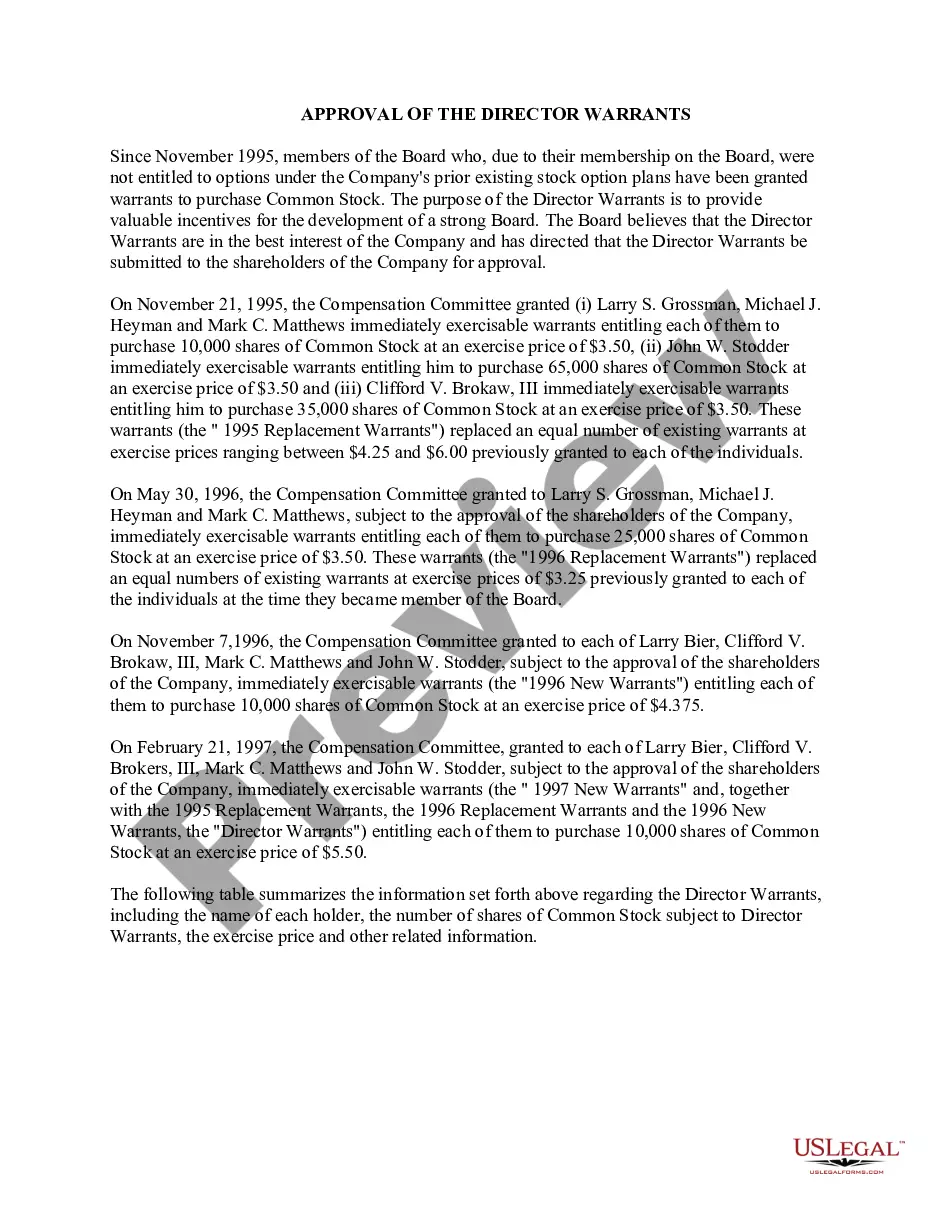

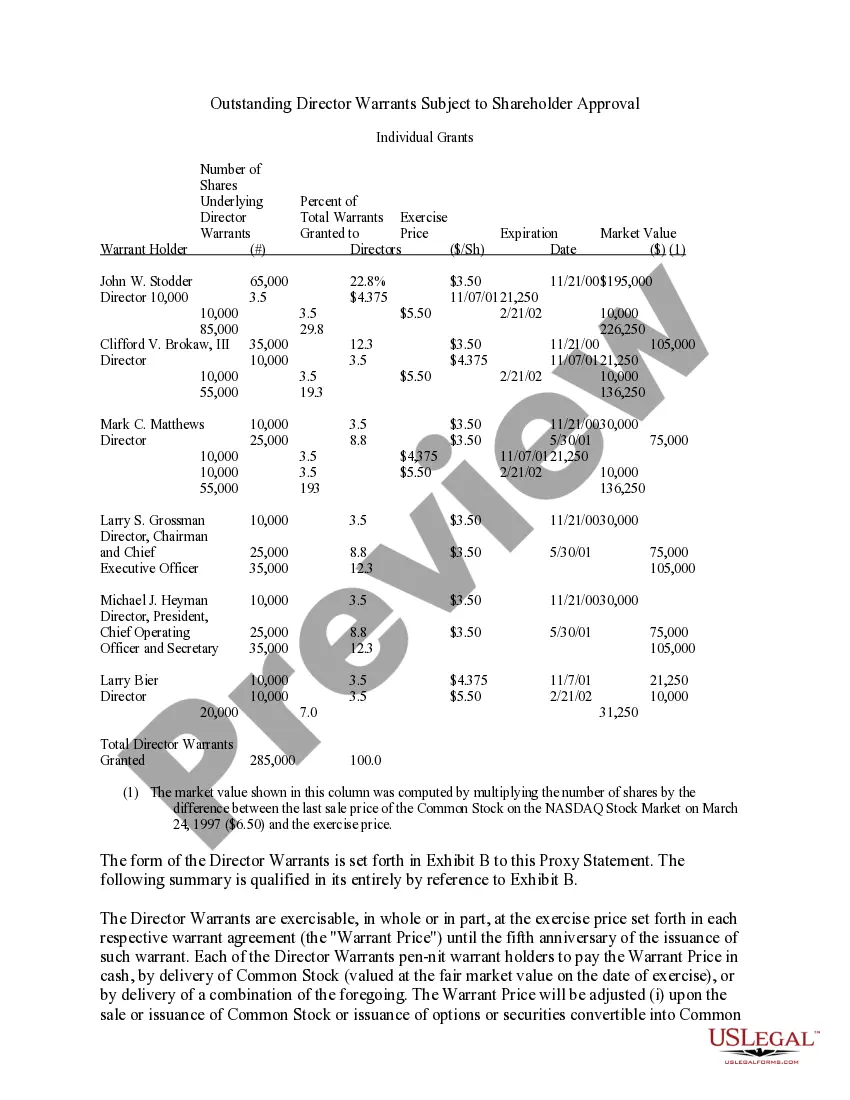

Tennessee Approval of Director Warrants: A Comprehensive Overview In Tennessee, the Approval of Director Warrants is a crucial process that enables an organization's directors to receive compensation in the form of warrants. These director warrants are rights to purchase shares of the company's stock at a predetermined price within a specified period. They serve as incentives for directors to contribute their knowledge, skills, and expertise in driving the company's growth and success. Having a clear understanding of the Tennessee Approval of Director Warrants is essential for both companies and directors. Let's delve into the details of this process, its purpose, and its various types. Purpose and Benefits: The primary purpose of Tennessee Approval of Director Warrants is to align the interests of the directors with those of the company's shareholders. By offering director warrants, companies encourage directors to focus on long-term value creation. It ensures that directors are not only financially compensated through their service, but also motivated to enhance the company's performance, profitability, and shareholder value. Different Types of Tennessee Approval of Director Warrants: 1. Non-Qualified Stock Options (Nests): Non-qualified stock options are a common type of director warrant. They provide directors the right to purchase company shares at a predetermined price, known as the exercise price. Directors can exercise these options at their discretion, within a specified period. 2. Incentive Stock Options (SOS): In addition to Nests, Tennessee also recognizes incentive stock options. SOS offer certain tax benefits to directors, but they come with particular restrictions and requirements. These options qualify for favorable long-term capital gains tax treatment if held for a specific period and meet other criteria specified by tax laws. 3. Restricted Stock Units (RSS): While not technically warrants, restricted stock units are another form of director compensation in Tennessee. RSS grant directors the right to receive company shares at a future date, often contingent upon various performance or vesting conditions. These units offer a direct equity stake in the company but do not require any upfront payment. Approval Process: The Approval of Director Warrants process in Tennessee involves several steps. Firstly, the company's board of directors proposes the warrant grants, indicating the number of warrants, exercise price, and vesting conditions. This proposal must comply with relevant laws, regulations, and the company's bylaws. Subsequently, the company's shareholders review and approve the director warrant grants. This approval is typically sought in the company's annual general meeting, where shareholders vote on the proposal. Companies must disclose all relevant details in the proxy statement provided to shareholders to ensure transparency and informed decision-making. After shareholders' approval, directors become legally entitled to exercise their approved warrants within the predetermined period and under any specified conditions. Upon exercise, directors acquire shares of the company's stock while often being subject to additional restrictions like holding periods or necessary tax compliance. Conclusion: Tennessee Approval of Director Warrants plays a crucial role in incentivizing and rewarding directors for their contributions to the company's success. By granting director warrants, companies align the interests of directors with shareholders, foster long-term growth, and enhance corporate governance. Organizations and directors alike should familiarize themselves with the various types of warrants, the approval process, and relevant legal requirements to ensure compliance and maximize the benefits associated with director warrants in Tennessee.

Tennessee Approval of director warrants

Description

How to fill out Tennessee Approval Of Director Warrants?

Choosing the right lawful file template can be a battle. Needless to say, there are plenty of templates available on the net, but how can you obtain the lawful develop you require? Take advantage of the US Legal Forms internet site. The services provides thousands of templates, such as the Tennessee Approval of director warrants, which you can use for organization and personal requires. Each of the forms are inspected by pros and meet up with state and federal demands.

When you are previously authorized, log in in your profile and click on the Down load key to obtain the Tennessee Approval of director warrants. Make use of your profile to check from the lawful forms you might have acquired earlier. Check out the My Forms tab of your own profile and get another backup in the file you require.

When you are a fresh user of US Legal Forms, allow me to share straightforward instructions that you should comply with:

- Initially, ensure you have chosen the appropriate develop for your personal city/area. You are able to check out the form utilizing the Review key and browse the form explanation to guarantee it is the right one for you.

- If the develop fails to meet up with your needs, utilize the Seach industry to get the right develop.

- Once you are positive that the form would work, select the Acquire now key to obtain the develop.

- Opt for the rates prepare you desire and enter the essential information. Make your profile and pay for an order making use of your PayPal profile or Visa or Mastercard.

- Pick the document structure and obtain the lawful file template in your gadget.

- Full, revise and printing and signal the obtained Tennessee Approval of director warrants.

US Legal Forms will be the greatest catalogue of lawful forms for which you can see various file templates. Take advantage of the service to obtain skillfully-created paperwork that comply with express demands.