Tennessee Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation

Description

How to fill out Underwriting Agreement Between Advanta Equipment Receivable Series LLC And Advanta Bank Corporation?

If you wish to total, down load, or print legal papers templates, use US Legal Forms, the most important selection of legal types, which can be found on the Internet. Take advantage of the site`s simple and easy practical search to find the documents you require. Different templates for business and personal purposes are sorted by classes and claims, or search phrases. Use US Legal Forms to find the Tennessee Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation with a few mouse clicks.

When you are presently a US Legal Forms client, log in in your bank account and click on the Obtain button to get the Tennessee Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation. You may also gain access to types you previously saved from the My Forms tab of your bank account.

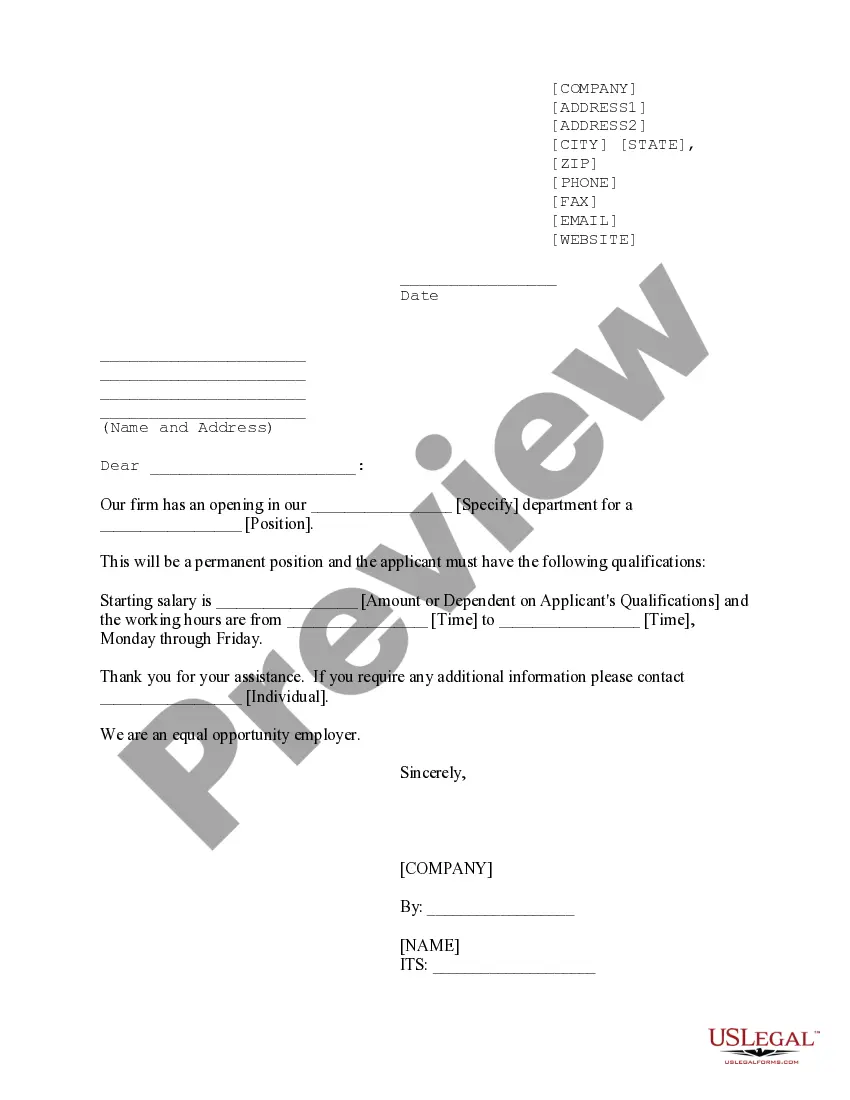

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that appropriate metropolis/land.

- Step 2. Take advantage of the Preview choice to look through the form`s content. Do not forget to see the explanation.

- Step 3. When you are not happy with the develop, use the Look for discipline on top of the display to get other types of the legal develop format.

- Step 4. When you have located the shape you require, click the Buy now button. Select the pricing strategy you like and add your accreditations to sign up for the bank account.

- Step 5. Procedure the deal. You can use your credit card or PayPal bank account to complete the deal.

- Step 6. Find the formatting of the legal develop and down load it in your product.

- Step 7. Full, revise and print or indicator the Tennessee Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation.

Every single legal papers format you acquire is yours eternally. You might have acces to every develop you saved within your acccount. Click on the My Forms section and choose a develop to print or down load again.

Be competitive and down load, and print the Tennessee Underwriting Agreement between Advanta Equipment Receivable Series LLC and Advanta Bank Corporation with US Legal Forms. There are many expert and state-distinct types you may use for the business or personal demands.