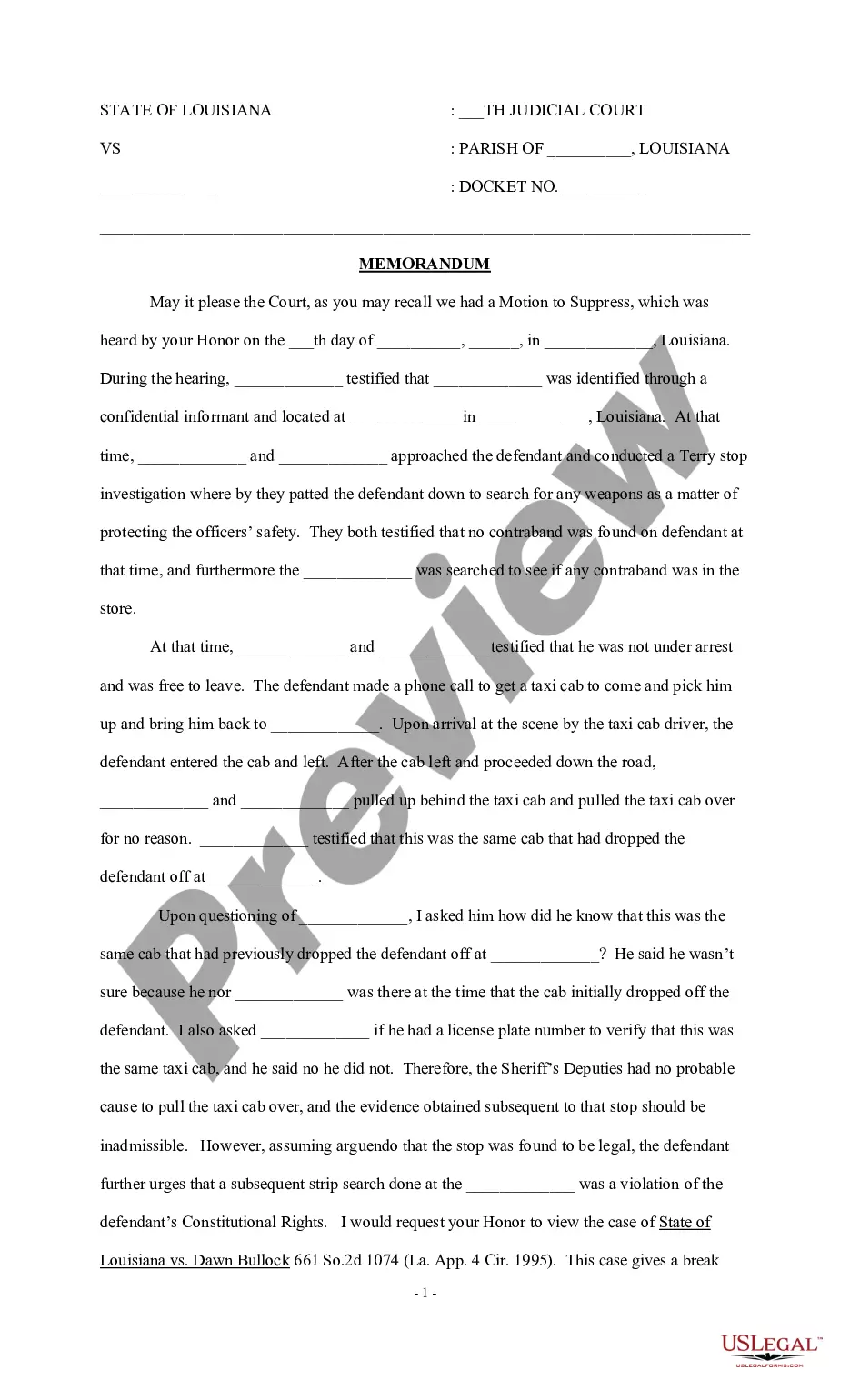

Tennessee Form of Convertible Promissory Note, Preferred Stock is a legal document designed for businesses and investors based in Tennessee seeking to raise capital through the issuance of convertible notes or preferred stock. This detailed description will provide an overview of the key elements and features of this financial instrument as well as its different types. The Tennessee Form of Convertible Promissory Note, Preferred Stock serves as a binding agreement between the issuing company and the investor. It outlines the terms and conditions of the investment, including the amount invested, interest rates, conversion rights, and other relevant details. This form is carefully structured to protect the interests of both parties involved and ensure compliance with Tennessee state laws and regulations. Keywords: Tennessee, convertible promissory note, preferred stock, capital raising, legal document, business, investor, terms and conditions, interest rates, conversion rights, compliance, state laws, regulations. There are different types of Tennessee Form of Convertible Promissory Note, Preferred Stock that businesses can choose from depending on their specific needs and objectives. These types include: 1. Convertible Promissory Note: This type of investment instrument allows an investor to lend money to a company in exchange for a promissory note, which can later be converted into equity or preferred stock at a predetermined conversion price or conversion ratio. Convertible promissory notes provide flexibility for both the investor and the company, enabling them to convert the debt into equity if certain predetermined conditions or milestones are met. 2. Preferred Stock: Preferred stock represents ownership in a company with certain preferential rights or privileges over common stockholders. Holders of preferred stock typically receive fixed dividends and have priority in the distribution of assets in the event of liquidation or bankruptcy. They also often possess the ability to convert their preferred shares into common shares at a specified conversion ratio. By utilizing the Tennessee Form of Convertible Promissory Note, Preferred Stock, businesses can efficiently raise capital while offering potential investors the opportunity for future equity participation. It is crucial for both parties involved to thoroughly review and understand the terms and conditions outlined in this legal document to ensure a mutually beneficial and compliant investment arrangement. Overall, the Tennessee Form of Convertible Promissory Note, Preferred Stock is an important tool for companies and investors in Tennessee to engage in capital raising activities while maintaining legal clarity and protection for both parties.

Tennessee Form of Convertible Promissory Note, Preferred Stock

Description

How to fill out Tennessee Form Of Convertible Promissory Note, Preferred Stock?

Finding the right lawful papers format can be a battle. Obviously, there are tons of web templates accessible on the Internet, but how will you get the lawful type you need? Utilize the US Legal Forms web site. The services gives 1000s of web templates, for example the Tennessee Form of Convertible Promissory Note, Preferred Stock, that you can use for business and private requirements. Each of the forms are checked out by experts and fulfill federal and state demands.

In case you are already registered, log in in your bank account and then click the Download option to find the Tennessee Form of Convertible Promissory Note, Preferred Stock. Make use of bank account to search through the lawful forms you may have acquired in the past. Check out the My Forms tab of your respective bank account and acquire another version of the papers you need.

In case you are a brand new customer of US Legal Forms, allow me to share straightforward directions so that you can comply with:

- Initial, ensure you have selected the appropriate type for your area/region. You may look over the shape making use of the Review option and browse the shape outline to ensure it will be the best for you.

- In case the type does not fulfill your expectations, take advantage of the Seach area to find the correct type.

- Once you are positive that the shape is acceptable, select the Get now option to find the type.

- Choose the prices plan you need and type in the necessary info. Build your bank account and buy your order using your PayPal bank account or Visa or Mastercard.

- Opt for the submit file format and acquire the lawful papers format in your device.

- Total, revise and produce and indication the acquired Tennessee Form of Convertible Promissory Note, Preferred Stock.

US Legal Forms is the largest catalogue of lawful forms for which you can see various papers web templates. Utilize the service to acquire appropriately-made papers that comply with status demands.

Form popularity

FAQ

Convertible loan notes can lead to dilution of existing shareholders' equity when the notes convert. This can be a disadvantage for start-ups that want to maintain control over their company.

The basic concept for valuing a convertible note is the same in theory as the valuation of any other financial asset. The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.

Typical terms of convertible notes are: interest rate, maturity date, conversion provisions, a conversion discount, and a valuation cap.

Are convertible note offerings registered with the SEC? Convertible note offerings can be conducted as registered offerings or as unregistered private offerings under Rule 144A under the Securities Act of 1933, as amended (the ?Securities Act?).

Disadvantages: 1. Convertible notes can create a down round problem, where the conversion price is set at a lower price than the current valuation of the company, resulting in the investor receiving less equity than they would have if they had invested at the current valuation.

Also known as convertible promissory notes, bridge notes, or convertible debt. Since convertible notes are securities, they must be registered, or qualify for an exemption from registration, under the Securities Act.

Convertible notes are promissory notes that serve an additional business purpose other than merely representing debt. Convertible notes include all of the terms of a vanilla promissory note, such as an interest rate and the pledge of underlying security (if applicable).

Common provisions of a convertible debt financing include: The interest rate. Usually somewhere between 4% and 8%. The maturity date. Usually 12?24 months. A mandatory conversion paragraph. ... An optional conversion paragraph. ... A change of control provision. ... A conversion discount. ... A valuation cap. ... An amendment provision.