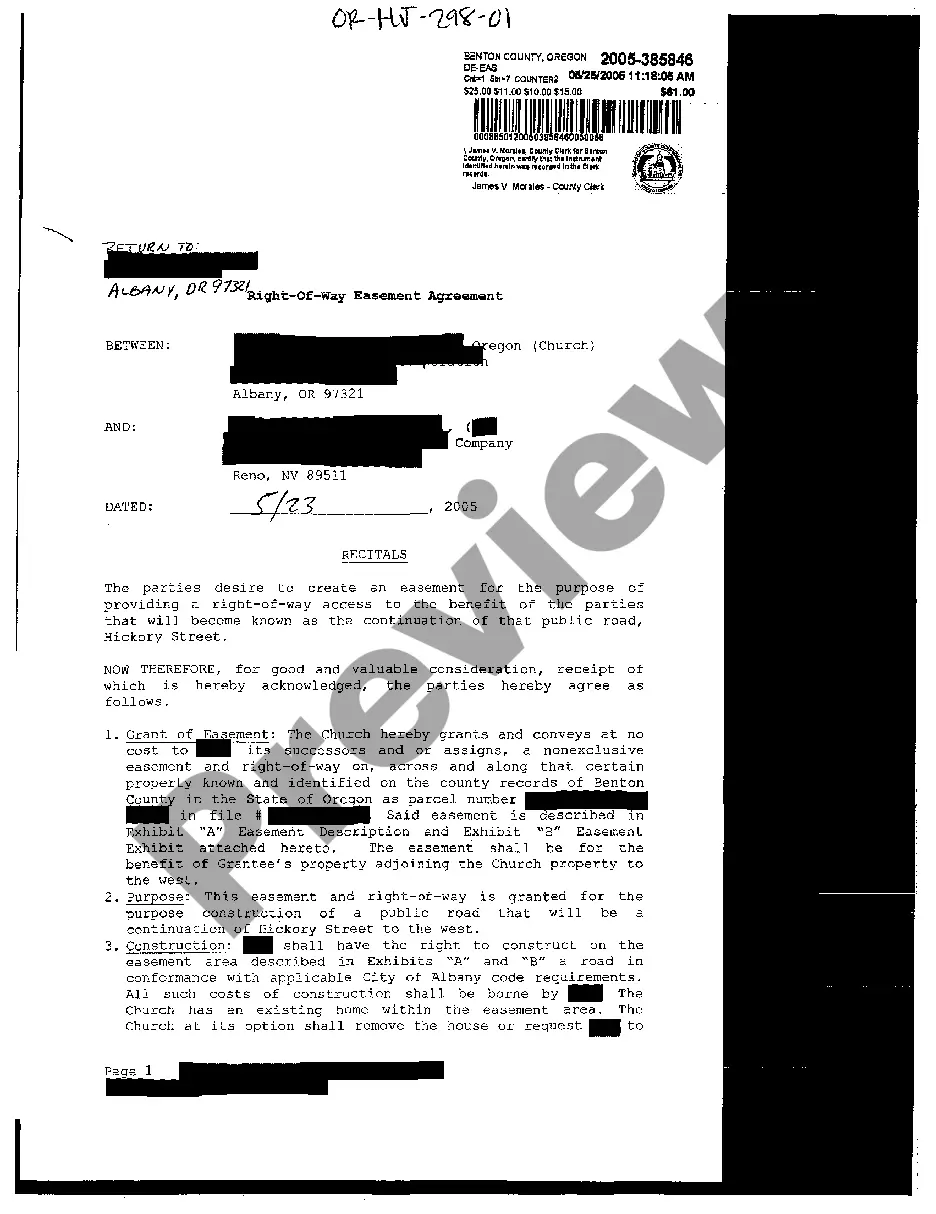

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Tennessee Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

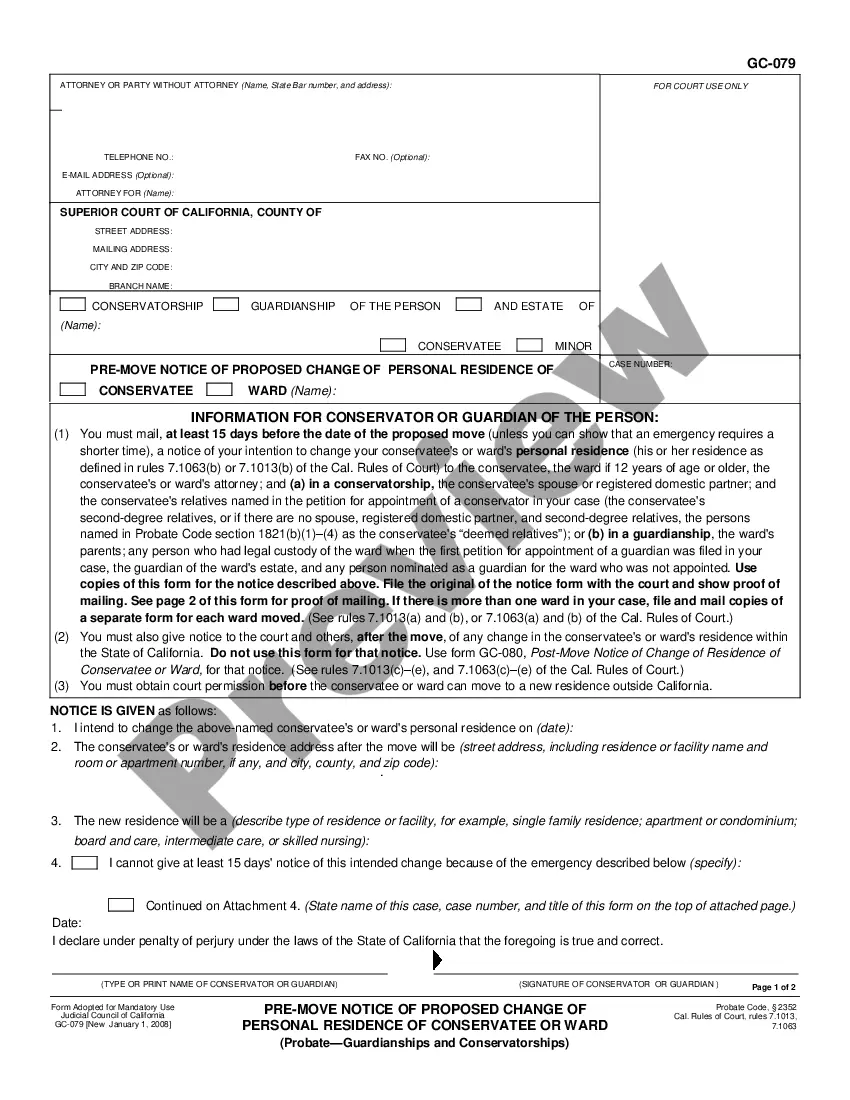

How to fill out Tennessee Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

If you want to full, obtain, or produce legitimate document layouts, use US Legal Forms, the greatest selection of legitimate kinds, that can be found on the web. Take advantage of the site`s easy and convenient search to discover the documents you want. Various layouts for business and individual functions are sorted by groups and states, or search phrases. Use US Legal Forms to discover the Tennessee Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law in just a number of mouse clicks.

In case you are currently a US Legal Forms buyer, log in to your accounts and click the Obtain button to get the Tennessee Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law. You can even accessibility kinds you previously saved within the My Forms tab of your respective accounts.

Should you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for the right area/nation.

- Step 2. Take advantage of the Preview option to look through the form`s articles. Do not forget about to see the explanation.

- Step 3. In case you are unhappy with the develop, make use of the Research discipline towards the top of the display screen to find other types in the legitimate develop web template.

- Step 4. After you have discovered the shape you want, go through the Purchase now button. Select the rates program you like and include your qualifications to register for the accounts.

- Step 5. Process the purchase. You can use your credit card or PayPal accounts to finish the purchase.

- Step 6. Select the format in the legitimate develop and obtain it on the device.

- Step 7. Total, change and produce or indicator the Tennessee Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law.

Each legitimate document web template you get is your own eternally. You possess acces to every develop you saved in your acccount. Select the My Forms area and select a develop to produce or obtain yet again.

Be competitive and obtain, and produce the Tennessee Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law with US Legal Forms. There are many expert and express-distinct kinds you can utilize for your personal business or individual requires.

Form popularity

FAQ

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

A debt validation letter should include the name of your creditor, how much you supposedly owe, and information on how to dispute the debt. After receiving a debt validation letter, you have 30 days to dispute the debt and request written evidence of it from the debt collector.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

There is a statute of limitations on debt in Tennessee which is 6 years. This means that if the debt does not get closed out in six years, a lender is not eligible to sue the person to collect the debt.

If a debt collector fails to verify the debt but continues to go after you for payment, you have the right to sue that debt collector in federal or state court. You might be able to get $1,000 per lawsuit, plus actual damages, attorneys' fees, and court costs.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

Debt collectors are legally required to send one within five days of first contact. You have within 30 days from receiving a debt validation letter to send a debt verification letter. Here's the important part: You have just 30 days to respond to a debt validation letter with your debt verification letter.

If you make a payment (even as small as $5), the debt collector will be given the right to sue you again, leading to possible wage garnishment. In Tennessee the statute of limitations on debt is as follows: Mortgage debt: 6 years. Medical debt: 6 years.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.