Title: Tennessee Agreement and Plan of Merger by Gel co Corp. and Grossman Corp.: A Comprehensive Overview Keywords: Tennessee Agreement and Plan of Merger, Gel co Corp., Grossman Corp., types Introduction: The Tennessee Agreement and Plan of Merger between Gel co Corp. and Grossman Corp. presents a crucial business consolidation strategy. This detailed description aims to provide insights into the agreement's purpose, process, benefits, and potential types of mergers. I. Overview The Tennessee Agreement and Plan of Merger is a legally binding contract that outlines the terms and conditions for merging Gel co Corp. and Grossman Corp., two independent entities operating in Tennessee. This strategic move brings together complementary resources, expertise, and market presence to achieve long-term objectives. II. Purpose The primary purpose of the Tennessee Agreement and Plan of Merger is to streamline operations, eliminate redundancies, and foster mutual growth opportunities for Gel co Corp. and Grossman Corp. through collaboration. By merging their respective assets, knowledge, and customer bases, both companies aim to enhance their competitive edge and achieve economies of scale. III. Process 1. Pre-Merger Phase: a. Identification and evaluation: Gel co Corp. and Grossman Corp. identify the potential benefits and risks associated with the merger, considering financials, market positions, legal implications, and competitive landscapes. b. Negotiations: The parties engage in extensive negotiations to finalize terms, including the structure of the merger, stock exchange ratios, regulatory approvals, employee retention plans, and other relevant aspects conducive to successful integration. 2. Merger Implementation: a. Shareholder approval: Gel co Corp. and Grossman Corp. seek approval from their respective shareholders, holding meetings to present the merger plan, address concerns, and obtain necessary votes. b. Legal and regulatory compliance: The agreement ensures compliance with Tennessee state laws and regulations governing mergers, such as filing necessary documents with the Tennessee Secretary of State and obtaining requisite approvals. c. Integration planning: The companies establish a detailed integration plan, addressing financial consolidation, combining operations, human resources, IT systems, and establishing a joint corporate culture. d. Post-merger operations: After the merger, all efforts are directed towards effectively integrating business units, streamlining operations, maintaining customer satisfaction, and executing the integration plan within specified timelines. IV. Types of Tennessee Agreement and Plan of Merger 1. Merger of Equals: Gel co Corp. and Grossman Corp. agree to merge as equal partners, combining their assets, management teams, and operations to form a new, single entity. 2. Acquisition or Takeover Merger: Gel co Corp. acquires the shares or assets of Grossman Corp., making it a wholly-owned subsidiary or integrating it into its existing structure. 3. Cash Merger: Gel co Corp. acquires all the shares of Grossman Corp., providing the shareholders of Grossman Corp. with cash consideration instead of acquiring their shares. Conclusion: The Tennessee Agreement and Plan of Merger between Gel co Corp. and Grossman Corp. represents a significant strategic decision aimed at leveraging synergies, enhancing business performance, and maximizing shareholder value. This comprehensive description sheds light on the purpose, process, and potential types of mergers involved, emphasizing the importance of meticulous planning and effective integration for a successful merger.

Tennessee Agreement and plan of merger by Gelco Corp. and Grossman Corp.

Description

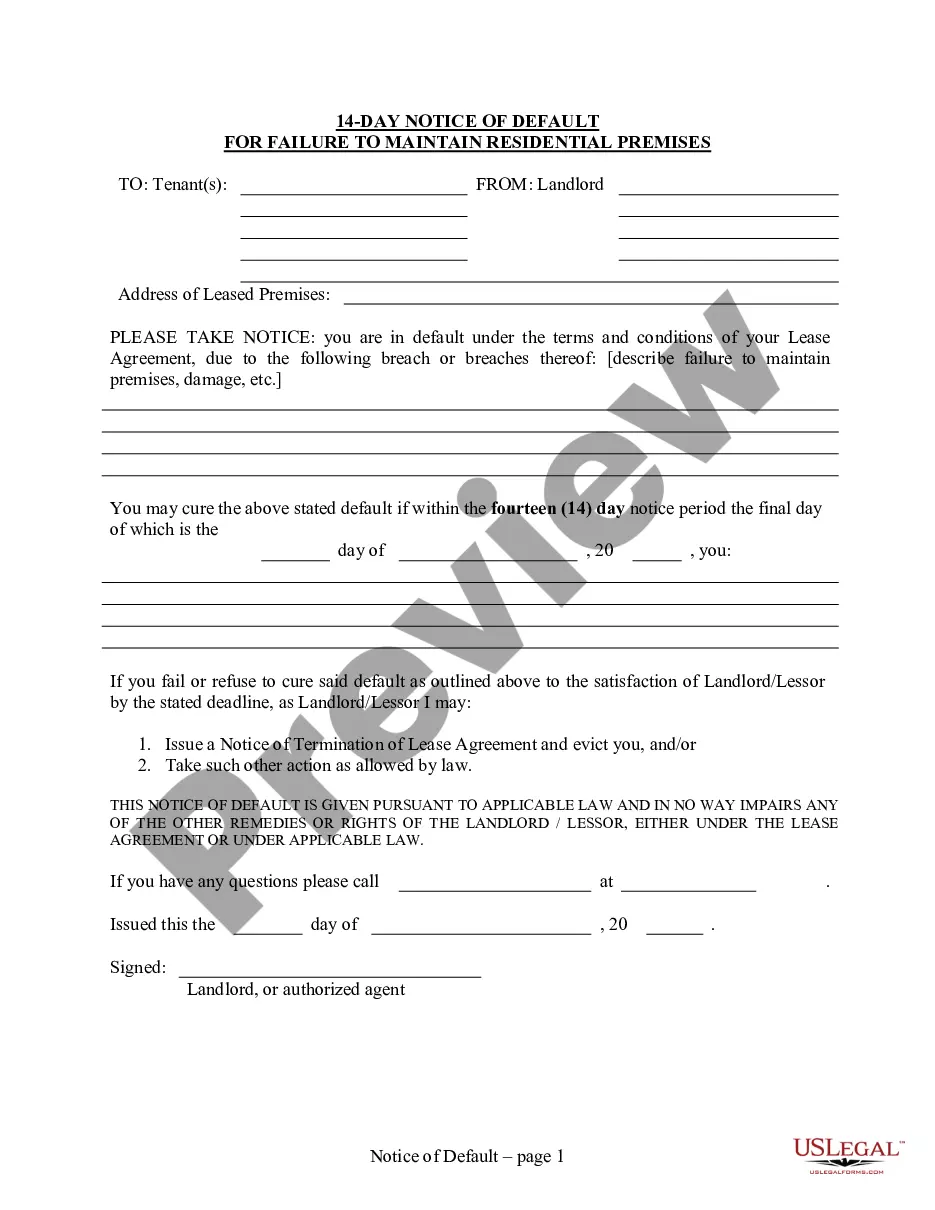

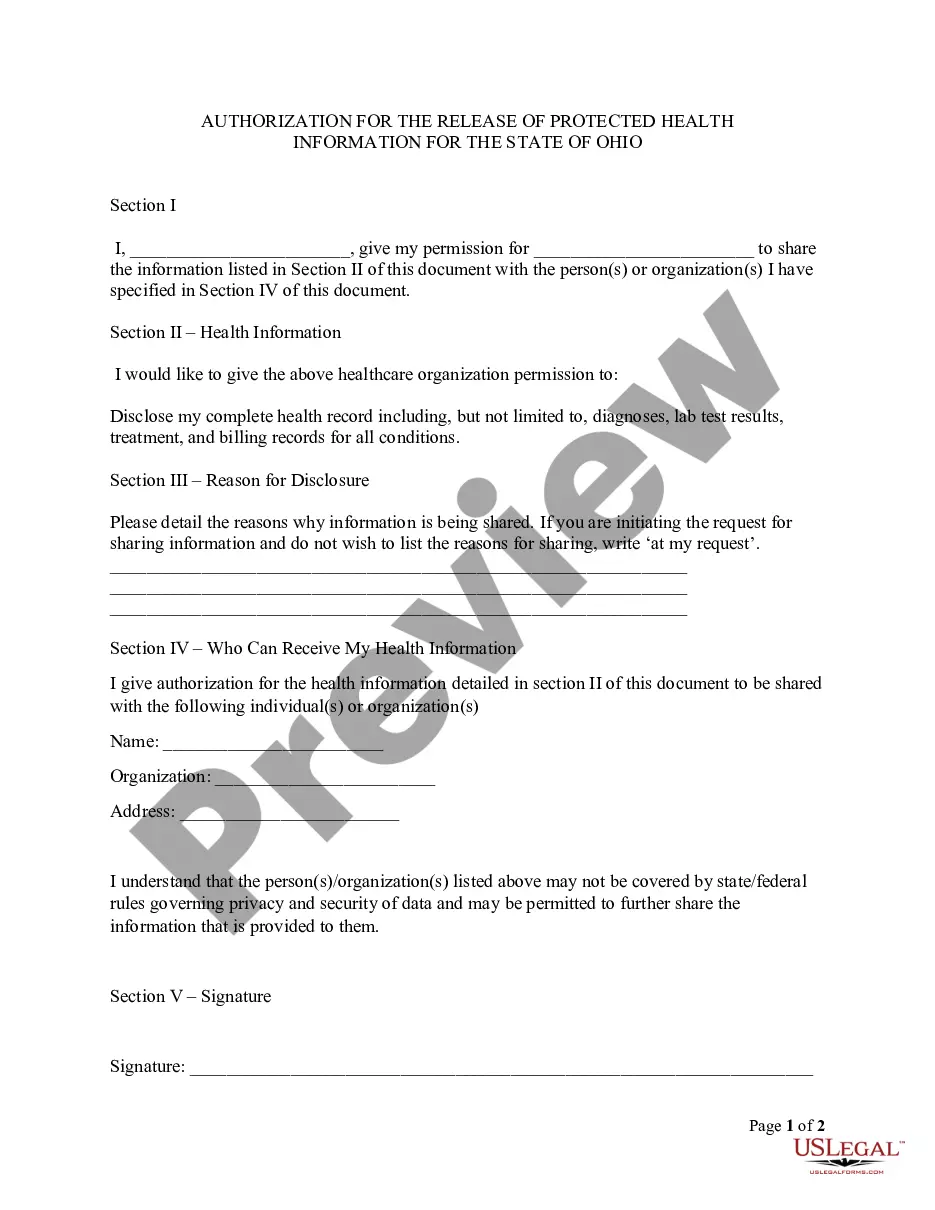

How to fill out Tennessee Agreement And Plan Of Merger By Gelco Corp. And Grossman Corp.?

If you have to comprehensive, obtain, or print out legal record layouts, use US Legal Forms, the biggest assortment of legal forms, that can be found on-line. Use the site`s easy and handy search to discover the files you require. Different layouts for company and individual uses are sorted by classes and states, or keywords and phrases. Use US Legal Forms to discover the Tennessee Agreement and plan of merger by Gelco Corp. and Grossman Corp. within a few clicks.

If you are currently a US Legal Forms consumer, log in for your accounts and click the Down load key to obtain the Tennessee Agreement and plan of merger by Gelco Corp. and Grossman Corp.. You may also accessibility forms you earlier acquired in the My Forms tab of the accounts.

If you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for that right city/land.

- Step 2. Use the Review solution to look over the form`s content material. Don`t forget to learn the information.

- Step 3. If you are not satisfied together with the type, make use of the Search industry at the top of the monitor to find other models from the legal type design.

- Step 4. Once you have located the form you require, click on the Purchase now key. Choose the costs strategy you like and add your credentials to register on an accounts.

- Step 5. Process the transaction. You can use your Мisa or Ьastercard or PayPal accounts to complete the transaction.

- Step 6. Pick the formatting from the legal type and obtain it on the device.

- Step 7. Complete, edit and print out or sign the Tennessee Agreement and plan of merger by Gelco Corp. and Grossman Corp..

Each and every legal record design you acquire is the one you have for a long time. You possess acces to each and every type you acquired in your acccount. Select the My Forms section and decide on a type to print out or obtain again.

Be competitive and obtain, and print out the Tennessee Agreement and plan of merger by Gelco Corp. and Grossman Corp. with US Legal Forms. There are many skilled and status-certain forms you may use for your company or individual needs.

Form popularity

FAQ

If the merger or acquisition requires a vote by shareholders, the agreement will be available in the proxy document, Schedule 14A (or sometimes an information statement, Schedule 14C). The proxy will include the terms of the merger and what shareholders can expect to receive as proceeds.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

Questions to Ask During a Merger or Acquisition Company. ? What is the timeframe for change? When can customers expect to see changes to the company or products? ... People. ? What will happen to the current leadership team? ... Products. ? Are there any plans to sunset the brand of one of the companies?

After that, I'll also very briefly introduce you to several other common mergers and acquisitions (M&A) transaction documents, including: Confidentiality Agreements. Letters of Intent. Exclusivity Agreements. Disclosure Schedules. HSR Filings. Third Party Consents. Legal Opinions. Stock Certificates.

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.