Tennessee Utilization by a REIT of partnership structures in financing five development projects

Description

How to fill out Utilization By A REIT Of Partnership Structures In Financing Five Development Projects?

Are you presently in a place the place you will need paperwork for sometimes enterprise or personal functions virtually every time? There are tons of authorized papers templates accessible on the Internet, but getting ones you can rely on isn`t straightforward. US Legal Forms delivers a huge number of form templates, just like the Tennessee Utilization by a REIT of partnership structures in financing five development projects, that are created to meet state and federal specifications.

When you are currently informed about US Legal Forms web site and get your account, merely log in. After that, it is possible to obtain the Tennessee Utilization by a REIT of partnership structures in financing five development projects design.

Unless you provide an account and need to begin using US Legal Forms, follow these steps:

- Find the form you want and make sure it is for the correct city/region.

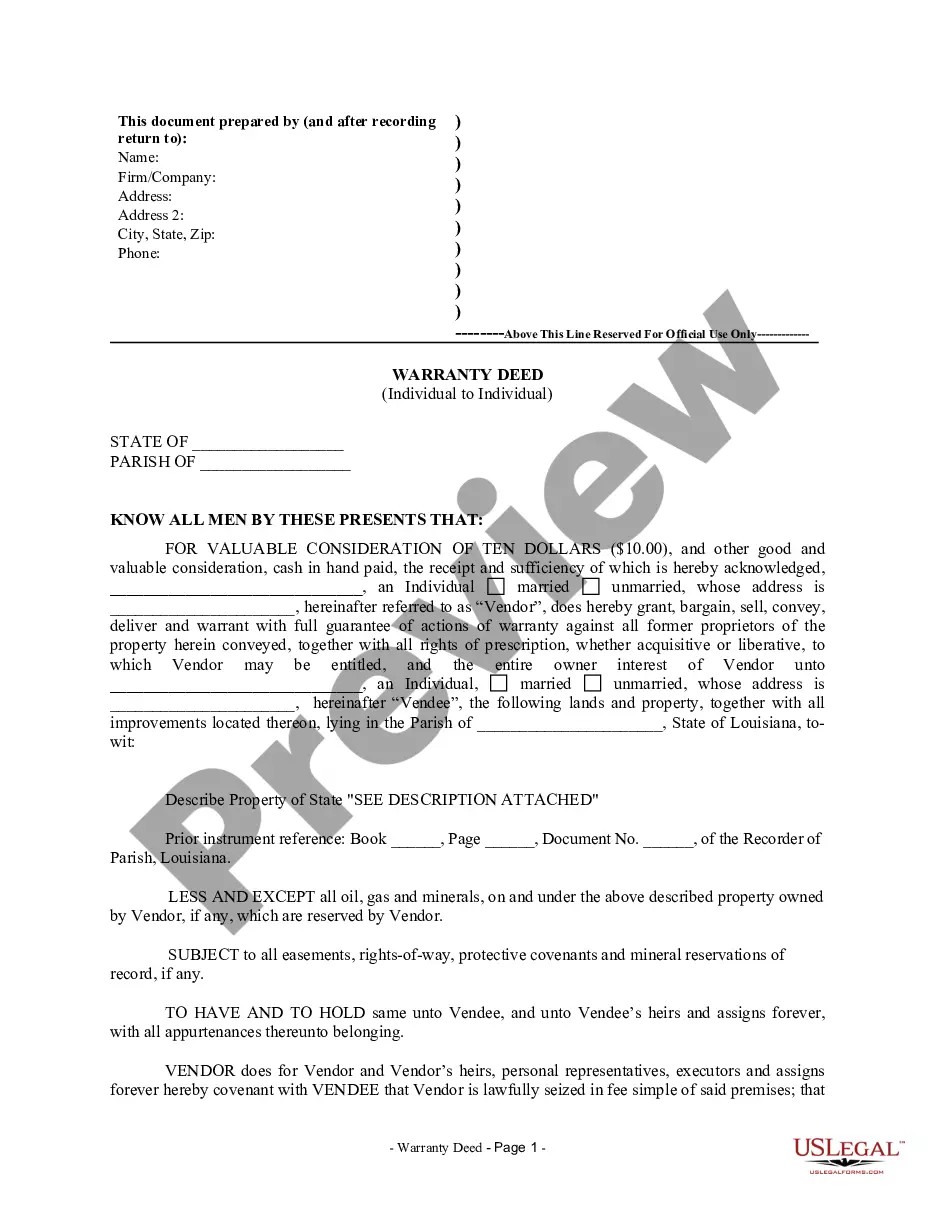

- Use the Review button to review the shape.

- Look at the explanation to ensure that you have selected the appropriate form.

- If the form isn`t what you are seeking, utilize the Look for area to obtain the form that meets your needs and specifications.

- If you find the correct form, simply click Get now.

- Opt for the costs plan you want, fill in the desired details to produce your bank account, and buy the order with your PayPal or Visa or Mastercard.

- Choose a hassle-free document structure and obtain your copy.

Discover all the papers templates you possess bought in the My Forms food list. You can aquire a more copy of Tennessee Utilization by a REIT of partnership structures in financing five development projects any time, if required. Just select the required form to obtain or produce the papers design.

Use US Legal Forms, the most substantial selection of authorized kinds, in order to save time as well as avoid errors. The services delivers professionally manufactured authorized papers templates that can be used for a variety of functions. Make your account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

How must a real estate company be organized to qualify as a REIT? A U.S. REIT must be formed in one of the 50 states or the District of Columbia as an entity taxable for federal purposes as a corporation. It must be governed by directors or trustees and its shares must be transferable.

General requirements A REIT cannot be closely held. A REIT will be closely held if more than 50 percent of the value of its outstanding stock is owned directly or indirectly by or for five or fewer individuals at any point during the last half of the taxable year, (this is commonly referred to as the 5/50 test). ABCs of REITs rsmus.com ? insights ? industries ? real-estate ? ab... rsmus.com ? insights ? industries ? real-estate ? ab...

For starters, REITs are corporations with regular management structures and shareholders, whereas MLPs are partnerships with so-called unitholders (i.e., limited partners). Investing in a REIT gives you an ownership share in a corporation, whereas MLP investors possess units in a partnership. REITs vs. MLPs - Dividend.com dividend.com ? how-to-invest ? reits-vs-mlps dividend.com ? how-to-invest ? reits-vs-mlps

REIT is governed by and established pursuant to a declaration of trust. Trustees of the REIT hold legal title to and manage the trust property on behalf of the unitholders of the REIT. Trustees of the REIT are generally subject to fiduciary duties similar to those applicable to directors of a corporation.

For starters, REITs are corporations with regular management structures and shareholders, whereas MLPs are partnerships with so-called unitholders (i.e., limited partners). Investing in a REIT gives you an ownership share in a corporation, whereas MLP investors possess units in a partnership.

A Real Estate Investment Trust (REIT) is a security that trades like a stock on the major exchanges and owns?and in most cases operates?income-producing real estate or related assets. Many REITs are registered with the SEC and are publicly traded on a stock exchange. These are known as publicly traded REITs. Real Estate Investment Trusts (REITs) | Charles Schwab schwab.com ? stocks ? understand-stocks ? r... schwab.com ? stocks ? understand-stocks ? r...

REIT Tax Advantages There are no wage restrictions or caps on the deduction, and taxpayers don't need to itemize their deductions to receive the QBI deduction. Therefore, in a REIT structure, the QBI deduction can benefit high-net-worth individuals, as non-REIT structures may have income limitations.

REIT stands for "Real Estate Investment Trust". A REIT is organized as a partnership, corporation, trust, or association that invests directly in real estate through the purchase of properties or by buying up mortgages. REITs issue shares that trade stock exchange and are bought and sold like ordinary stocks. Real Estate Investment Trust (REIT): How They Work and How ... investopedia.com ? ... ? Real Estate Investing investopedia.com ? ... ? Real Estate Investing