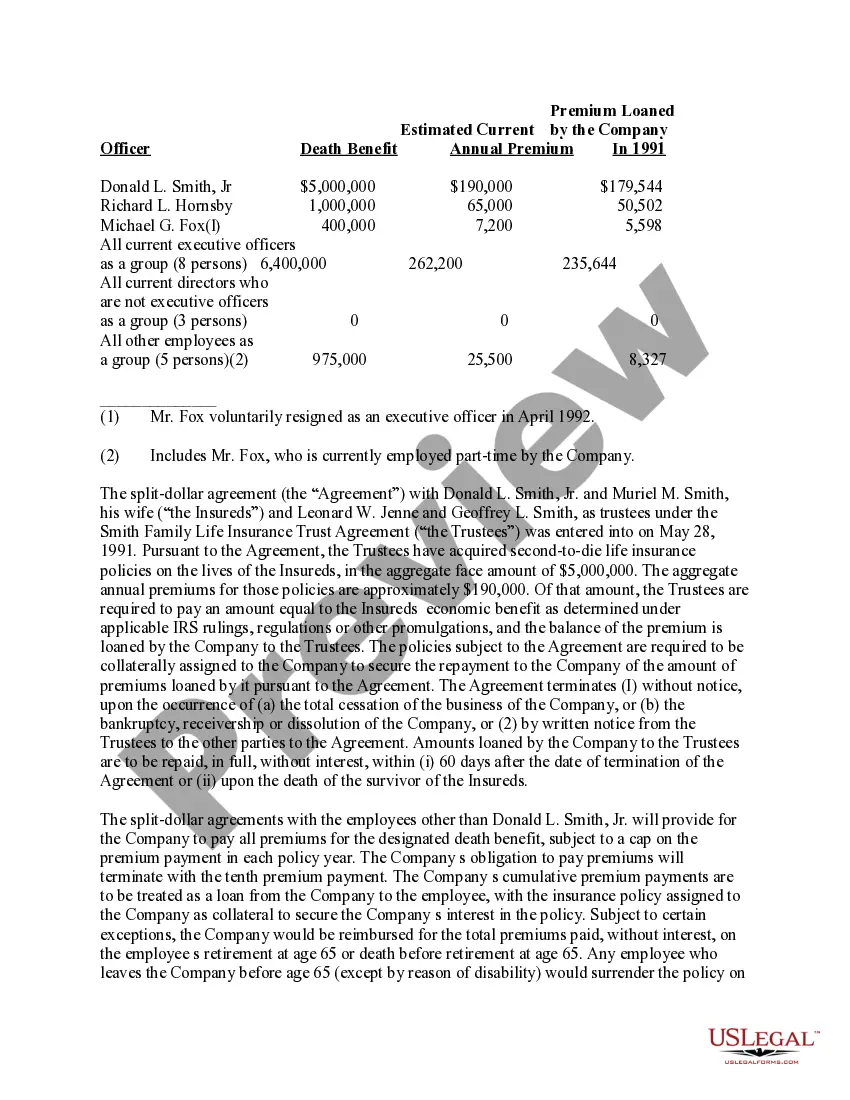

Tennessee Split-Dollar Life Insurance is a unique type of life insurance policy that combines elements of both term and permanent life insurance. It is an arrangement where two parties, typically an employer and an employee, share the cost and benefits of a life insurance policy. In this arrangement, the employer typically pays the premiums for the policy, while the employee is designated as the insured. The policy's death benefit is then split between the employer and the employee, based on a predetermined agreement. This type of insurance arrangement is commonly used in business settings, often as an employee benefit or as part of a corporate succession plan. There are several types of Tennessee Split-Dollar Life Insurance, each with its own features and benefits. Some commonly known types include: 1. Endorsement Split-Dollar: This type involves the employer paying the premiums and endorsing the policy over to the employee. The employee then becomes the policy owner and can access the cash value and make decisions regarding the policy. 2. Collateral Assignment Split-Dollar: In this type, the employer loans the premiums to the employee, which are then secured by the policy's cash value or death benefit. The employee also has some control over the policy. 3. Reverse Split-Dollar: In this arrangement, the employee pays the premiums, but the employer is entitled to a portion of the death benefit. This type of split-dollar plan is often used when the employee wants to retain greater control over the policy. 4. Economic Benefit Split-Dollar: This type involves the employer paying the premiums and providing the employee with the economic benefits derived from the cash value or death benefit of the policy, while still retaining some level of control. Tennessee Split-Dollar Life Insurance offers several advantages. For employers, it can serve as a valuable employee benefit, helping attract and retain talented individuals. Additionally, it can be a useful tool for business owners looking to fund buy-sell agreements or plan for the future transfer of ownership. For employees, it provides a valuable life insurance coverage, sometimes at a reduced cost, and potential access to cash value accumulation. In order to fully understand the intricacies of Tennessee Split-Dollar Life Insurance and choose the right type for your needs, it is recommended to consult with a qualified insurance professional or financial advisor. They can help assess your specific situation and provide guidance on structuring the split-dollar arrangement to meet your financial goals and objectives.

Tennessee Split-Dollar Life Insurance

Description

How to fill out Tennessee Split-Dollar Life Insurance?

Are you presently within a position where you need to have paperwork for either enterprise or specific purposes nearly every time? There are a variety of authorized record web templates available on the net, but locating versions you can depend on is not simple. US Legal Forms gives a large number of form web templates, like the Tennessee Split-Dollar Life Insurance, which are created in order to meet federal and state requirements.

Should you be currently acquainted with US Legal Forms internet site and possess an account, merely log in. Next, you can download the Tennessee Split-Dollar Life Insurance format.

If you do not offer an account and wish to begin using US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for that correct city/area.

- Use the Review key to examine the shape.

- Look at the outline to ensure that you have selected the proper form.

- When the form is not what you are seeking, make use of the Research discipline to obtain the form that meets your requirements and requirements.

- Whenever you get the correct form, click on Buy now.

- Opt for the rates strategy you need, fill in the necessary information and facts to make your money, and purchase an order making use of your PayPal or credit card.

- Decide on a convenient paper formatting and download your version.

Locate every one of the record web templates you possess purchased in the My Forms menus. You can get a more version of Tennessee Split-Dollar Life Insurance any time, if required. Just click on the essential form to download or print the record format.

Use US Legal Forms, by far the most substantial collection of authorized types, to save lots of time as well as prevent faults. The assistance gives professionally produced authorized record web templates that can be used for a selection of purposes. Create an account on US Legal Forms and start generating your life a little easier.