Title: Tennessee Agreement and Plan of Merger by NFL Corp. and Cast Acquisition Corp. Introduction: The Tennessee Agreement and Plan of Merger by NFL Corp. and Cast Acquisition Corp. is a legal document that outlines the process and terms of merging two businesses in the state of Tennessee. It serves as a binding agreement between NFL Corp. and Cast Acquisition Corp., detailing the rights, obligations, and conditions agreed upon by both parties. There may be various types of Tennessee Agreement and Plan of Merger by NFL Corp. and Cast Acquisition Corp., depending on the specific circumstances and objectives of the merger. Key Keywords: Tennessee Agreement and Plan of Merger, NFL Corp., Cast Acquisition Corp., legal document, merging businesses, binding agreement, rights, obligations, conditions, specific circumstances. 1. Tennessee Agreement and Plan of Merger (Standard): The Tennessee Agreement and Plan of Merger (Standard) is a comprehensive legal document that outlines the merger process between NFL Corp. and Cast Acquisition Corp. It includes detailed provisions related to the purchase of shares, transfer of assets, and assumption of liabilities. This type of agreement ensures all stakeholders are informed and protected throughout the merger process. 2. Tennessee Agreement and Plan of Merger (Financial): The Tennessee Agreement and Plan of Merger (Financial) focuses primarily on the financial aspects of the merger between NFL Corp. and Cast Acquisition Corp. It outlines the allocation of shares, valuation of assets, determination of purchase price, and other financial considerations. This type of agreement is typically used when financial details play a significant role in the merger transaction. 3. Tennessee Agreement and Plan of Merger (Stock-for-Stock): The Tennessee Agreement and Plan of Merger (Stock-for-Stock) primarily involves the exchange of stock between NFL Corp. and Cast Acquisition Corp. This agreement outlines the ratio at which the stock will be exchanged, any adjustments to the stock value, and the treatment of outstanding stock options or restricted stock units. It ensures a fair and equitable exchange of ownership interests. 4. Tennessee Agreement and Plan of Merger (Asset Acquisition): The Tennessee Agreement and Plan of Merger (Asset Acquisition) focuses on the acquisition of specific assets and liabilities of one company by another, rather than a full-scale merger. This type of agreement outlines the assets being transferred, the assumption of liabilities, any conditions precedent, and the consideration for the acquisition. It may be used when a company prefers to acquire specific assets instead of merging entirely. Conclusion: The Tennessee Agreement and Plan of Merger by NFL Corp. and Cast Acquisition Corp. is a crucial legal document that facilitates the merger process in Tennessee. Depending on the specific circumstances and objectives of the merger, different types of agreements may be used, such as the standard merger agreement, financial agreement, stock-for-stock agreement, or asset acquisition agreement. The agreement ensures transparency, protects the rights and obligations of both parties involved, and lays out the conditions under which the merger transaction will take place.

Tennessee Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp.

Description

How to fill out Tennessee Agreement And Plan Of Merger By NFA Corp. And Casty Acquisition Corp.?

Are you inside a situation that you need documents for possibly organization or individual uses nearly every time? There are plenty of legitimate document templates accessible on the Internet, but discovering kinds you can rely on isn`t simple. US Legal Forms offers a huge number of kind templates, much like the Tennessee Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp., which can be composed to satisfy federal and state demands.

When you are presently familiar with US Legal Forms site and have an account, just log in. Next, you may download the Tennessee Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp. format.

Unless you offer an profile and would like to begin using US Legal Forms, follow these steps:

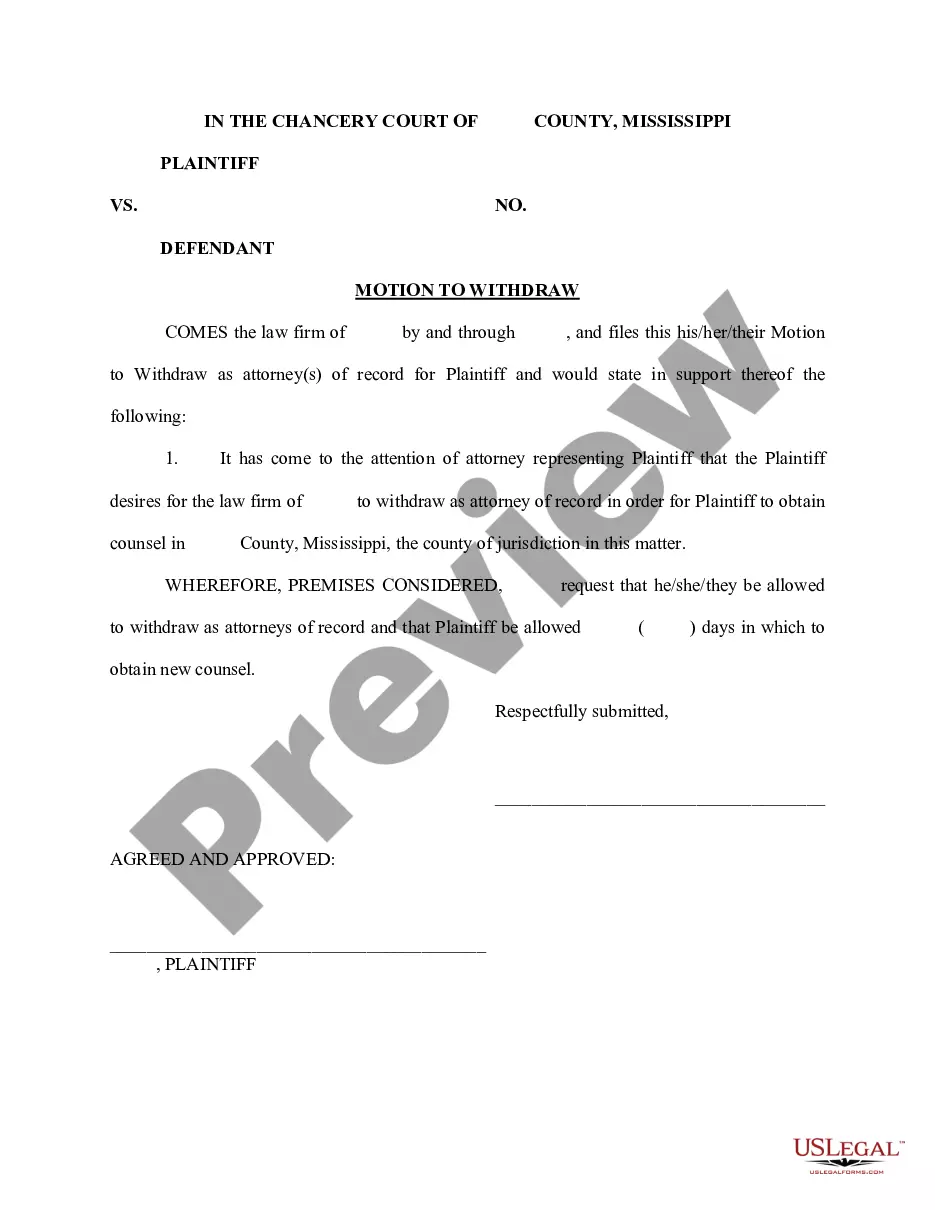

- Obtain the kind you need and ensure it is for that appropriate area/county.

- Take advantage of the Preview button to review the form.

- See the explanation to ensure that you have chosen the appropriate kind.

- When the kind isn`t what you are looking for, take advantage of the Look for discipline to find the kind that suits you and demands.

- Once you find the appropriate kind, simply click Purchase now.

- Select the rates plan you need, fill in the desired info to produce your money, and buy an order utilizing your PayPal or credit card.

- Choose a practical document structure and download your copy.

Discover every one of the document templates you possess bought in the My Forms menu. You can aquire a further copy of Tennessee Agreement and Plan of Merger by NFA Corp. and Casty Acquisition Corp. whenever, if required. Just click on the needed kind to download or printing the document format.

Use US Legal Forms, the most comprehensive variety of legitimate varieties, to save lots of some time and prevent faults. The support offers professionally produced legitimate document templates that can be used for a variety of uses. Produce an account on US Legal Forms and initiate creating your lifestyle a little easier.