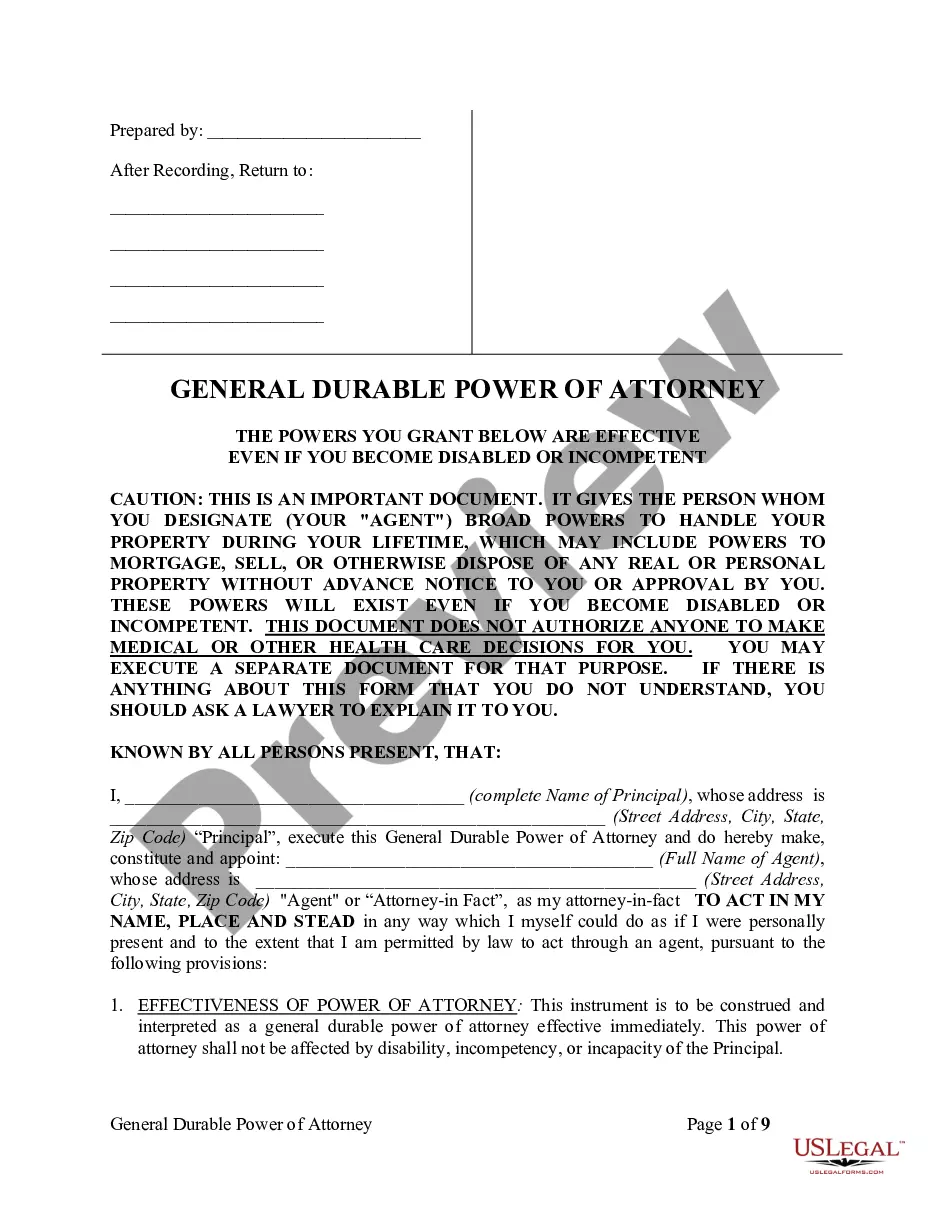

Tennessee Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York

Description

How to fill out Investment Advisory Agreement Between Hamilton Small Cap Growth CRT Fund And The Bank Of New York?

You may invest hours on the web searching for the legal document web template that suits the federal and state specifications you want. US Legal Forms provides a huge number of legal kinds that are evaluated by professionals. It is simple to obtain or produce the Tennessee Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York from your services.

If you already possess a US Legal Forms profile, you may log in and click the Acquire key. After that, you may full, edit, produce, or indication the Tennessee Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York. Every legal document web template you acquire is your own permanently. To obtain one more version of any bought form, proceed to the My Forms tab and click the corresponding key.

If you use the US Legal Forms site the very first time, keep to the straightforward recommendations under:

- First, ensure that you have chosen the right document web template for your state/town of your liking. Read the form description to ensure you have chosen the right form. If offered, take advantage of the Review key to appear with the document web template also.

- In order to locate one more edition in the form, take advantage of the Research field to discover the web template that suits you and specifications.

- Once you have discovered the web template you need, just click Get now to continue.

- Select the pricing prepare you need, type your credentials, and sign up for a free account on US Legal Forms.

- Complete the financial transaction. You should use your charge card or PayPal profile to cover the legal form.

- Select the file format in the document and obtain it for your product.

- Make modifications for your document if necessary. You may full, edit and indication and produce Tennessee Investment Advisory Agreement between Hamilton Small Cap Growth CRT Fund and The Bank of New York.

Acquire and produce a huge number of document themes using the US Legal Forms site, which provides the most important collection of legal kinds. Use professional and status-particular themes to tackle your company or person requirements.