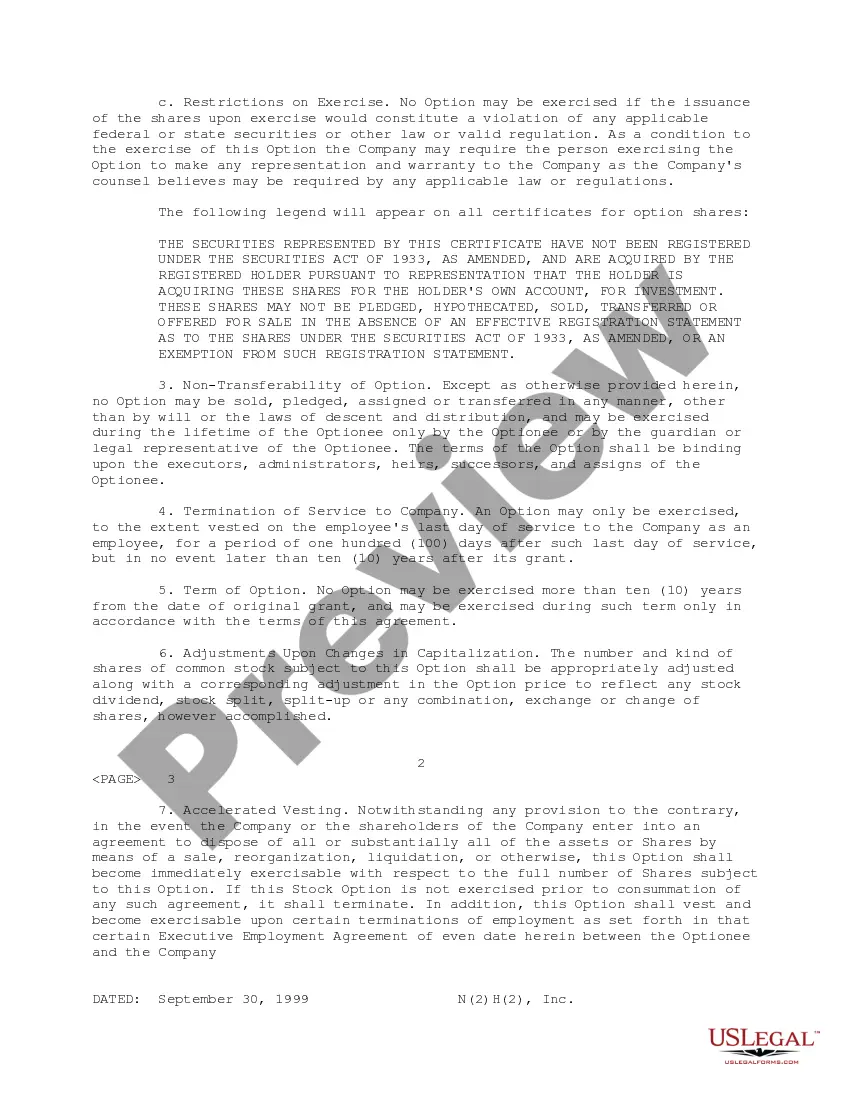

Tennessee Nonqualified Stock Option Agreement of N(2)H(2), Inc.

Description

How to fill out Nonqualified Stock Option Agreement Of N(2)H(2), Inc.?

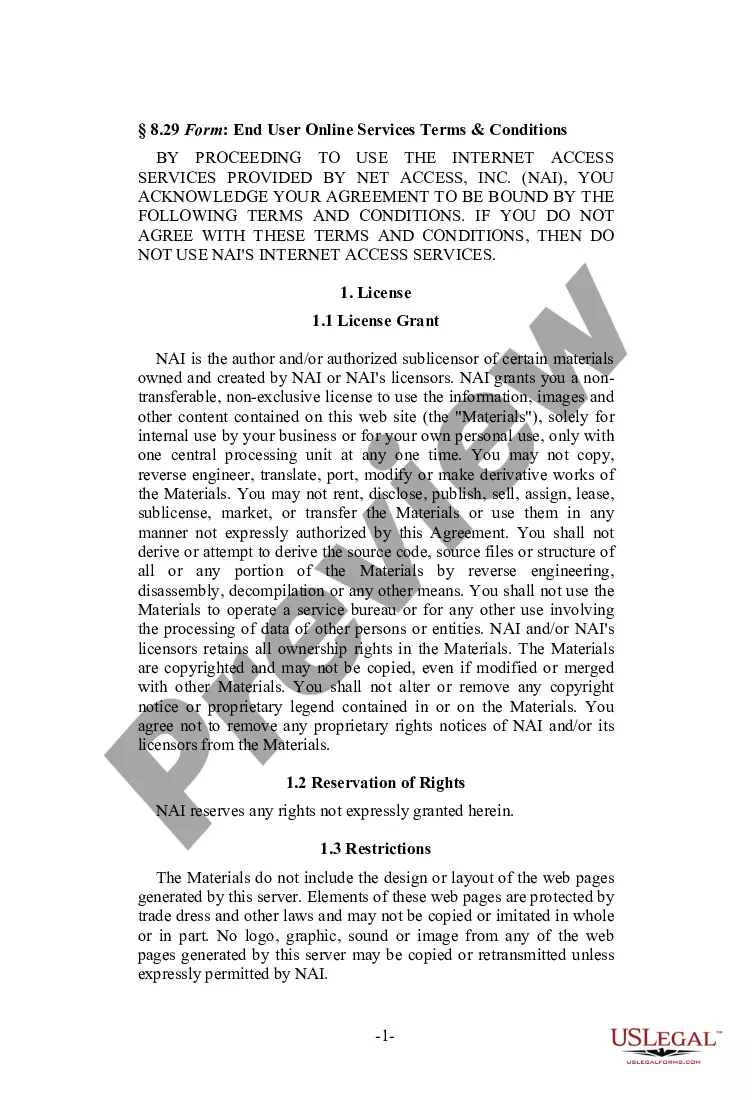

US Legal Forms - one of several biggest libraries of lawful varieties in America - gives a variety of lawful document templates it is possible to download or print. Making use of the internet site, you can get thousands of varieties for enterprise and person functions, categorized by categories, claims, or key phrases.You will discover the most up-to-date models of varieties such as the Tennessee Nonqualified Stock Option Agreement of N(2)H(2), Inc. within minutes.

If you have a membership, log in and download Tennessee Nonqualified Stock Option Agreement of N(2)H(2), Inc. from the US Legal Forms library. The Download button can look on each and every type you perspective. You have access to all previously saved varieties in the My Forms tab of your own profile.

If you want to use US Legal Forms the very first time, listed below are straightforward recommendations to get you started out:

- Make sure you have selected the proper type for your personal town/area. Select the Preview button to analyze the form`s content material. See the type information to ensure that you have selected the right type.

- In case the type doesn`t match your specifications, use the Research field near the top of the monitor to find the the one that does.

- Should you be pleased with the form, confirm your choice by simply clicking the Acquire now button. Then, choose the rates strategy you favor and give your references to register for the profile.

- Procedure the transaction. Make use of your credit card or PayPal profile to complete the transaction.

- Find the structure and download the form in your gadget.

- Make adjustments. Load, revise and print and signal the saved Tennessee Nonqualified Stock Option Agreement of N(2)H(2), Inc..

Each and every format you put into your account does not have an expiry date which is your own property for a long time. So, if you wish to download or print another version, just check out the My Forms area and click on on the type you want.

Get access to the Tennessee Nonqualified Stock Option Agreement of N(2)H(2), Inc. with US Legal Forms, one of the most considerable library of lawful document templates. Use thousands of professional and condition-distinct templates that satisfy your organization or person requires and specifications.

Form popularity

FAQ

NSOs are subject to ordinary income tax and reported as W-2 wages for employees. They are also subject to federal and state income taxes as well as Social Security and Medicare taxes.

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.

If you exercised nonqualified stock options (NQSOs) last year, the income you recognized at exercise is reported on your W-2. It appears on the W-2 with other income in: Box 1: Wages, tips, and other compensation. Box 3: Social Security wages (up to the income ceiling)

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

For nonstatutory options without a readily determinable fair market value, there's no taxable event when the option is granted but you must include in income the fair market value of the stock received on exercise, less the amount paid, when you exercise the option.

NSOs are subject to ordinary income tax and reported as W-2 wages for employees.

Form W-2 (or 1099-NEC if you are a nonemployee) Your W-2 (or 1099-NEC) includes the taxable income from your award and, on the W-2, the taxes that have been withheld. This form is provided by your employer. Form 1099-B This IRS form has details about your stock sale and helps you calculate any capital gain/loss.

Tax Rules for Nonstatutory Stock Options When you exercise the option, you include, in income, the fair market value of the stock at the time you acquired it, less any amount you paid for the stock. This is ordinary wage income reported on your W2, therefore increasing your tax basis in the stock.