Tennessee Reclassification of Class B common stock into Class A common stock refers to the process of changing the classification of a certain type of stock in Tennessee. This reclassification typically involves upgrading Class B common stock into Class A common stock, which offers greater rights and benefits to the shareholders. Class B common stock is commonly associated with certain restrictions or reduced rights compared to Class A stock. These restrictions may include limited voting rights or limitations on dividend distributions. In order to provide greater benefits and privileges to investors, companies might decide to reclassify their Class B common stock into Class A common stock. The Tennessee Reclassification of Class B common stock into Class A common stock process involves various steps. Firstly, the company's board of directors must propose the reclassification and provide a detailed plan outlining the reasons and benefits of the change. This plan is then presented to the shareholders for approval. Upon receiving shareholder consent, the company will submit the proposal to the appropriate regulatory authorities in Tennessee. They will review the plan to ensure compliance with state laws and regulations. If approved, the company will implement the reclassification by amending its articles of incorporation or issuing a new class of shares. The reclassification offers several advantages to both the company and the shareholders. For the company, it can attract new investors and increase its financial flexibility by offering Class A common stock with improved rights and benefits. This may positively impact the company's transparency and corporate governance, fostering investor confidence. For shareholders, the reclassification can enhance their voting power, dividend entitlement, and potentially increase the market value of their holdings. The upgrade to Class A common stock can also provide better protection against dilution and certain takeover strategies that may be applicable to Class B shares. It's important to note that while the general concept of reclassification remains consistent, there are no specific types of Tennessee Reclassification of Class B common stock into Class A common stock. The process and benefits remain the same regardless of the industry or company involved. The reclassification is tailored to meet the unique needs and goals of each individual company pursuing such a change. In conclusion, the Tennessee Reclassification of Class B common stock into Class A common stock allows companies to upgrade the classification of their stock, providing shareholders with improved benefits and rights. This process enhances transparency, governance, and potential investor confidence. By reclassifying shares, companies can adapt to evolving market demands, attract new investors, and potentially increase shareholder value.

Tennessee Reclassification of Class B common stock into Class A common stock

Description

How to fill out Tennessee Reclassification Of Class B Common Stock Into Class A Common Stock?

Finding the right legitimate document web template could be a struggle. Needless to say, there are plenty of themes available online, but how can you find the legitimate kind you require? Make use of the US Legal Forms web site. The assistance provides a large number of themes, for example the Tennessee Reclassification of Class B common stock into Class A common stock, which you can use for business and personal requirements. All the types are checked out by professionals and meet up with state and federal needs.

If you are previously signed up, log in to your accounts and click on the Down load key to find the Tennessee Reclassification of Class B common stock into Class A common stock. Use your accounts to check from the legitimate types you might have purchased earlier. Check out the My Forms tab of your own accounts and get an additional duplicate from the document you require.

If you are a fresh user of US Legal Forms, allow me to share straightforward directions for you to comply with:

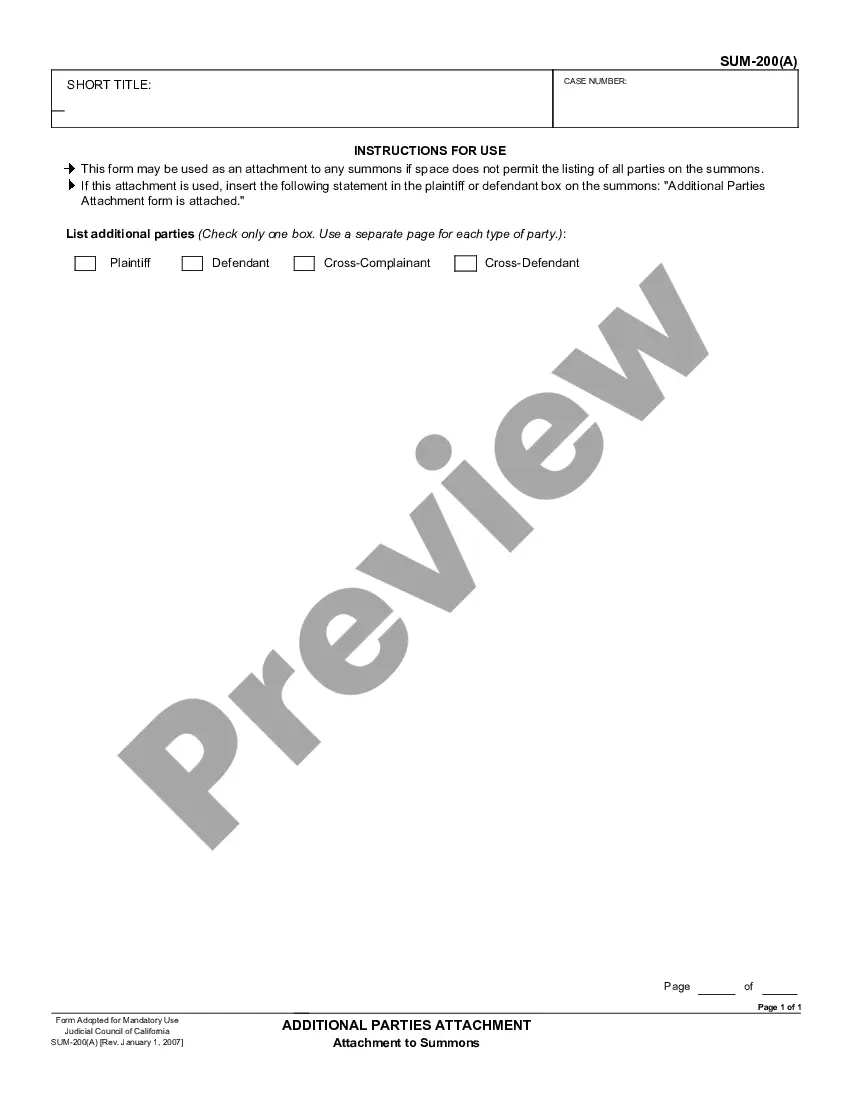

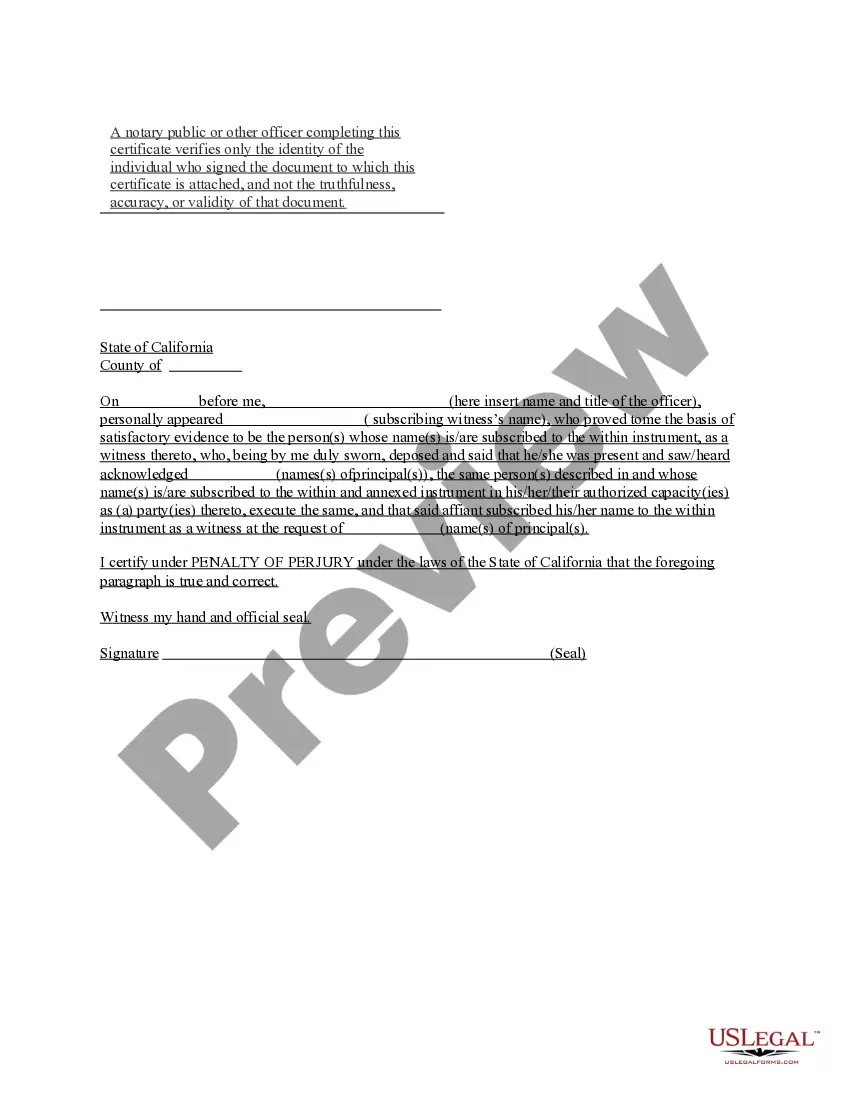

- Very first, be sure you have selected the right kind for the town/state. You are able to check out the shape making use of the Review key and study the shape information to make sure this is the best for you.

- When the kind is not going to meet up with your preferences, take advantage of the Seach field to discover the appropriate kind.

- When you are positive that the shape is suitable, click on the Acquire now key to find the kind.

- Select the rates program you want and enter the required info. Build your accounts and pay money for an order utilizing your PayPal accounts or credit card.

- Select the file file format and obtain the legitimate document web template to your gadget.

- Full, change and print and indication the obtained Tennessee Reclassification of Class B common stock into Class A common stock.

US Legal Forms is definitely the most significant local library of legitimate types where you can discover a variety of document themes. Make use of the company to obtain expertly-produced documents that comply with condition needs.

Form popularity

FAQ

Commonly, Class B shares are held by promoters or senior management of a company and carry significantly higher voting rights than Class A shares. It effectively allows firms to raise capital (by selling Class A shares) while retaining control of voting (and retaining Class B shares).

Pursuant to the Company's amended and restated certificate of incorporation (the "Charter"), class B shares generally may not be transferred until the Escrow Termination Date (as defined in the Charter).

The Bottom Line. Class A and Class B shares differ in their availability, convertibility, and power as it relates to voting. One isn't necessarily better than the other, but Class A shares offer significant benefit in the event of a sale or when an outside force wants to obtain more voting power.

What Are Class B Shares? Class B shares are a classification of common stock that may be accompanied by more or fewer voting rights than Class A shares. Class B shares may also have lower repayment priority in the event of a bankruptcy.

B shares also have voting rights in the company, but their dividends are worked out based on a lower rate. C shareholders have the same rate of dividends as A shareholders, but have no voting rights at all.

Class A shares may offer 10 voting rights per stock held, while class B shares offer only one. It depends on how the company decides to structure its stock. Class B shares are lower in payment priority than Class A shares.

The process of converting issued shares from one class or group into another is called re-designation, re-classification, re-naming or converting of shares.

Class B shares are financial instruments which represent ownership in a company and proportionate claims on its assets. They exist in companies with dual-class structures or with multiple classes of stock with differences in their voting rights attached to each class.