Title: Understanding the Tennessee Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank Introduction: The Tennessee Escrow Agreement Public Offering serves as a legally binding agreement between Lorelei Corporation and Chase Manhattan Bank, assuring transparency and protection for both parties involved. This article aims to provide a comprehensive overview of this agreement, highlighting its purpose, key provisions, and potential types. Keywords: Tennessee Escrow Agreement Public Offering, Lorelei Corporation, Chase Manhattan Bank, detailed description, types I. Understanding the Tennessee Escrow Agreement Public Offering: The Tennessee Escrow Agreement Public Offering is a mutual agreement entered into by Lorelei Corporation, the issuing company, and Chase Manhattan Bank, acting as the escrow agent. This agreement aims to secure and facilitate the transfer of assets or funds from one party to another, ensuring a smooth and transparent transaction process. II. Key Provisions of the Tennessee Escrow Agreement Public Offering: a. Asset Protection: The agreement safeguards the assets or funds being transferred during the transaction, providing both parties with assurance that the escrow agent will safely hold and manage them until the agreed conditions are met. b. Transparent Transaction Process: This agreement ensures transparency by specifying the terms and conditions under which the funds or assets are being transferred. It defines the obligations of each party involved and outlines the procedures for disbursement or release of funds. c. Dispute Resolution: In the event of a dispute, the Tennessee Escrow Agreement provides guidelines for dispute resolution, including the possibility of arbitration or litigation, helping to maintain a fair and impartial process. III. Types of Tennessee Escrow Agreement Public Offering: There could be various types of Tennessee Escrow Agreement Public Offering, categorized based on the specific transaction purpose or nature. Some possible types include: a. Merger & Acquisition Escrow: This type of agreement is established when Lorelei Corporation acquires or merges with another entity. The escrow funds act as a security measure, ensuring that any potential claims or indemnifications by the acquiring party can be covered using the BS crowed funds. b. Initial Public Offering (IPO) Escrow: In an IPO scenario, where Lorelei Corporation plans to go public, an escrow agreement is established to safeguard investor funds or shares until the public offering occurs. This ensures that the resources are safely deposited and managed by the escrow agent until the completion of the IPO. c. Custodial Escrow: The custodial escrow agreement is used when Lorelei Corporation chooses to keep certain assets or funds in custody with Chase Manhattan Bank for a specific duration. This may be done to secure loans, meet contractual obligations, or fulfill regulatory requirements. Conclusion: The Tennessee Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank plays a crucial role in securing and facilitating various transactions. By understanding its purpose, key provisions, and potential types, both parties can ensure the smooth and transparent transfer of assets or funds while minimizing potential risks.

Tennessee Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank

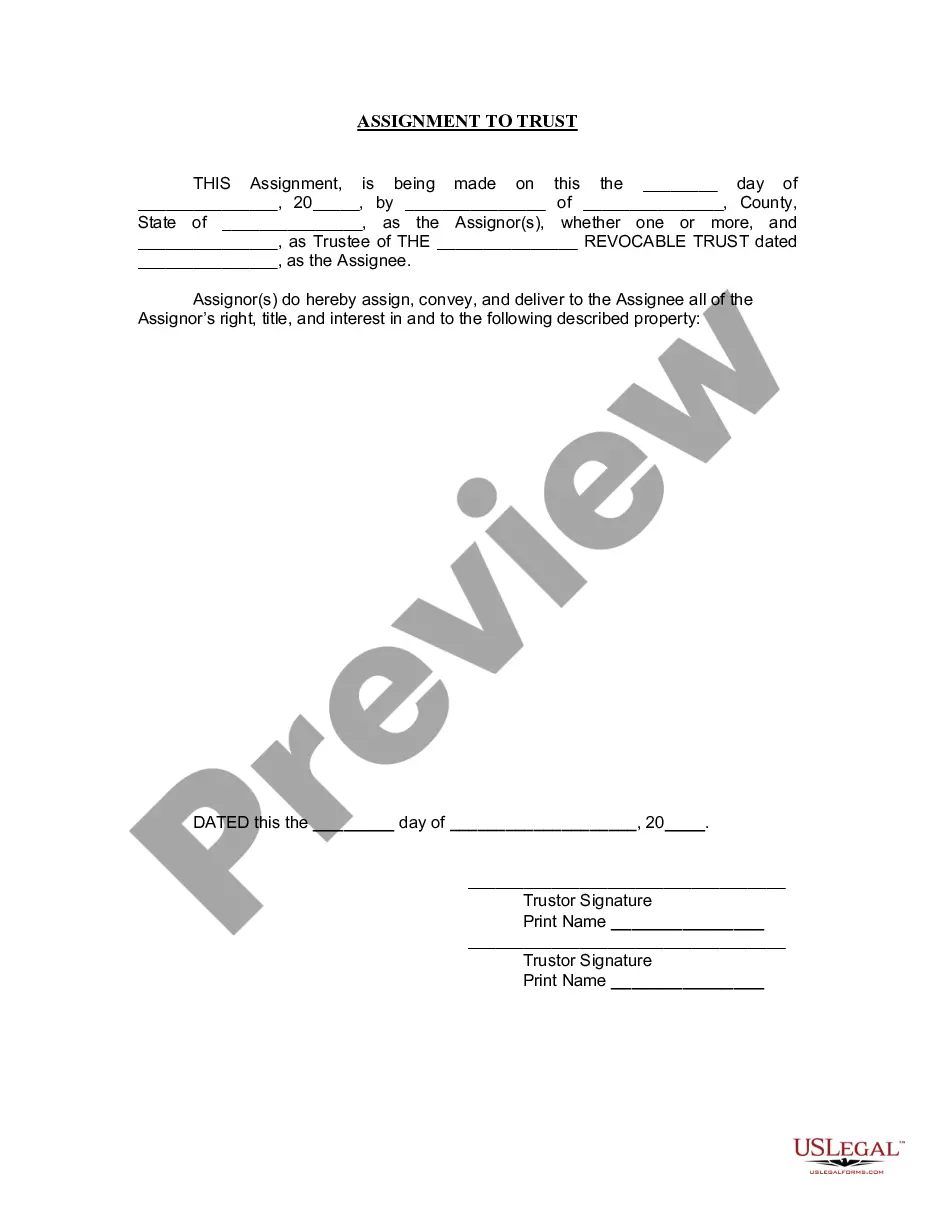

Description

How to fill out Tennessee Escrow Agreement Public Offering Between Lorelei Corporation And Chase Manhattan Bank?

It is possible to invest time online searching for the legal document web template that fits the federal and state specifications you want. US Legal Forms gives a large number of legal types which are reviewed by specialists. It is simple to download or print out the Tennessee Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank from your services.

If you already possess a US Legal Forms account, you may log in and click on the Down load option. Following that, you may full, revise, print out, or sign the Tennessee Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank. Each and every legal document web template you get is the one you have for a long time. To obtain yet another duplicate of the acquired type, go to the My Forms tab and click on the related option.

If you work with the US Legal Forms site the very first time, keep to the straightforward instructions below:

- First, make certain you have selected the proper document web template for your region/area of your liking. Browse the type information to ensure you have picked out the proper type. If accessible, take advantage of the Review option to appear throughout the document web template too.

- If you wish to locate yet another version in the type, take advantage of the Lookup area to obtain the web template that suits you and specifications.

- When you have discovered the web template you need, click Buy now to move forward.

- Select the prices plan you need, key in your references, and sign up for a merchant account on US Legal Forms.

- Full the deal. You should use your bank card or PayPal account to purchase the legal type.

- Select the format in the document and download it in your system.

- Make changes in your document if needed. It is possible to full, revise and sign and print out Tennessee Escrow Agreement Public Offering between Lorelei Corporation and Chase Manhattan Bank.

Down load and print out a large number of document themes utilizing the US Legal Forms Internet site, which offers the greatest variety of legal types. Use professional and condition-distinct themes to take on your company or person demands.