The Tennessee Stock Option Plan of National Penn Ranchers, Inc. is a comprehensive program designed to offer employees of the company the opportunity to acquire stock options as a form of compensation. This plan aims to align employee interests with the company's overall performance and create a sense of ownership among the workforce. Under this plan, employees are granted the right to purchase a specific number of shares of National Penn Ranchers, Inc. stock at a predetermined price, known as the exercise price. These options typically vest over a period of time, incentivizing employees to stay with the company and contribute to its long-term success. There are several types of Tennessee Stock Option Plans available within National Penn Ranchers, Inc., each serving different purposes. These types may include: 1. Incentive Stock Options (SOS): SOS are typically offered to key employees and provide certain tax advantages. These options must meet specific criteria outlined by the Internal Revenue Code, such as requiring a minimum holding period before the shares can be sold without incurring additional taxes. 2. Non-Qualified Stock Options (Nests): Nests are more flexible than SOS and can be offered to employees at all levels within the company. Unlike SOS, Nests do not have to adhere to the same strict tax rules, allowing for greater versatility in their design and implementation. 3. Restricted Stock Units (RSS): RSS are another type of equity-based compensation offered by National Penn Ranchers, Inc. Under this arrangement, employees are granted units that represent the right to receive shares of company stock at a future date. RSS often have vesting schedules and may be subject to certain performance criteria or time-based conditions. 4. Stock Appreciation Rights (SARS): SARS provide employees with the opportunity to receive cash or stock equal to the appreciation in National Penn Ranchers, Inc. stock price from the date of grant to the exercise date. SARS do not require employees to purchase shares, making them an attractive alternative for those who may prefer cash compensation. Overall, the Tennessee Stock Option Plan of National Penn Ranchers, Inc. aims to motivate and reward employees through various types of stock-based compensation arrangements. These plans provide employees with tangible incentives to contribute to the growth and success of the company while aligning their interests with shareholders.

Tennessee Stock Option Plan of National Penn Bancshares, Inc.

Description

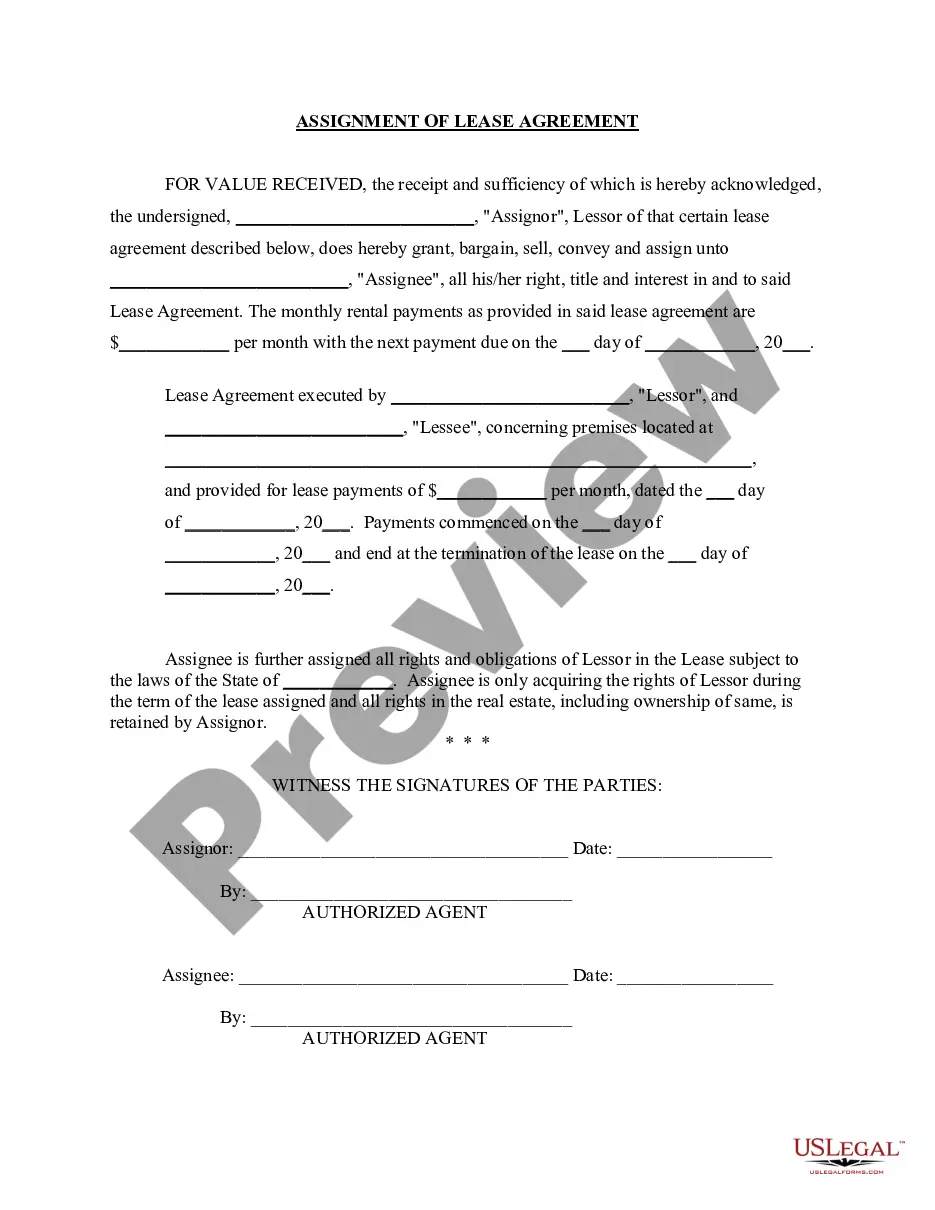

How to fill out Tennessee Stock Option Plan Of National Penn Bancshares, Inc.?

If you wish to total, acquire, or printing legal record web templates, use US Legal Forms, the largest assortment of legal varieties, which can be found on the web. Utilize the site`s basic and hassle-free research to discover the papers you will need. Different web templates for company and specific reasons are categorized by types and claims, or search phrases. Use US Legal Forms to discover the Tennessee Stock Option Plan of National Penn Bancshares, Inc. with a couple of click throughs.

Should you be previously a US Legal Forms customer, log in to the accounts and click the Download button to get the Tennessee Stock Option Plan of National Penn Bancshares, Inc.. You can also entry varieties you previously delivered electronically in the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the form to the proper area/nation.

- Step 2. Utilize the Review solution to examine the form`s information. Never forget to read through the description.

- Step 3. Should you be not satisfied with the kind, make use of the Lookup discipline at the top of the monitor to find other models from the legal kind design.

- Step 4. Once you have located the form you will need, go through the Purchase now button. Choose the prices program you choose and add your credentials to sign up on an accounts.

- Step 5. Process the financial transaction. You may use your credit card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the structure from the legal kind and acquire it in your gadget.

- Step 7. Full, modify and printing or sign the Tennessee Stock Option Plan of National Penn Bancshares, Inc..

Every legal record design you buy is the one you have for a long time. You might have acces to every single kind you delivered electronically in your acccount. Select the My Forms portion and pick a kind to printing or acquire once again.

Be competitive and acquire, and printing the Tennessee Stock Option Plan of National Penn Bancshares, Inc. with US Legal Forms. There are thousands of professional and status-distinct varieties you can use for your company or specific requires.