Tennessee Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc.

Description

How to fill out Plan Of Merger Between Ichargeit.Com, Inc. And Ichargeit.Com, Inc.?

Have you been in a place that you will need papers for sometimes enterprise or personal functions nearly every time? There are plenty of legitimate document web templates available on the Internet, but locating ones you can trust isn`t easy. US Legal Forms provides 1000s of type web templates, like the Tennessee Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc., which can be written to meet federal and state demands.

If you are already knowledgeable about US Legal Forms website and have an account, simply log in. Following that, you can download the Tennessee Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. web template.

If you do not offer an account and need to start using US Legal Forms, abide by these steps:

- Find the type you will need and make sure it is for the right town/area.

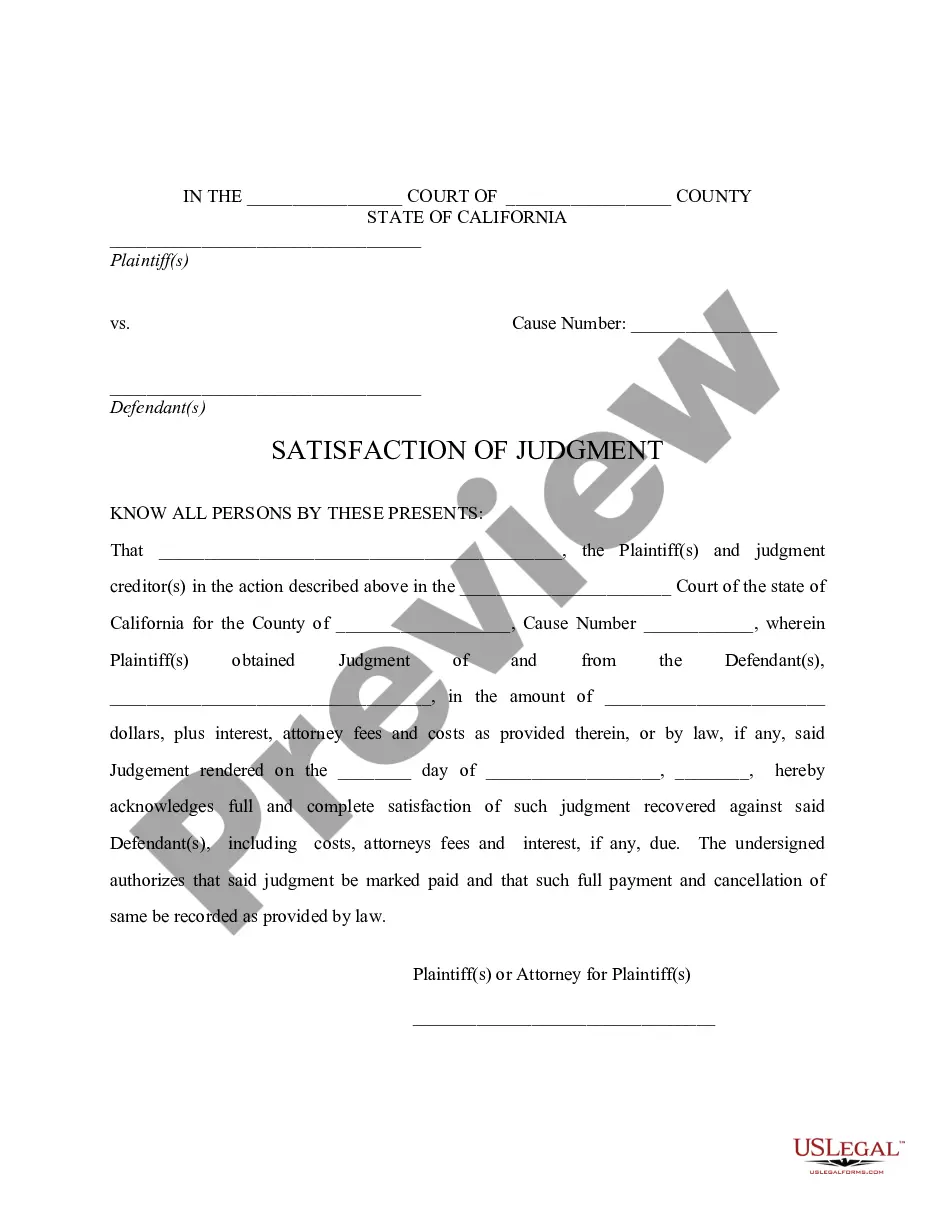

- Use the Preview key to examine the form.

- Browse the information to ensure that you have selected the proper type.

- If the type isn`t what you`re looking for, utilize the Look for industry to find the type that suits you and demands.

- When you get the right type, simply click Purchase now.

- Pick the prices plan you desire, fill in the specified details to make your account, and pay for an order with your PayPal or charge card.

- Select a hassle-free paper format and download your version.

Locate each of the document web templates you might have purchased in the My Forms menus. You can obtain a extra version of Tennessee Plan of Merger between Ichargeit.Com, Inc. and Ichargeit.Com, Inc. at any time, if necessary. Just click the needed type to download or print the document web template.

Use US Legal Forms, probably the most extensive collection of legitimate varieties, to conserve time and prevent blunders. The service provides skillfully created legitimate document web templates which you can use for an array of functions. Generate an account on US Legal Forms and begin generating your daily life easier.