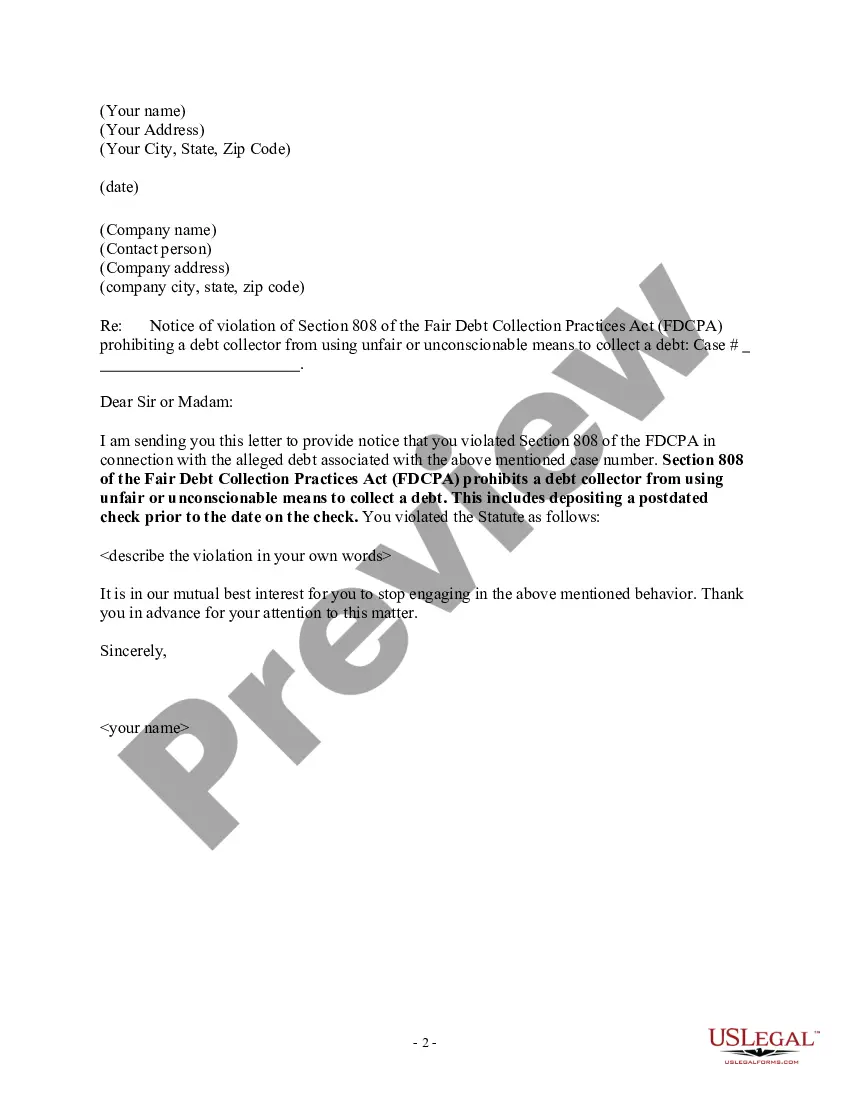

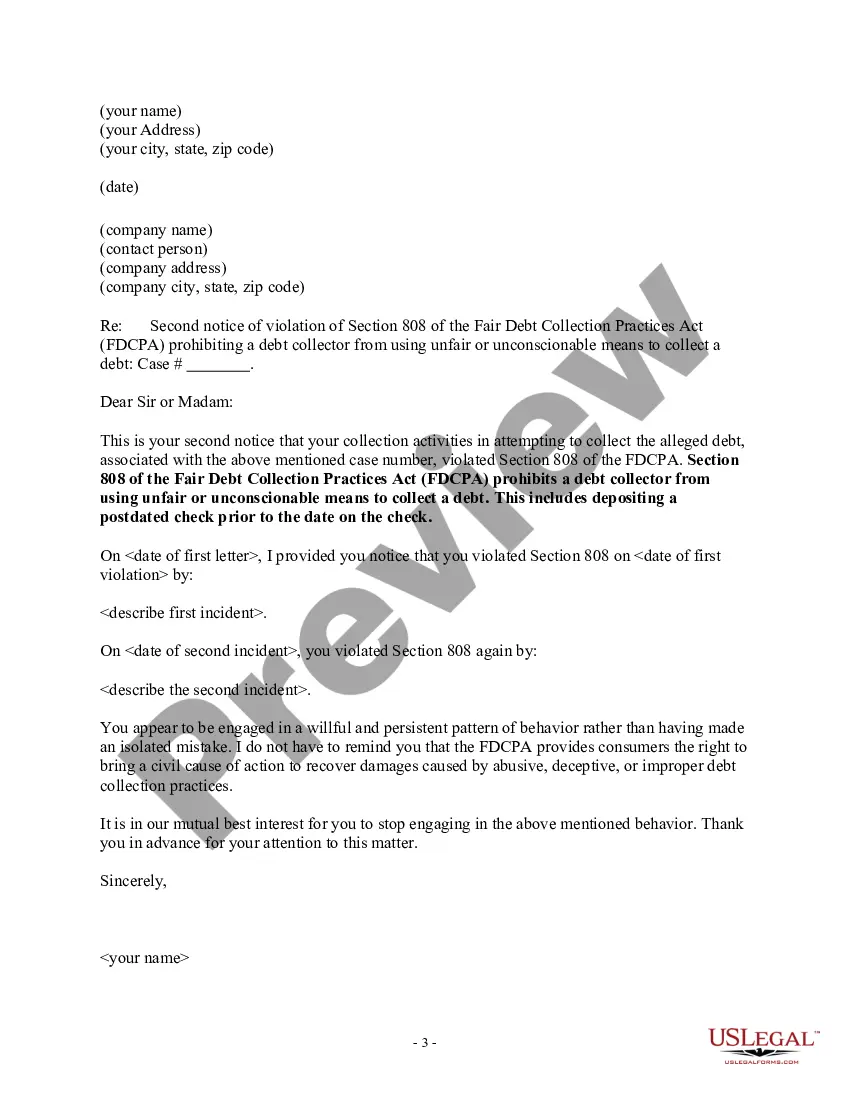

A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Tennessee Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

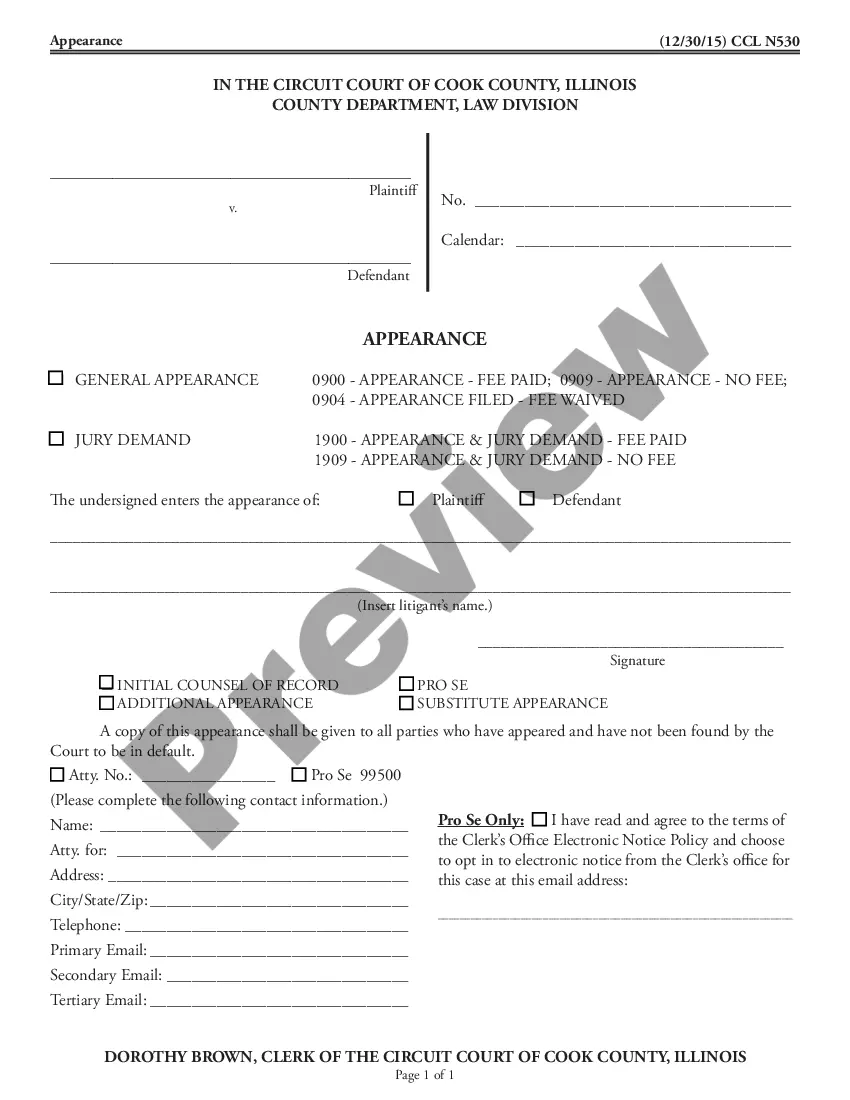

How to fill out Tennessee Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

US Legal Forms - one of many largest libraries of legitimate kinds in the States - delivers a wide range of legitimate record templates you may down load or printing. Using the website, you will get a huge number of kinds for enterprise and person reasons, categorized by categories, claims, or keywords.You can find the newest types of kinds such as the Tennessee Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check within minutes.

If you already have a registration, log in and down load Tennessee Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check in the US Legal Forms library. The Down load key will show up on every single form you see. You get access to all formerly saved kinds from the My Forms tab of your own profile.

If you would like use US Legal Forms for the first time, allow me to share simple directions to help you get began:

- Be sure to have chosen the proper form for your area/region. Go through the Preview key to analyze the form`s articles. Look at the form description to ensure that you have selected the appropriate form.

- In the event the form does not satisfy your requirements, use the Research field at the top of the display to find the one who does.

- When you are happy with the form, confirm your selection by clicking on the Get now key. Then, pick the rates plan you want and offer your qualifications to register for an profile.

- Method the purchase. Make use of your credit card or PayPal profile to accomplish the purchase.

- Select the formatting and down load the form on your product.

- Make adjustments. Load, modify and printing and signal the saved Tennessee Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check.

Each and every format you put into your bank account lacks an expiration time and is your own property for a long time. So, in order to down load or printing an additional duplicate, just proceed to the My Forms section and then click about the form you require.

Obtain access to the Tennessee Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check with US Legal Forms, the most extensive library of legitimate record templates. Use a huge number of specialist and status-distinct templates that meet your organization or person needs and requirements.

Form popularity

FAQ

Generally, state law provides that if you notified your bank or credit union about a post-dated check a reasonable time before it received the check, your notice is valid for six months. During that time, the bank or credit union should not cash the check before the date you wrote on the check.

From a criminal law perspective, there is nothing inherently illegal about postdating a check, says Eric Hintz, a criminal defense attorney in Sacramento, California. Hintz says that only criminal intent, such as intentionally not having enough money for a payment, can be grounds for check fraud.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

Can a bank or credit union cash a post-dated check before the date on the check? Yes. Banks and credit unions generally don't have to wait until the date you put on a check to cash it. However, state law may require the bank or credit union to wait to cash the check if you give it reasonable notice.

In most cases, when you receive a postdated check, you can deposit or cash a postdated check at any time. Debt collectors may be prohibited from processing a check before the date on the check, but most individuals are free to take postdated checks to the bank immediately.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

A signed check immediately becomes legal tender that a bank can deposit or cash before the indicated date on the check. Therefore, a bank will be able to accept a check if it is dated and signed. Ask your bank or credit union for their specific policy for postdated checks in their account disclosures.

Depositing a postdated check a day early may cause the check writer's bank to attempt to pay the check immediately. If the check writer does not yet have the funds in his bank account, this will cause the check to "bounce," or be returned for nonsufficient funds.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

Postdating a check is done by writing a check for a future date instead of the actual date the check was written. This is typically done with the intention that the check recipient will not cash or deposit the check until the future indicated date.