Tennessee Executive Stock Incentive Plan of Octo Limited

Description

How to fill out Executive Stock Incentive Plan Of Octo Limited?

Discovering the right legal record template might be a have difficulties. Obviously, there are a lot of themes available on the net, but how can you discover the legal form you require? Utilize the US Legal Forms internet site. The service gives a huge number of themes, including the Tennessee Executive Stock Incentive Plan of Octo Limited, that you can use for organization and personal requires. Each of the forms are inspected by specialists and meet up with state and federal requirements.

When you are already registered, log in to the profile and then click the Acquire button to get the Tennessee Executive Stock Incentive Plan of Octo Limited. Make use of profile to look through the legal forms you have acquired formerly. Proceed to the My Forms tab of the profile and get yet another version in the record you require.

When you are a whole new consumer of US Legal Forms, listed here are basic recommendations for you to adhere to:

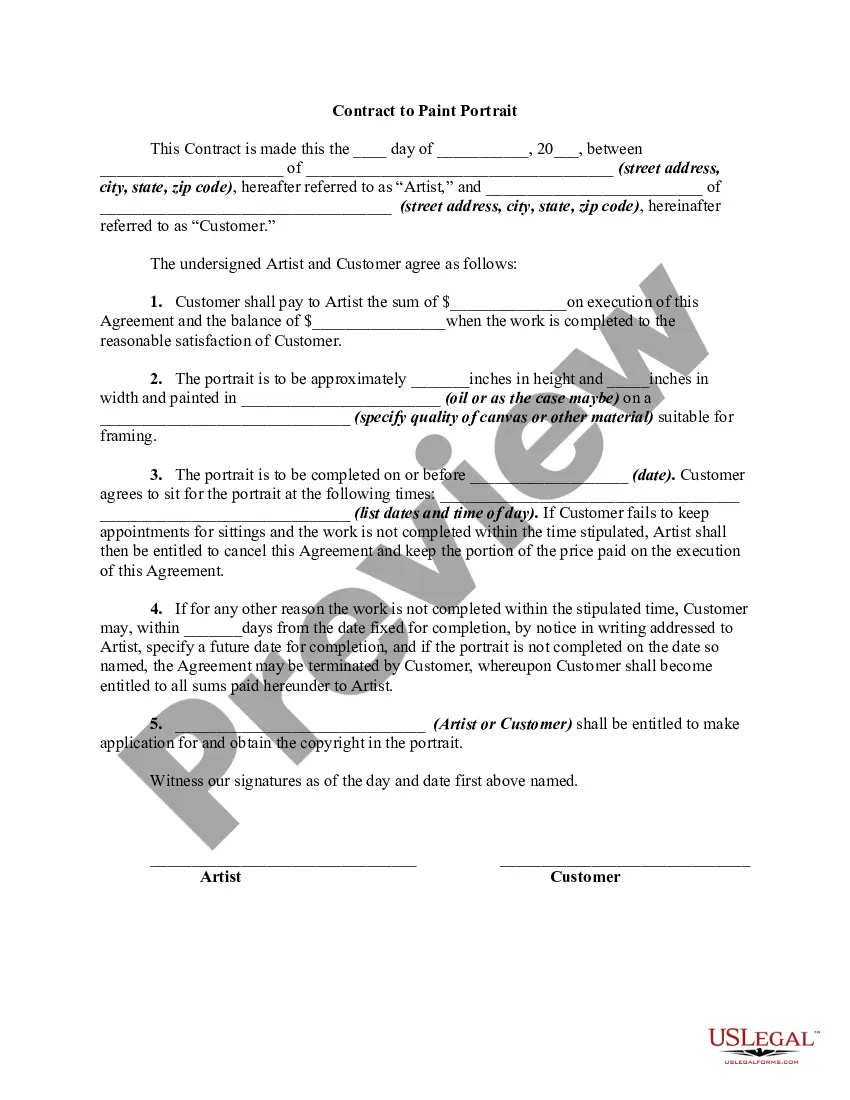

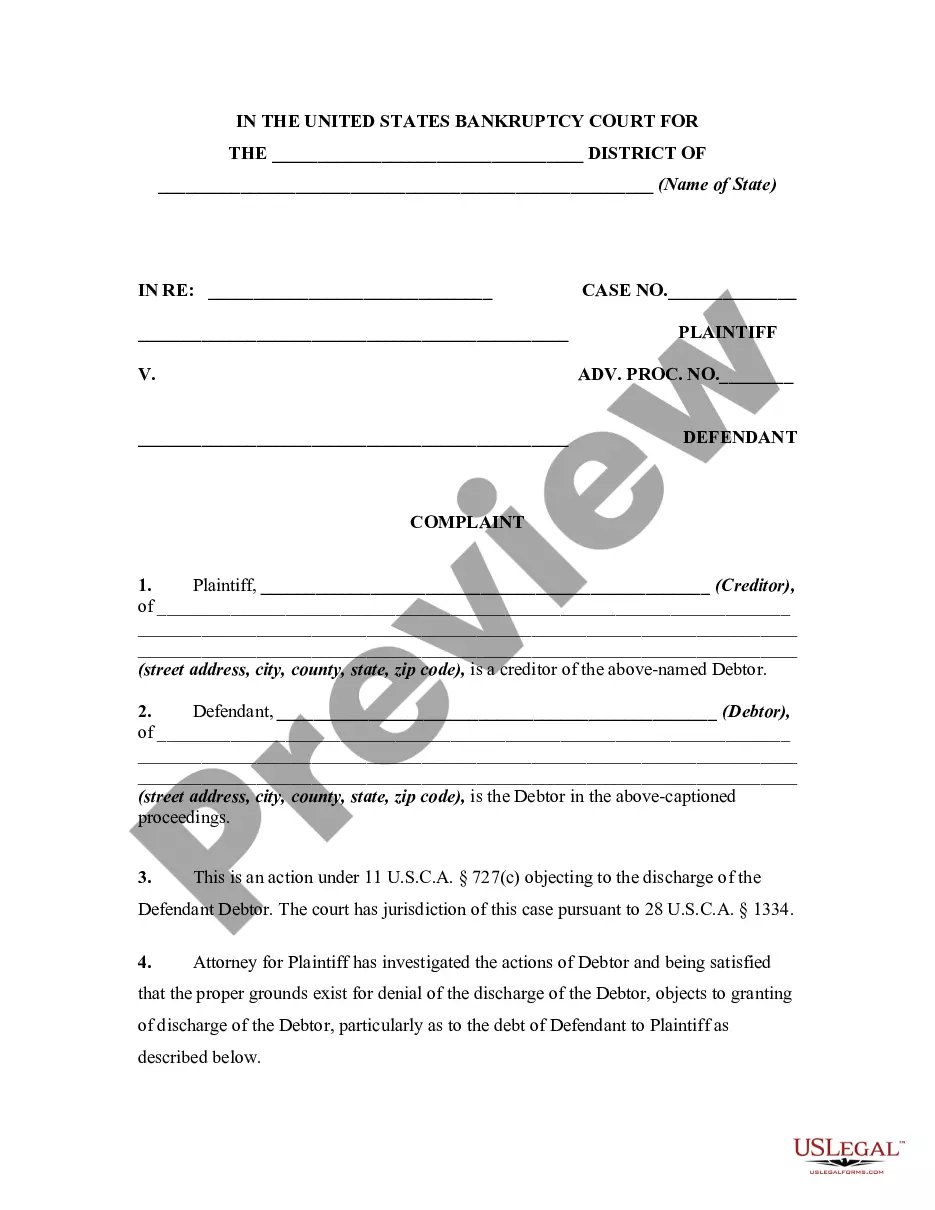

- Initially, make certain you have selected the correct form for your town/state. You may look through the form while using Review button and read the form description to guarantee it is the right one for you.

- If the form fails to meet up with your requirements, use the Seach discipline to find the proper form.

- When you are sure that the form is suitable, click on the Acquire now button to get the form.

- Opt for the costs strategy you want and enter the essential information. Build your profile and buy the transaction with your PayPal profile or credit card.

- Opt for the file formatting and download the legal record template to the product.

- Complete, change and print out and sign the obtained Tennessee Executive Stock Incentive Plan of Octo Limited.

US Legal Forms is the most significant local library of legal forms in which you can see a variety of record themes. Utilize the company to download expertly-made paperwork that adhere to express requirements.

Form popularity

FAQ

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

balanced executive compensation package generally includes base salary, short and longterm incentive pay, and various benefits and perks (e.g., enhanced retirement benefits, executive wellness programs, company cars, country club memberships, etc.).

An Executive Bonus Plan, also referred to as Section 162 Plan, is a non-qualified plan used by employers to provide special compensation to key executives. The employers' contribution to an executive bonus plan is considered salary to the executive and is therefore subject to taxation.

Executive bonus plans are often popular with top-level employees, but they also provide benefits to your company. In some cases, they can be a more tax-efficient way to reward top talent. They give employees additional compensation with a lower current cost to the employer than some other types of benefits.