Title: A Comprehensive Overview of Tennessee Investment Advisory Agreements: First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. Introduction: Tennessee Investment Advisory Agreement establishes the contractual relationship between First American Insurance Portfolios, Inc. (FAIR) and U.S. Bank National Association. This agreement governs the provision of investment advisory services by FAIR to U.S. Bank. By understanding the various types of Tennessee Investment Advisory Agreements in place between these entities, we can gain insight into the scope and significance of their collaboration. 1. Standard Investment Advisory Agreement: The Standard Investment Advisory Agreement between FAIR and U.S. Bank National Association outlines the core terms and conditions. It encompasses the basics of the advisory relationship, such as fee structure, duration, termination rights, investment objectives, and risk management strategies. This agreement serves as the foundation for other specialized Tennessee Investment Advisory Agreements. 2. Exclusive Portfolio Management Agreement: Within the realm of Tennessee Investment Advisory Agreements, FAIR may offer an Exclusive Portfolio Management Agreement to U.S. Bank National Association. This agreement grants U.S. Bank exclusive access to FAIR's portfolio management services. It includes provisions defining the rights and responsibilities of both parties, along with additional customization options catering specifically to U.S. Bank's investment goals, risk tolerance, and compliance requirements. 3. Customized Investment Advisory Agreement: In certain instances, FAIR and U.S. Bank National Association may mutually establish a Customized Investment Advisory Agreement. This type of agreement allows for greater flexibility to tailor the investment strategy, reporting requirements, asset allocation, and other related parameters to suit U.S. Bank's unique preferences and circumstances. By customizing the advisory agreement, U.S. Bank benefits from a personalized approach to investment management. 4. Performance-Based Compensation Agreement: Tennessee Investment Advisory Agreements may also include a Performance-Based Compensation Agreement. This agreement outlines the terms for additional compensation to FAIR based on the achievement of certain predetermined performance benchmarks. By linking FAIR's compensation to the attainment of specified investment goals, this agreement aligns the interests of both parties, fostering a strong commitment to achieving desired outcomes. Conclusion: The Tennessee Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Association is a pivotal document that governs the provision of investment advisory services. Various types of agreements, such as the Standard Investment Advisory Agreement, Exclusive Portfolio Management Agreement, Customized Investment Advisory Agreement, and Performance-Based Compensation Agreement, are utilized to accommodate the specific requirements and preferences of U.S. Bank National Association. These agreements contribute to ensuring a collaborative and mutually beneficial relationship in the pursuit of investment objectives.

Tennessee Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.

Description

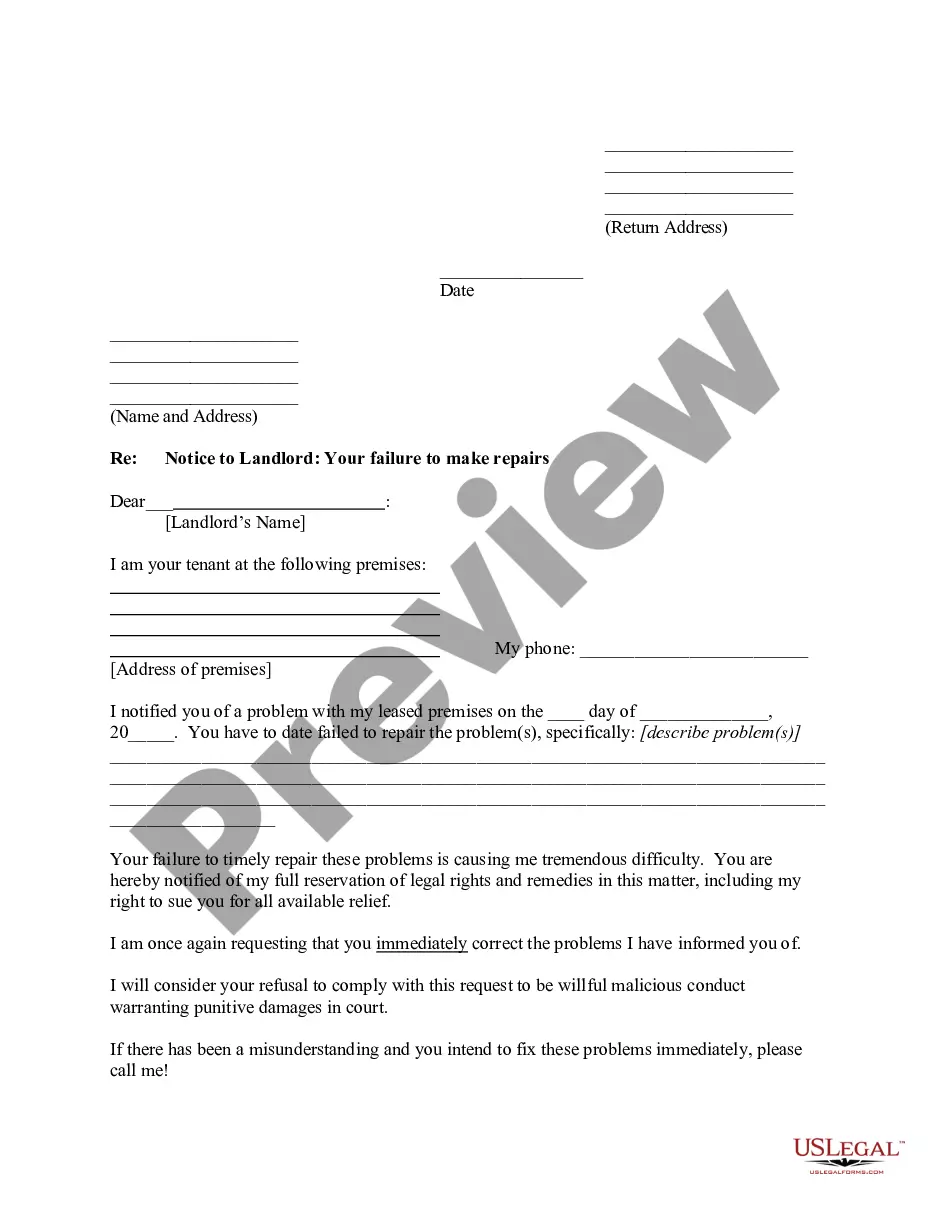

How to fill out Tennessee Investment Advisory Agreement Between First American Insurance Portfolios, Inc. And U.S. Bank National Assoc.?

You may devote hours online searching for the legitimate document design that meets the federal and state demands you require. US Legal Forms provides a huge number of legitimate varieties which are reviewed by specialists. It is simple to acquire or print the Tennessee Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc. from the assistance.

If you already possess a US Legal Forms account, it is possible to log in and then click the Acquire option. Following that, it is possible to comprehensive, edit, print, or signal the Tennessee Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc.. Every legitimate document design you buy is your own permanently. To obtain one more copy associated with a obtained kind, check out the My Forms tab and then click the corresponding option.

If you work with the US Legal Forms internet site for the first time, follow the basic instructions listed below:

- Very first, make certain you have chosen the proper document design for the state/metropolis of your liking. Browse the kind description to ensure you have picked the right kind. If offered, use the Review option to appear with the document design at the same time.

- If you wish to discover one more variation from the kind, use the Research industry to obtain the design that fits your needs and demands.

- Upon having located the design you would like, simply click Get now to move forward.

- Select the rates strategy you would like, key in your qualifications, and register for an account on US Legal Forms.

- Complete the purchase. You should use your Visa or Mastercard or PayPal account to cover the legitimate kind.

- Select the format from the document and acquire it to the gadget.

- Make changes to the document if necessary. You may comprehensive, edit and signal and print Tennessee Investment Advisory Agreement between First American Insurance Portfolios, Inc. and U.S. Bank National Assoc..

Acquire and print a huge number of document layouts while using US Legal Forms site, which offers the greatest variety of legitimate varieties. Use specialist and state-distinct layouts to deal with your business or person needs.