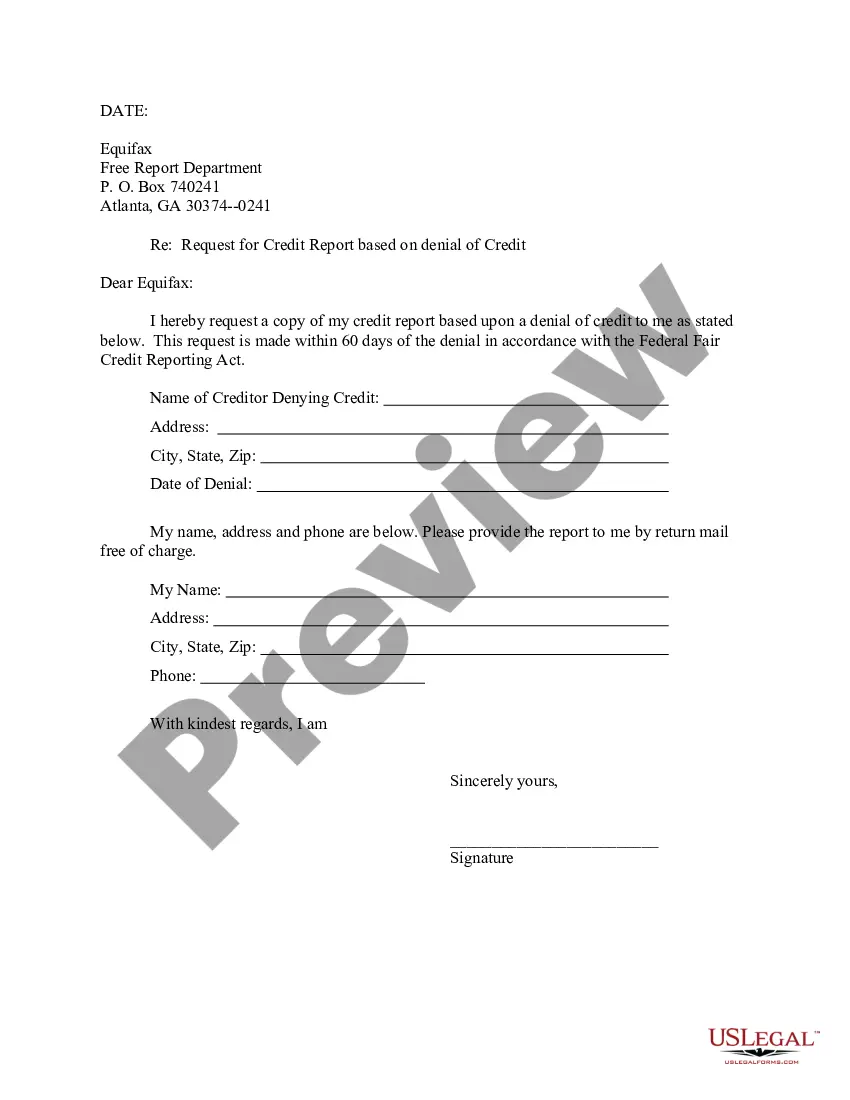

Tennessee Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit

Description

How to fill out Letter To Equifax Requesting Free Copy Of Your Credit Report Based On Denial Of Credit?

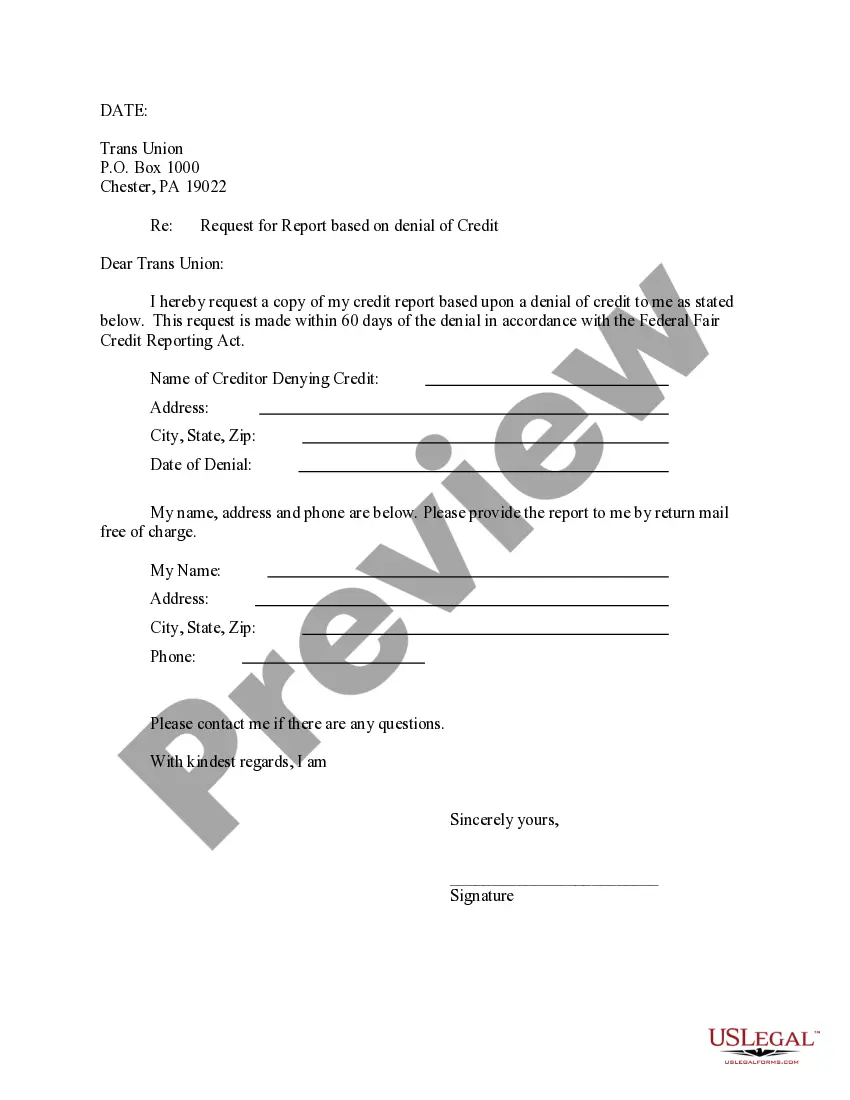

US Legal Forms - among the most significant libraries of lawful forms in the United States - offers a variety of lawful papers web templates you can down load or produce. While using web site, you can find 1000s of forms for organization and individual purposes, categorized by categories, suggests, or keywords.You will find the most recent types of forms such as the Tennessee Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit in seconds.

If you currently have a subscription, log in and down load Tennessee Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit through the US Legal Forms local library. The Acquire button will show up on every develop you look at. You gain access to all previously saved forms inside the My Forms tab of your account.

In order to use US Legal Forms the first time, here are straightforward guidelines to get you started out:

- Be sure to have chosen the correct develop to your area/region. Select the Preview button to analyze the form`s content material. Browse the develop explanation to actually have chosen the right develop.

- In case the develop doesn`t match your specifications, take advantage of the Lookup industry on top of the display to discover the one who does.

- In case you are pleased with the shape, confirm your option by visiting the Buy now button. Then, choose the costs strategy you want and provide your qualifications to sign up for the account.

- Procedure the purchase. Use your bank card or PayPal account to accomplish the purchase.

- Find the structure and down load the shape in your product.

- Make adjustments. Complete, change and produce and sign the saved Tennessee Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit.

Each format you included in your account lacks an expiration day and is your own property permanently. So, if you wish to down load or produce another version, just check out the My Forms section and then click on the develop you need.

Get access to the Tennessee Letter to Equifax Requesting Free Copy of Your Credit Report based on Denial of Credit with US Legal Forms, probably the most extensive local library of lawful papers web templates. Use 1000s of skilled and status-certain web templates that meet up with your business or individual requirements and specifications.