Title: Understanding the Tennessee Stock Agreement between Food Lion, Inc. and Selling Stockholders Introduction: In this article, we will delve into the Tennessee Stock Agreement between Food Lion, Inc. and selling stockholders. We will provide an in-depth description of what this agreement entails and highlight its significance for both parties involved. Additionally, we will touch upon any distinct variations or types of agreements that may exist within this framework. Key Concepts and Definitions: 1. Tennessee Stock Agreement: A legally binding contract that governs the selling and transfer of stock in a company operating in the state of Tennessee. This agreement outlines the terms and conditions, rights, and obligations of both the company (Food Lion, Inc.) and the selling stockholders. 2. Food Lion, Inc.: A prominent retail grocery store chain operating within Tennessee and other states. It forms the focal point of the stock agreement as the company offering shares to potential buyers. 3. Selling Stockholders: Individuals, groups, or entities who currently own shares in Food Lion, Inc. and wish to sell them to interested buyers. These stockholders become party to the stock agreement during the selling process. Key Elements of the Tennessee Stock Agreement: 1. Purchase Price: The agreement specifies the agreed-upon purchase price per share of the company's stock. This ensures transparency and facilitates a fair transaction for both buyers and sellers. 2. Number of Shares: Details the number of shares the selling stockholders are offering for sale, giving potential buyers insights into the available stock and enabling them to make informed purchase decisions. 3. Payment Terms: Outlines the payment structure and the timeline within which buyers must submit payment for the purchased shares. This includes any installments, conditions, or accepted forms of payment. 4. Representations and Warranties: This section states that the selling stockholders represent and warrant that they have full ownership rights to the shares and that there are no liens, claims, or restrictions on the stock being sold. 5. Rights and Restrictions: The agreement may outline certain rights or restrictions concerning the purchased shares, such as voting rights, restrictions on further transfer, non-compete clauses, and other provisions that protect the interests of both Food Lion, Inc. and the selling stockholders. Types of Tennessee Stock Agreements: While specific variations of Tennessee Stock Agreements may exist, two common types are often seen: 1. Stock Purchase Agreement: This agreement occurs when selling stockholders directly sell their shares to a buyer. The buyer becomes the new stockholder, thereby stepping into the shoes of the original seller. 2. Share Repurchase Agreement: A scenario where Food Lion, Inc. buys back the shares from the selling stockholders. This agreement may be exercised if the company believes it is in its best interest to acquire the stock or if the selling stockholders wish to exit their investment. Conclusion: The Tennessee Stock Agreement between Food Lion, Inc. and selling stockholders serves as the backbone for stock transactions within the state. It safeguards the rights and interests of both parties involved, defining the terms and conditions of the stock sale. These agreements are often tailored to fit specific circumstances, with two common types being stock purchase agreements and share repurchase agreements. Understanding the nuances of such agreements is crucial for a successful and transparent stock transfer process.

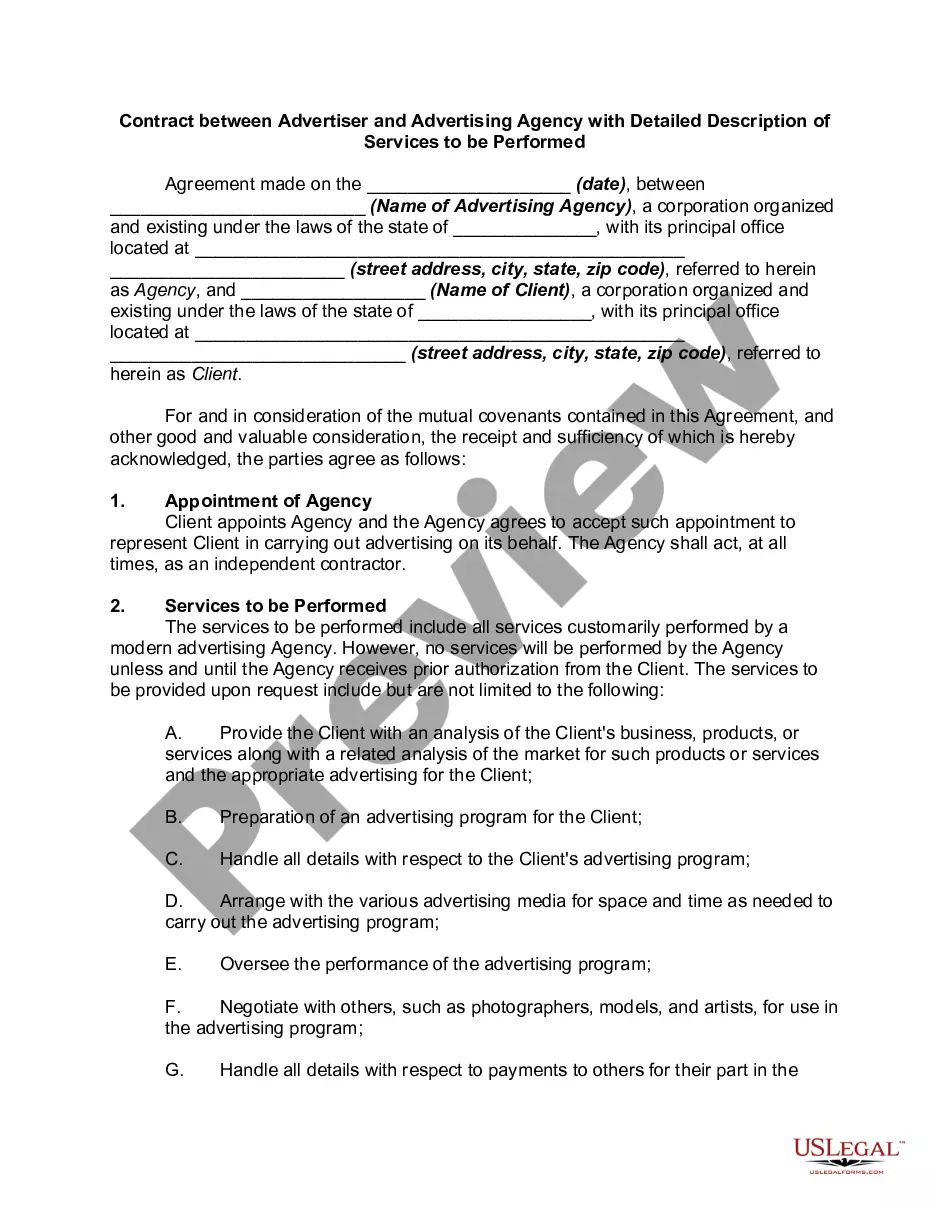

Tennessee Stock Agreement between Food Lion, Inc. and selling stockholders

Description

How to fill out Stock Agreement Between Food Lion, Inc. And Selling Stockholders?

You can spend hours on-line looking for the legal record design that suits the federal and state needs you require. US Legal Forms provides 1000s of legal varieties that happen to be reviewed by professionals. You can easily down load or produce the Tennessee Stock Agreement between Food Lion, Inc. and selling stockholders from my service.

If you currently have a US Legal Forms profile, you are able to log in and then click the Acquire option. Following that, you are able to complete, edit, produce, or indicator the Tennessee Stock Agreement between Food Lion, Inc. and selling stockholders. Each legal record design you purchase is your own property eternally. To obtain another version associated with a bought type, proceed to the My Forms tab and then click the related option.

Should you use the US Legal Forms website for the first time, keep to the easy instructions beneath:

- Initial, ensure that you have selected the proper record design for that area/town that you pick. Browse the type information to make sure you have selected the right type. If available, utilize the Review option to look throughout the record design too.

- If you would like find another edition in the type, utilize the Look for field to find the design that fits your needs and needs.

- Upon having discovered the design you need, just click Get now to continue.

- Select the pricing prepare you need, type your accreditations, and register for an account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal profile to fund the legal type.

- Select the file format in the record and down load it for your system.

- Make alterations for your record if needed. You can complete, edit and indicator and produce Tennessee Stock Agreement between Food Lion, Inc. and selling stockholders.

Acquire and produce 1000s of record templates utilizing the US Legal Forms website, that provides the most important variety of legal varieties. Use specialist and state-certain templates to deal with your small business or person demands.

Form popularity

FAQ

The Shareholder's Agreement is generally used to resolve disputes between the corporation and the Shareholder. The Share Purchase Agreement, on the other hand, is a document that justifies the exchange of shares held by the Buyer and Seller.

A stock agreement is a contract-binding purchase meaning the stock will be pre-ordered in advance. Once the agreement has been completed, stock will be allocated to your account, available exclusively and invoiced once dispatched.

Common due diligence issues unique to stock purchases include the seller's title to the target company's stock, terms of key contracts, identifying the target company's liabilities, and the nature and condition of the target company's assets.

Stock purchase agreements (SPAs) are legally binding contracts between shareholders and companies. Also known as share purchase agreements, these contracts establish all of the terms and conditions related to the sale of a company's stocks.

This means that the Seller is entitled to the cash on the balance sheet on the closing date of the transaction, and that the Seller is responsible for debts owed by the company (defined as Indebtedness).

A stock sale agreement, also called a share purchase agreement, is used to transfer the ownership of stock in a company from a seller to a buyer. Stock are units of ownership in a company that are divided among stockholders.