The Tennessee Amendment to Articles of Incorporation allows businesses to modify the terms of their authorized preferred stock. This amendment is designed to provide flexibility and adaptability for companies seeking to alter the characteristics and features of their preferred stock, such as dividend rates, conversion rights, and liquidation preferences. One type of Tennessee Amendment to Articles of Incorporation related to preferred stock is the "Amendment to Increase Authorized Preferred Stock." This amendment is filed when a company wants to expand the total number of shares of preferred stock it is authorized to issue. By increasing the authorized preferred stock, businesses can potentially raise additional capital or adjust their ownership structure to accommodate strategic decisions. Another type of amendment is the "Amendment to Modify Terms of Preferred Stock." Companies may opt to change the terms of their preferred stock to better align with their evolving business strategies or investor preferences. This amendment empowers organizations to tweak dividend preferences, convertibility features, voting rights, redemption rights, or any other terms specified in the existing preferred stock designation. By modifying these terms, companies can attract new investors, address potential funding needs, or adapt to market demands. Keywords: Tennessee Amendment to Articles of Incorporation, preferred stock, authorized preferred stock, amendment, terms, characteristics, features, dividend rates, conversion rights, liquidation preferences, Amendment to Increase Authorized Preferred Stock, authorized shares, capital, ownership structure, strategic decisions, Amendment to Modify Terms of Preferred Stock, business strategies, investor preferences, dividend preferences, convertibility features, voting rights, redemption rights, market demands.

Tennessee Amendment to Articles of Incorporation to change the terms of the authorized preferred stock

Description

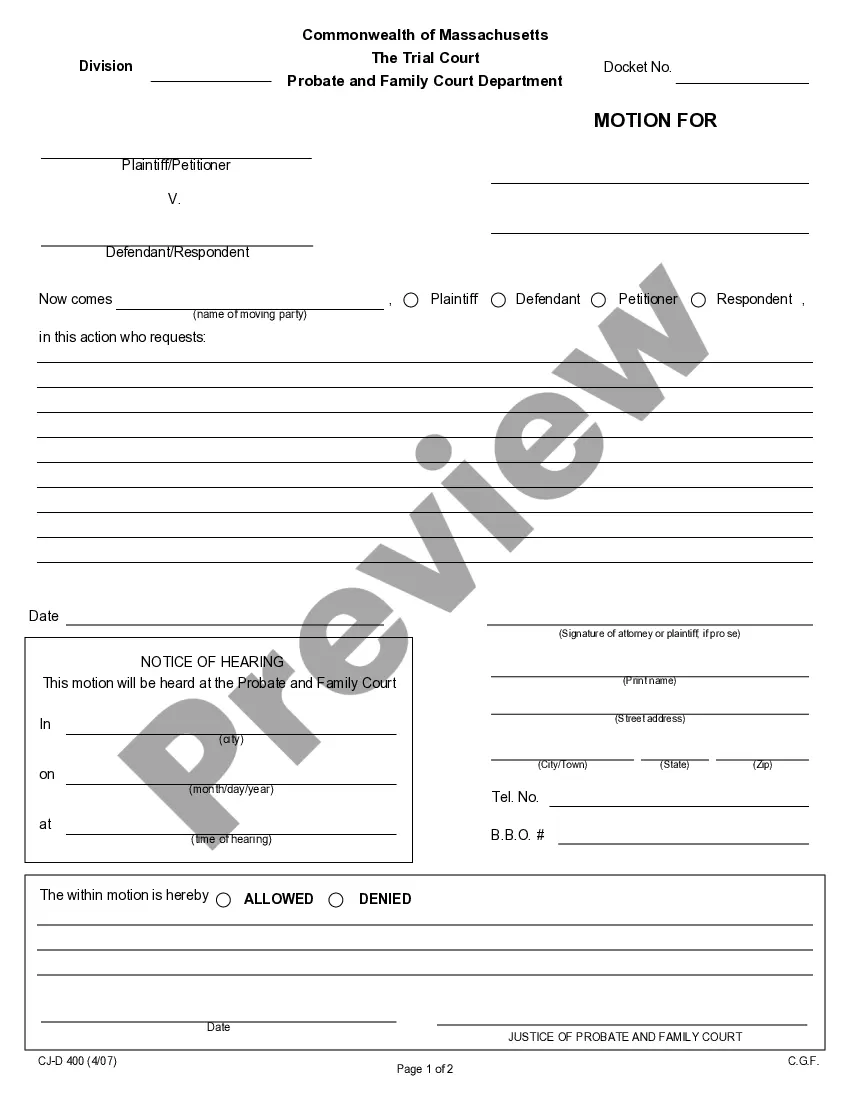

How to fill out Tennessee Amendment To Articles Of Incorporation To Change The Terms Of The Authorized Preferred Stock?

Are you currently inside a place that you need to have papers for either organization or person purposes just about every day? There are plenty of authorized papers web templates accessible on the Internet, but discovering kinds you can trust is not easy. US Legal Forms delivers a large number of kind web templates, just like the Tennessee Amendment to Articles of Incorporation to change the terms of the authorized preferred stock, which are composed to satisfy state and federal demands.

In case you are previously knowledgeable about US Legal Forms internet site and have a merchant account, merely log in. Following that, you are able to obtain the Tennessee Amendment to Articles of Incorporation to change the terms of the authorized preferred stock template.

If you do not come with an profile and would like to start using US Legal Forms, abide by these steps:

- Get the kind you need and make sure it is for that appropriate city/county.

- Make use of the Preview button to analyze the shape.

- Look at the information to ensure that you have selected the correct kind.

- If the kind is not what you`re trying to find, take advantage of the Lookup field to get the kind that fits your needs and demands.

- If you obtain the appropriate kind, simply click Acquire now.

- Opt for the rates program you want, fill out the required information and facts to create your bank account, and pay for the order with your PayPal or bank card.

- Pick a hassle-free document format and obtain your version.

Discover every one of the papers web templates you might have bought in the My Forms menu. You can get a extra version of Tennessee Amendment to Articles of Incorporation to change the terms of the authorized preferred stock at any time, if needed. Just click on the essential kind to obtain or printing the papers template.

Use US Legal Forms, the most considerable collection of authorized varieties, to conserve time as well as stay away from blunders. The services delivers appropriately produced authorized papers web templates that you can use for an array of purposes. Create a merchant account on US Legal Forms and initiate producing your lifestyle a little easier.