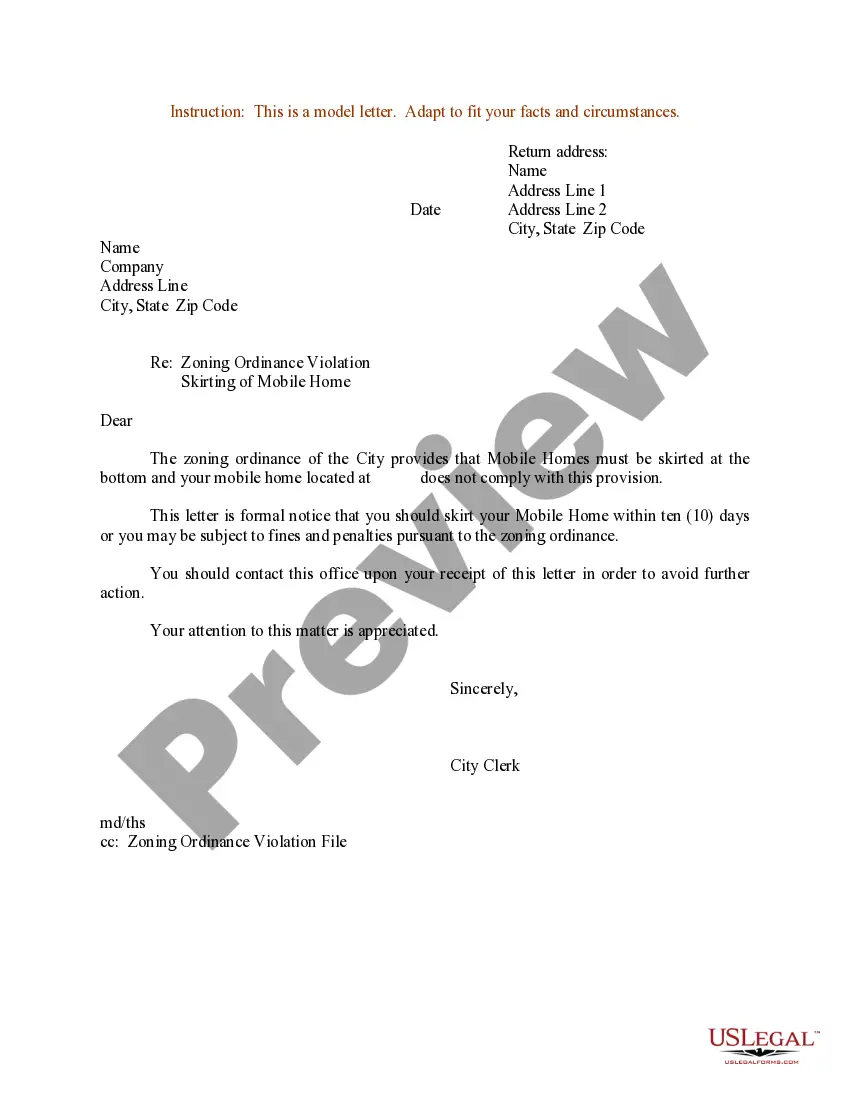

- Very first, ensure that you have chosen the right document web template for your county/town of your liking. See the type information to make sure you have selected the right type. If offered, utilize the Preview switch to search from the document web template as well.

- If you want to locate another edition in the type, utilize the Look for discipline to discover the web template that meets your needs and needs.

- Once you have found the web template you desire, just click Acquire now to proceed.

- Find the costs program you desire, type in your references, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You should use your charge card or PayPal profile to purchase the legitimate type.

- Find the structure in the document and down load it in your gadget.

- Make changes in your document if required. It is possible to comprehensive, revise and signal and print out Tennessee Approval of Ambase Corporation's Stock Incentive Plan.

Acquire and print out a huge number of document layouts using the US Legal Forms site, that offers the largest selection of legitimate types. Use professional and condition-particular layouts to take on your small business or personal requirements.

Form popularity

FAQ

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

Below are the steps you can use when developing and implementing an incentive program for employees: Involve the right people. ... Set goals for the program. ... Identify the incentive audience. ... Increase participant engagement. ... Choose a program structure and budget. ... Determine the rewards. ... Decide how you plan to track involvement.

Employee stock options can be a lucrative part of an individual's overall compensation package, although not every company offers them. Workers can buy shares at a pre-determined price at a future date, regardless of the price of the stock when the options are exercised.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.