Tennessee Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation

Description

How to fill out Merger Agreement Between Bay Micro Computers, Inc. And BMC Acquisition Corporation?

Have you been in the position that you will need paperwork for sometimes company or personal reasons nearly every time? There are a variety of legal document themes accessible on the Internet, but locating types you can rely is not easy. US Legal Forms offers a large number of develop themes, such as the Tennessee Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation, which are composed to meet state and federal needs.

When you are presently familiar with US Legal Forms web site and have a free account, simply log in. After that, you are able to obtain the Tennessee Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation design.

Unless you offer an bank account and would like to begin using US Legal Forms, follow these steps:

- Obtain the develop you require and ensure it is to the correct area/region.

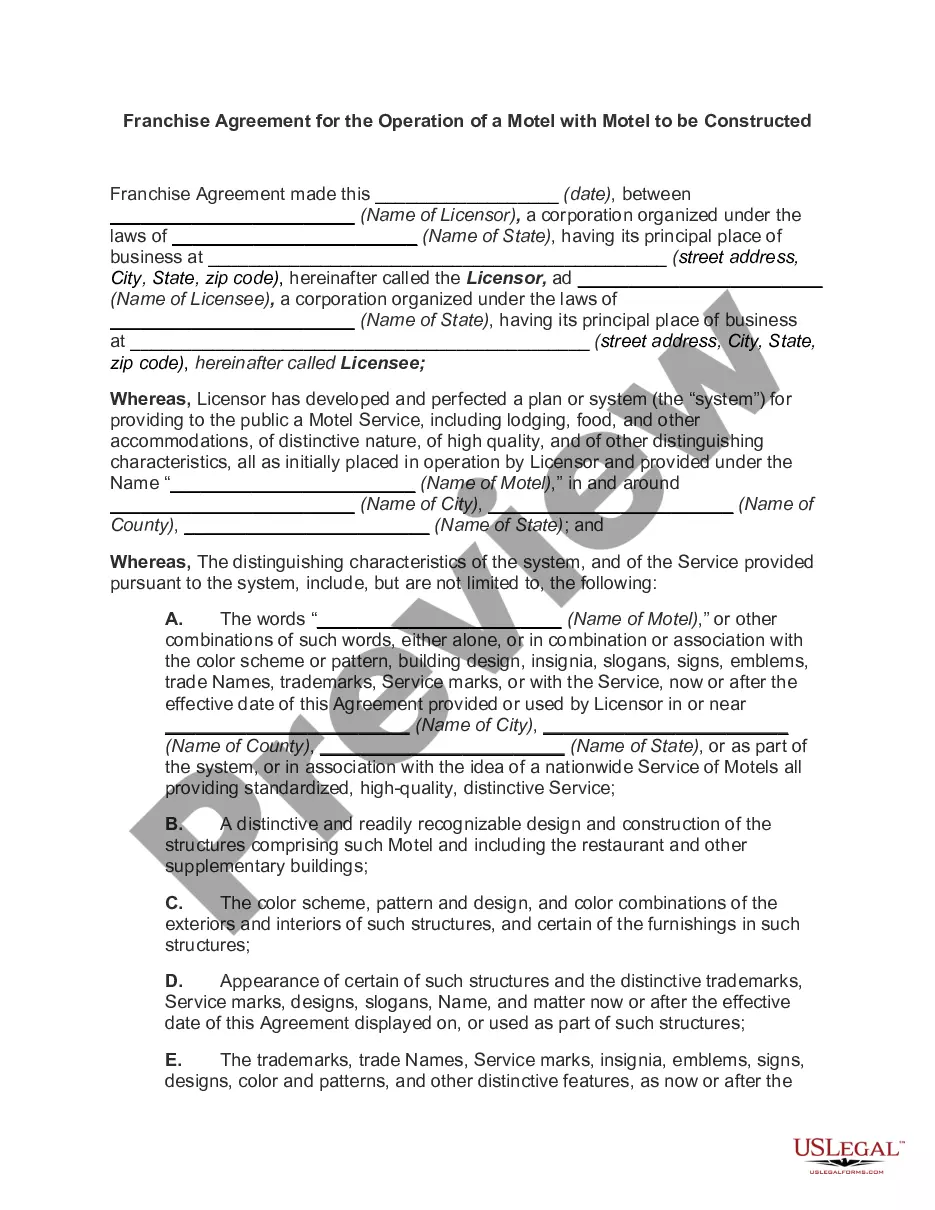

- Utilize the Preview switch to review the form.

- See the information to ensure that you have chosen the appropriate develop.

- In case the develop is not what you`re looking for, take advantage of the Search area to find the develop that suits you and needs.

- Whenever you get the correct develop, click on Purchase now.

- Choose the costs plan you want, complete the required details to produce your money, and pay for the transaction using your PayPal or bank card.

- Choose a handy paper format and obtain your version.

Locate every one of the document themes you might have bought in the My Forms food list. You can aquire a additional version of Tennessee Merger Agreement between Bay Micro Computers, Inc. and BMC Acquisition Corporation any time, if possible. Just click on the needed develop to obtain or print the document design.

Use US Legal Forms, by far the most considerable collection of legal types, to save time as well as stay away from blunders. The support offers skillfully manufactured legal document themes which can be used for an array of reasons. Make a free account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

Parts of merger and acquisition contracts ?Parties and recitals. ?Price, currencies, and structure. ?Representations and warranties. ?Covenants. ?Conditions. ?Termination provisions. ?Indemnification. ?Tax.

The Company and each of its subsidiaries is duly organized, validly existing and in good standing (with respect to jurisdictions that recognize the concept of good standing) under the laws of the jurisdiction of its organization and has all requisite corporate or similar power and authority to own, lease and operate ...

A merger is an agreement that unites two existing companies into one new company.

Merger means that two companies have joined hands and decided to proceed as one firm. It indicates that the CEOs of both companies have mutually agreed to ally. The structure of mergers depends on the relationship between two parties, but they include vertical, horizontal, conglomerate, and rollup mergers.

A merger is a business deal where two existing, independent companies combine to form a new, singular legal entity. Mergers are voluntary. Typically, both companies are of a similar size and scope and both stand to gain from the transaction.

12.2 Merger Clause. This Agreement and the other agreements, documents or instruments contemplated hereby shall constitute the entire agreement between the Parties, and shall supersede all prior agreements, understandings and negotiations between the Parties with respect to the subject matter hereof.