Tennessee Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation

Description

How to fill out Cash Award Paid To Holders Of Non-Exercisable Stock Options Upon Merger Or Consolidation?

Are you currently in the position where you need files for either company or person reasons almost every working day? There are tons of legal document themes accessible on the Internet, but finding types you can trust is not effortless. US Legal Forms provides a large number of form themes, like the Tennessee Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation, that happen to be created in order to meet federal and state requirements.

Should you be previously familiar with US Legal Forms internet site and possess an account, simply log in. Following that, it is possible to acquire the Tennessee Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation template.

Should you not offer an bank account and want to begin to use US Legal Forms, adopt these measures:

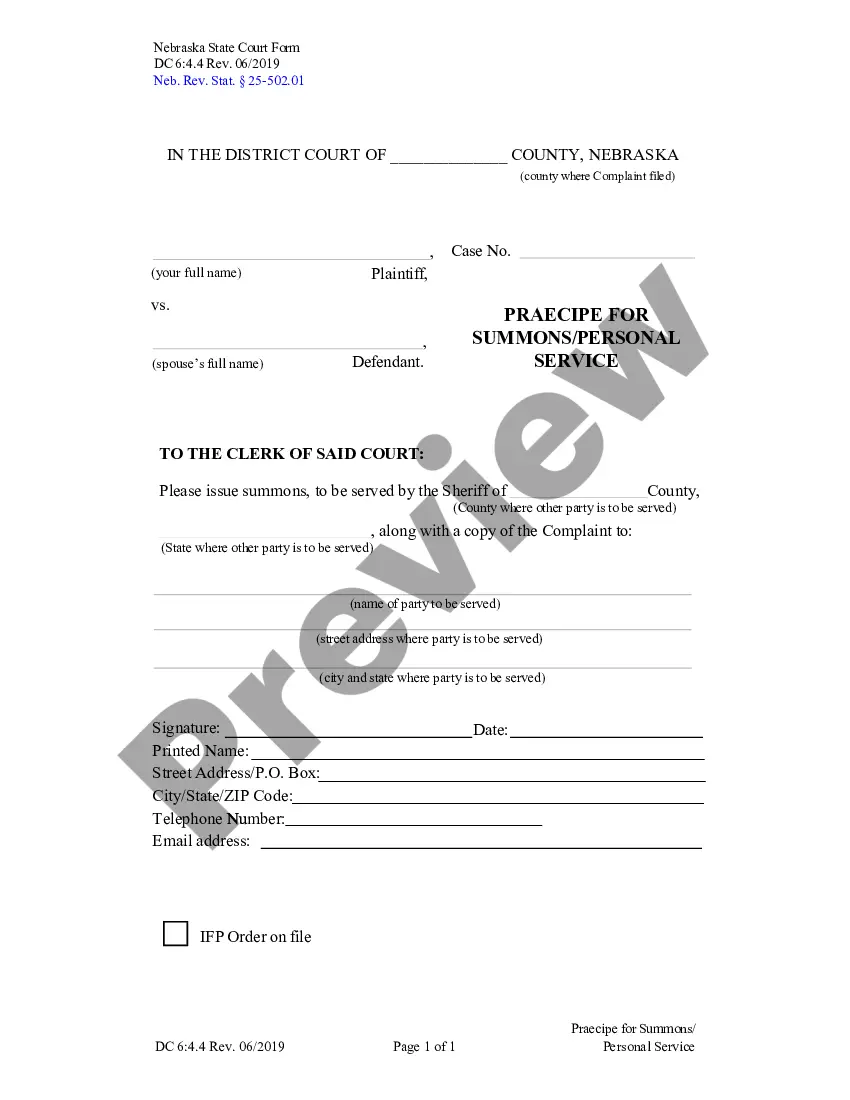

- Find the form you want and ensure it is for that appropriate area/region.

- Take advantage of the Preview button to check the form.

- Read the explanation to ensure that you have selected the proper form.

- If the form is not what you are seeking, make use of the Research industry to obtain the form that meets your needs and requirements.

- If you discover the appropriate form, click on Buy now.

- Choose the pricing strategy you want, fill in the desired details to make your account, and buy the transaction with your PayPal or Visa or Mastercard.

- Pick a hassle-free document format and acquire your copy.

Discover every one of the document themes you might have bought in the My Forms menus. You can get a extra copy of Tennessee Cash Award Paid to Holders of Non-Exercisable Stock Options Upon Merger or Consolidation anytime, if needed. Just click the needed form to acquire or printing the document template.

Use US Legal Forms, the most considerable variety of legal forms, in order to save efforts and avoid mistakes. The service provides expertly created legal document themes which can be used for a variety of reasons. Create an account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

Remember that you never want to exercise your shares when the Fair Market Value (FMV) is below the exercise price; these shares are in theory ?under water?, or of no monetary value to you. The other very important fact that you need to understand is what type of option you have been granted.

When a stock option is ?out-of-the-money? (or OTM), its strike price is higher than the current FMV of the underlying stock. This means that the option has no intrinsic value, because it would be worth nothing if it were exercised today.

Vested employee stock options contain guarantees, so when a company is acquired employees with vested options will have some options. First is the acquiring company may buy out the options for cash. They may also offer to replace those contracts with options of the acquirer of equal or greater value.

Unvested Options ? Depending on the structure of the deal, there are three possibilities for unvested options. The holdings could be canceled, they might be converted to cash and paid out over time, or they could be converted to the acquiring company stock and subject to a new vesting schedule.

A company can set the exercise price below the prevailing market price or at a discounted price but it cannot be below the face value of the shares.

For tax purposes, it is important that the option have an exercise price that is equal to the fair market value of the stock at the time the option is issued. If the exercise price is less than fair market value, the option most likely will violate the rules of Internal Revenue Code Section 409A.

When an underlying security is converted into a right to receive a fixed amount of cash, options on that security will generally be adjusted to require the delivery upon exercise of a fixed amount of cash. Additionally, trading in the options will cease when the merger becomes effective.

An in-the-money put option is when the exercise price is above the market price. Thus, the holder is eligible to sell the security at a price higher than what is being offered. For example, a put option with a strike price of $60 would be in the money if the market price is $45.