Tennessee Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.

Description

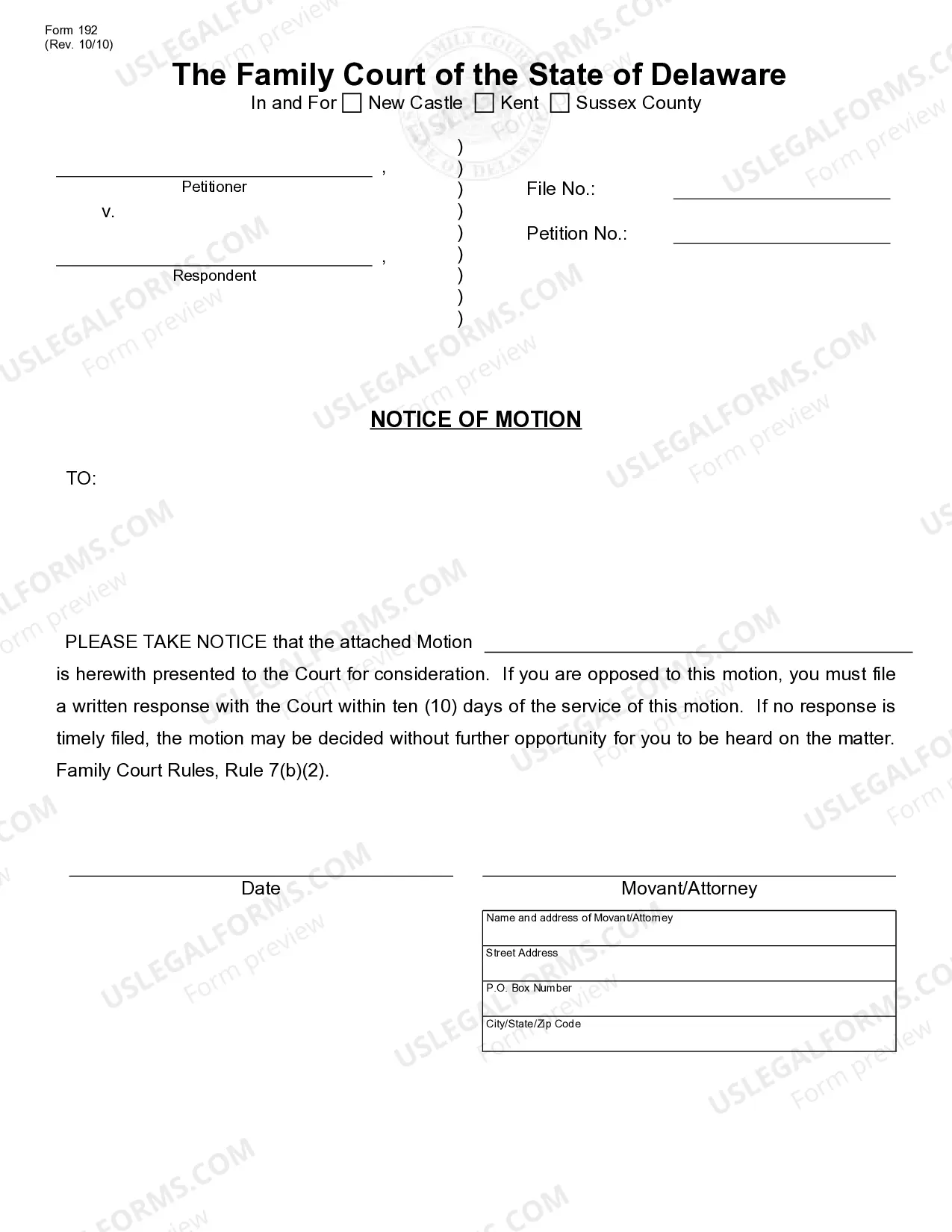

How to fill out Underwriting Agreement Of ABFS Mortgage Loan Trust 1999-4 And Prudential Securities, Inc.?

Are you in the place where you require paperwork for sometimes company or personal uses almost every working day? There are tons of authorized document web templates available on the Internet, but finding versions you can trust is not easy. US Legal Forms offers thousands of develop web templates, like the Tennessee Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc., which can be created to fulfill federal and state requirements.

Should you be presently acquainted with US Legal Forms website and have an account, basically log in. Following that, you can download the Tennessee Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. template.

Unless you have an accounts and would like to start using US Legal Forms, follow these steps:

- Get the develop you will need and ensure it is to the proper city/state.

- Take advantage of the Review switch to check the shape.

- Look at the information to ensure that you have selected the correct develop.

- In case the develop is not what you`re seeking, make use of the Lookup industry to discover the develop that meets your needs and requirements.

- If you get the proper develop, click on Purchase now.

- Select the costs strategy you want, submit the desired information and facts to produce your money, and pay for your order utilizing your PayPal or Visa or Mastercard.

- Decide on a hassle-free file structure and download your version.

Find each of the document web templates you possess purchased in the My Forms menus. You can obtain a more version of Tennessee Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. any time, if necessary. Just go through the necessary develop to download or print out the document template.

Use US Legal Forms, probably the most extensive selection of authorized varieties, to conserve time as well as steer clear of blunders. The assistance offers expertly manufactured authorized document web templates that can be used for a selection of uses. Create an account on US Legal Forms and start making your lifestyle easier.