The Tennessee Escrow Agreement is a legally binding contract between The Trident Group, Inc., the Finger Security holders, Stuart Schloss, and Bankers Trust Co. It outlines the terms and conditions governing the establishment and management of an escrow arrangement for the purpose of securing financial transactions and protecting the involved parties. This agreement serves as a safeguard and provides assurance to all parties involved by specifying the roles, responsibilities, and obligations of each party. It ensures that funds or assets are held in trust by Bankers Trust Co., an authorized third-party custodian, until certain predefined conditions are met or specified events occur. One type of Tennessee Escrow Agreement is known as the Purchase and Sale Agreement Escrow. In this scenario, The Trident Group, Inc. and the Finger Security holders may enter into an agreement regarding the sale or acquisition of assets, businesses, or securities. The escrow acts as a neutral intermediary, holding the consideration (such as purchase price or securities) until all conditions specified in the agreement are fulfilled. Another type of Tennessee Escrow Agreement could be the Litigation Escrow Agreement. This arrangement might occur when there is ongoing litigation involving Stuart Schloss, The Trident Group, Inc., and the Finger Security holders. This agreement would establish an escrow where funds or assets related to the litigation are held until the resolution of the dispute. The Tennessee Escrow Agreement typically includes key provisions such as: 1. Identification of the involved parties: The agreement clearly identifies The Trident Group, Inc., the Finger Security holders, Stuart Schloss, and Bankers Trust Co. as the primary parties involved in the escrow. 2. Purpose of the escrow: The agreement specifies the purpose for which the escrow is established, such as a business transaction, settlement of a dispute, or fulfillment of contractual obligations. 3. Es crowed funds or assets: It details the amount and nature of funds or assets that will be held in escrow, including any investment or interest earned on those funds. 4. Conditions for release: The agreement outlines the conditions that must be met before the BS crowed funds or assets can be released, such as obtaining regulatory approvals, reaching a settlement, or meeting specific milestones. 5. Termination and dispute resolution: It covers provisions for terminating the escrow arrangement, including procedures for dispute resolution and the appointment of an arbitrator if necessary. 6. Responsibilities and liabilities of the parties: The agreement assigns responsibilities and potential liabilities to the involved parties, specifying their obligations towards the escrow and each other. 7. Governing law and jurisdiction: It designates Tennessee law as the governing law for the agreement and outlines the jurisdiction in case of legal disputes. The Tennessee Escrow Agreement is a crucial tool for ensuring transparency, security, and fair dealings among The Trident Group, Inc., the Finger Security holders, Stuart Schloss, and Bankers Trust Co., as it establishes a trusted and regulated framework for the management and distribution of funds or assets in various business contexts.

Tennessee Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.

Description

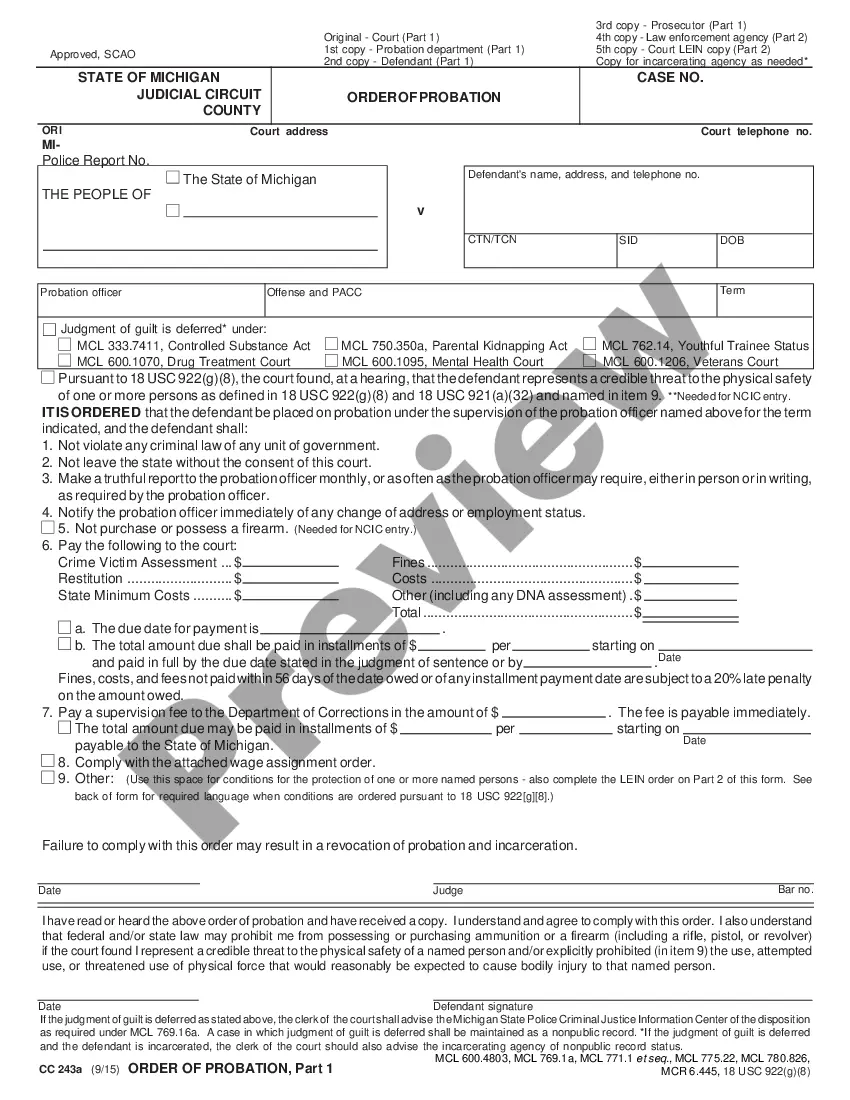

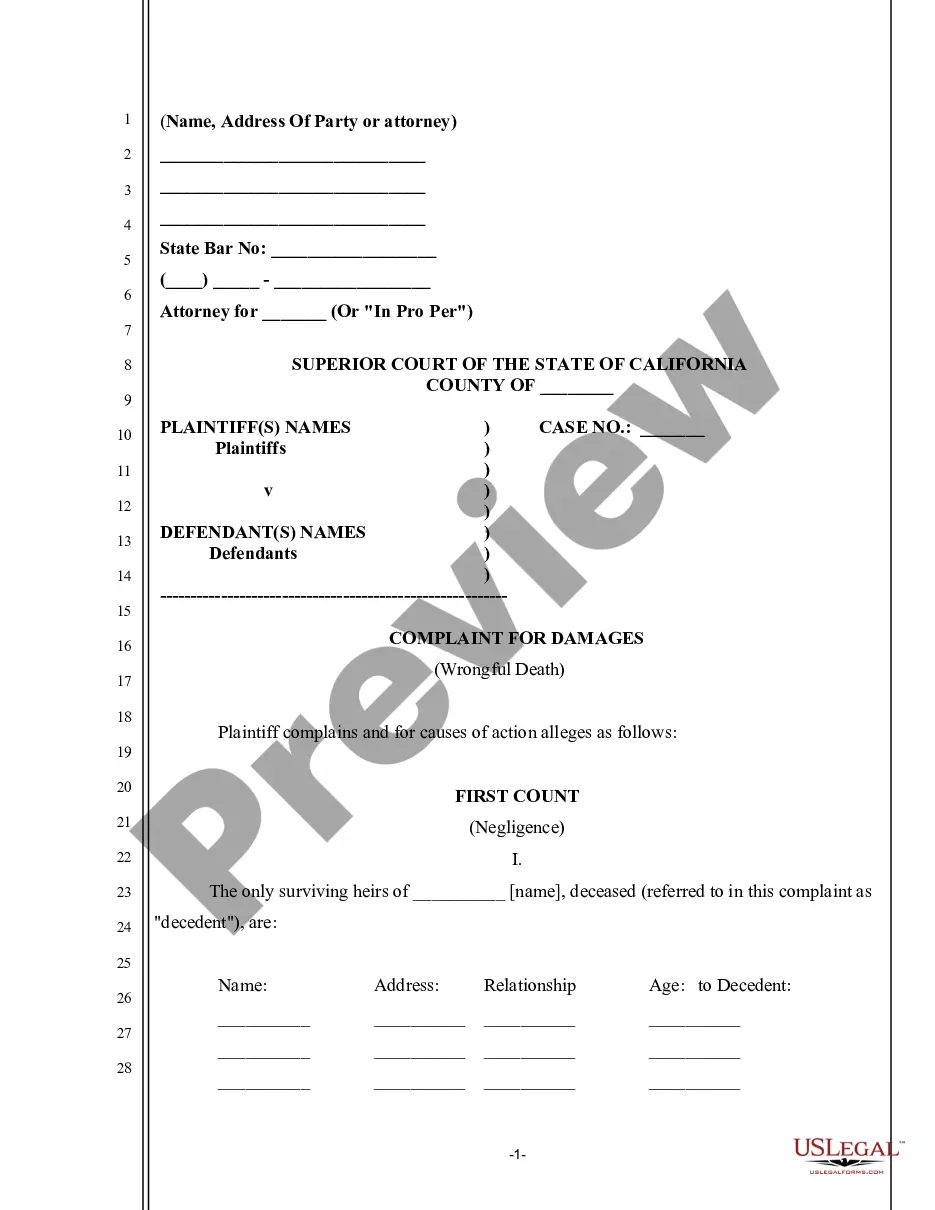

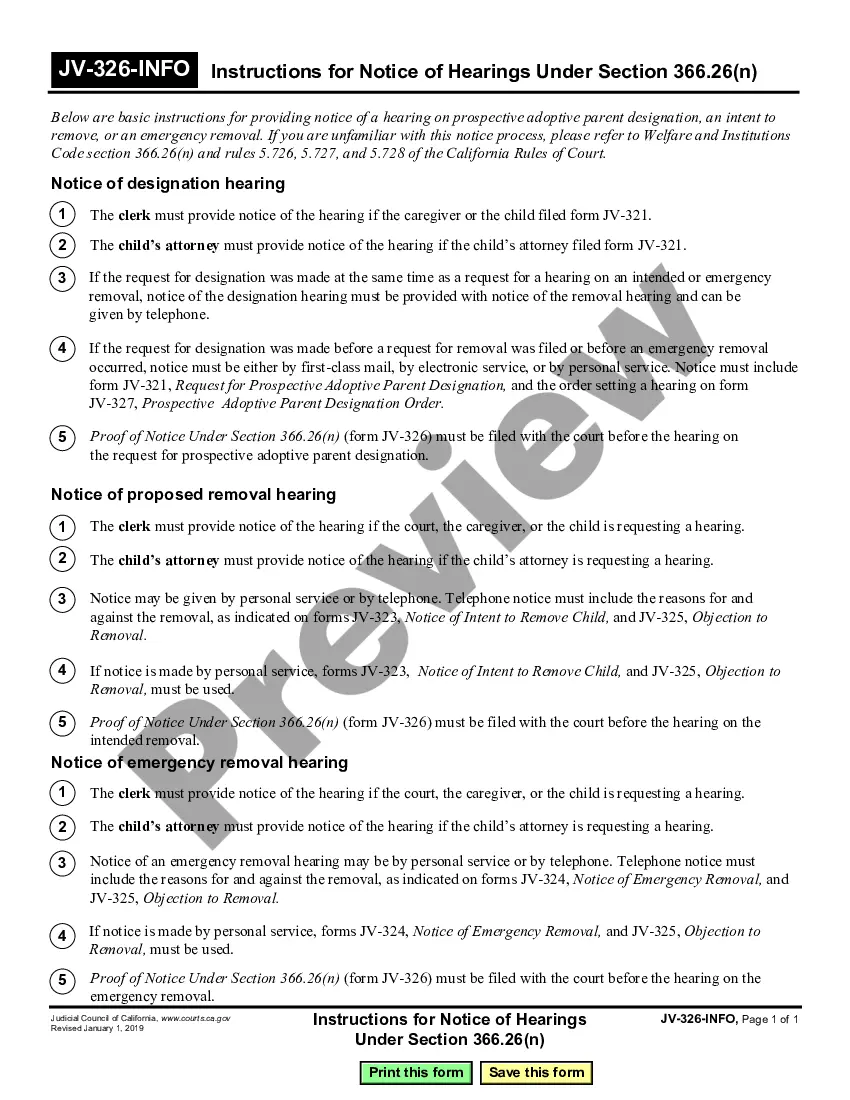

How to fill out Tennessee Escrow Agreement Between The TriZetto Group, Inc., The Finserv Securityholders, Stuart Schloss And Bankers Trust Co.?

Choosing the right lawful record web template can be a have difficulties. Naturally, there are a variety of layouts available online, but how would you obtain the lawful type you will need? Take advantage of the US Legal Forms internet site. The services provides thousands of layouts, including the Tennessee Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co., which you can use for company and private requirements. All the types are checked by professionals and meet federal and state requirements.

Should you be already registered, log in in your account and click on the Obtain switch to find the Tennessee Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co.. Make use of account to check with the lawful types you have bought in the past. Proceed to the My Forms tab of the account and have one more version of your record you will need.

Should you be a new user of US Legal Forms, listed below are easy recommendations that you can follow:

- Very first, be sure you have selected the right type to your city/state. You are able to look through the shape making use of the Review switch and study the shape description to make sure it will be the best for you.

- When the type is not going to meet your preferences, take advantage of the Seach area to find the proper type.

- Once you are sure that the shape is acceptable, click on the Buy now switch to find the type.

- Choose the costs program you desire and enter in the essential details. Make your account and pay for an order using your PayPal account or Visa or Mastercard.

- Select the submit structure and acquire the lawful record web template in your gadget.

- Total, change and printing and sign the acquired Tennessee Escrow Agreement between The TriZetto Group, Inc., the Finserv Securityholders, Stuart Schloss and Bankers Trust Co..

US Legal Forms is definitely the greatest catalogue of lawful types where you can find various record layouts. Take advantage of the service to acquire expertly-manufactured files that follow status requirements.