In Tennessee, a Distribution Agreement plays a crucial role in the continuous offering of a Trust's transferable shares of beneficial interest. This agreement outlines the terms and conditions under which these shares are distributed and provides a legal framework for the ongoing offering process. To understand this agreement better, let's delve into its essential components and use relevant keywords. The Tennessee Distribution Agreement serves as a comprehensive document that governs the sale and distribution of transferable shares of beneficial interest within a Trust. This agreement ensures compliance with applicable laws, regulations, and guidelines while facilitating a smooth offering process. By adhering to the requirements outlined in this agreement, the Trust can maintain transparency, protect the interests of both investors and beneficiaries, and establish clear guidelines for continuous offerings. Key elements included in a Tennessee Distribution Agreement cover aspects such as the registration process, offering limitations, transfer restrictions, sales materials, disclosure requirements, and commissions. These components help regulators, investors, and the Trust itself understand and adhere to the offering rules effectively. Additionally, this agreement defines the responsibilities of various stakeholders involved in the offering process, including the Trust, its manager/sponsor, broker-dealers, and legal professionals. Some keywords that are relevant to a Tennessee Distribution Agreement in continuous offerings of a Trust's transferable shares of beneficial interest include: 1. Continuous Offering: The agreement outlines the rules and regulations governing the Trust's continuous sale and distribution of shares. This ensures investors can participate in the offering at any time during the offering period. 2. Transferable Shares: The agreement details the transferability of shares, including any restrictions or limitations imposed by the Trust. This ensures that investors understand the conditions under which they can transfer their shares to others. 3. Beneficial Interest: The agreement defines the rights and benefits associated with holding shares of a Trust, including the entitlement to dividends, voting rights, and other financial rights. It protects the interest of the shareholders and specifies the distribution process. Different types of Tennessee Distribution Agreements may exist depending on the specific characteristics of the Trust or the investment vehicle. Some categories of Distribution Agreements include: 1. Open-End Distribution Agreement: This agreement allows for continuous offerings without a specified end date. Investors can enter or exit the investment at any time, and the Trust continuously issues new shares to meet demand. 2. Closed-End Distribution Agreement: This agreement permits an offering with a predetermined end date. Once the offering period concludes, no further shares are issued, and investors can only trade existing shares on secondary markets. This type of agreement imposes stricter limitations on the continuous offering. By incorporating these relevant keywords and understanding the potential variations in Tennessee Distribution Agreements, one can grasp the key intricacies and importance of this document in facilitating the continuous offering of a Trust's transferable shares of beneficial interest.

Tennessee Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest

Description

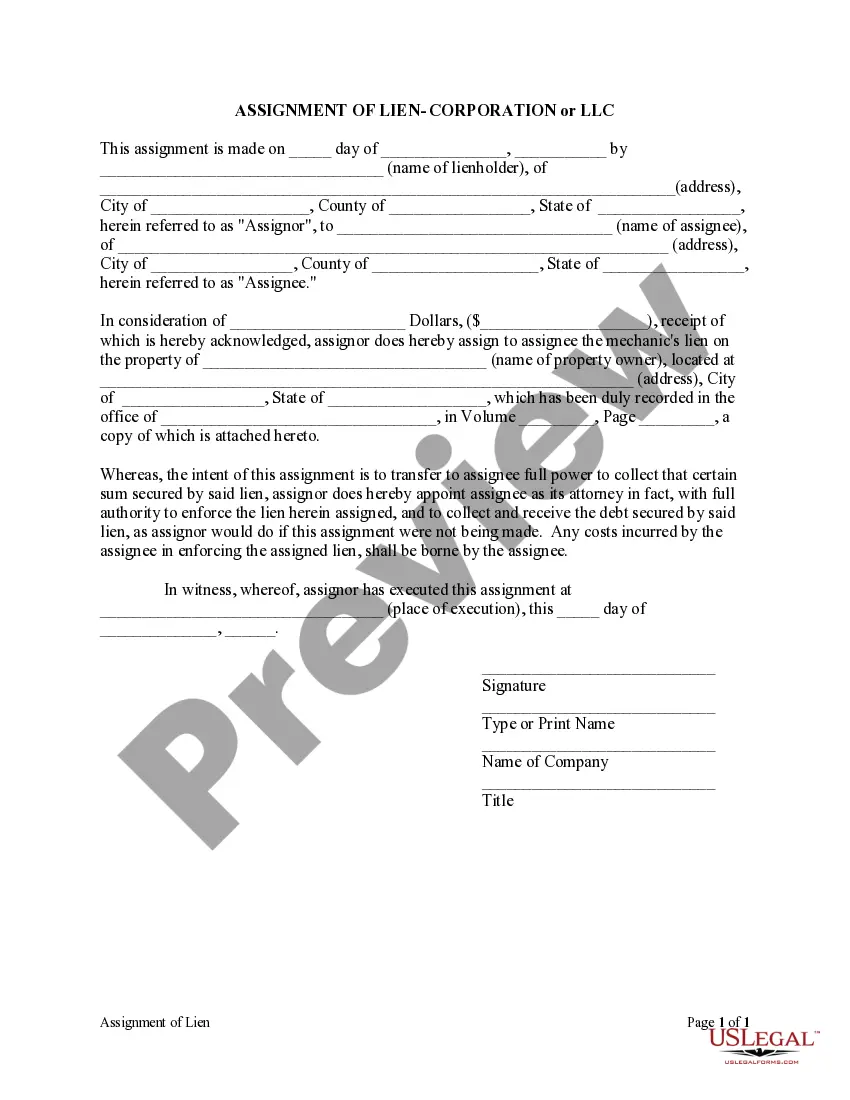

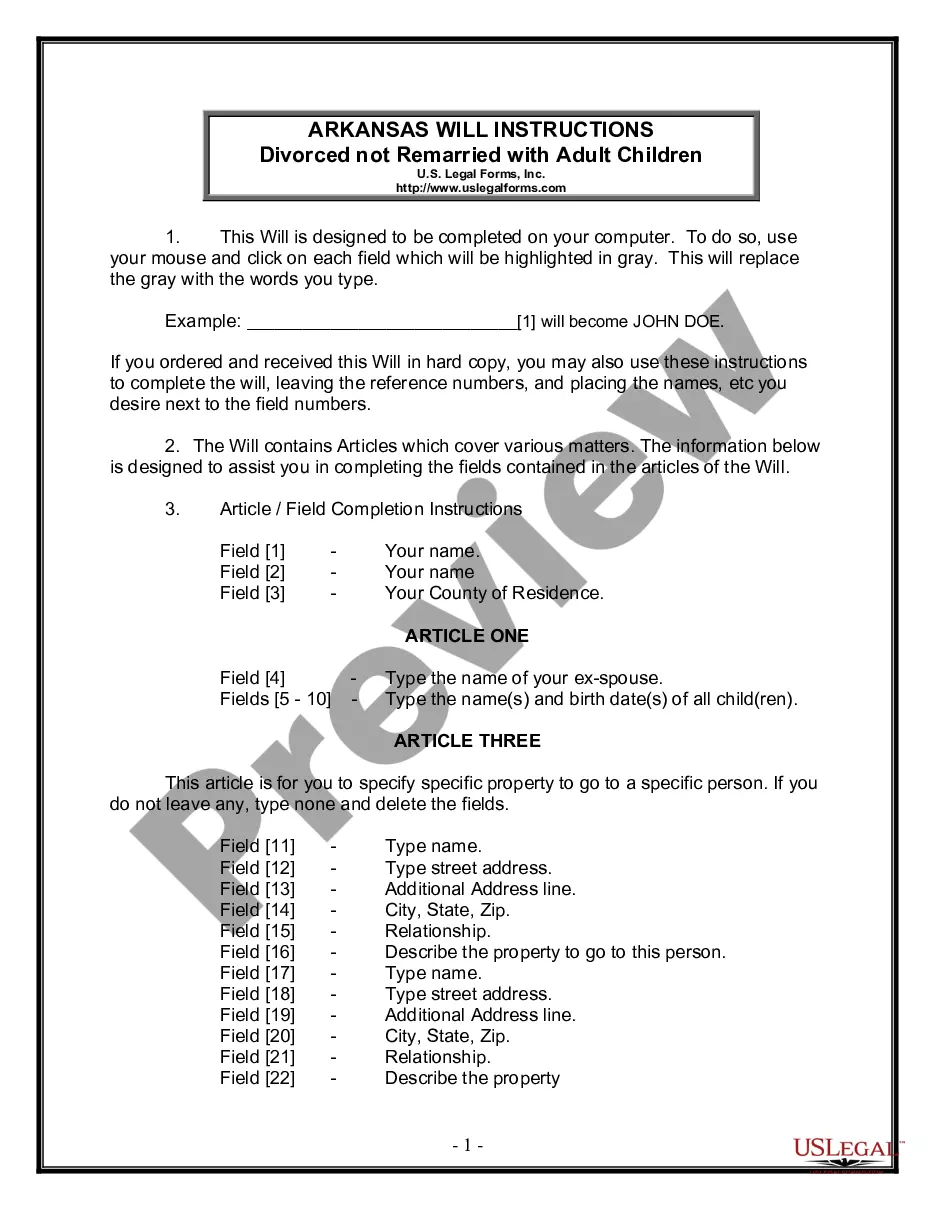

How to fill out Tennessee Distribution Agreement Regarding The Continuous Offering Of The Trust's Transferable Shares Of Beneficial Interest?

You can invest several hours on the Internet looking for the legitimate file web template which fits the federal and state specifications you will need. US Legal Forms gives thousands of legitimate types that happen to be analyzed by experts. You can easily download or print out the Tennessee Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest from the support.

If you already have a US Legal Forms accounts, you can log in and click the Down load key. Following that, you can complete, revise, print out, or indicator the Tennessee Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest. Every single legitimate file web template you acquire is your own property eternally. To get an additional backup of any acquired type, visit the My Forms tab and click the related key.

If you are using the US Legal Forms internet site for the first time, follow the easy instructions listed below:

- Initially, be sure that you have chosen the right file web template for the area/city of your choosing. Read the type description to ensure you have chosen the proper type. If offered, use the Review key to check throughout the file web template as well.

- In order to get an additional model of your type, use the Look for industry to get the web template that meets your needs and specifications.

- When you have located the web template you would like, click Buy now to continue.

- Select the rates program you would like, type your qualifications, and sign up for an account on US Legal Forms.

- Full the deal. You should use your bank card or PayPal accounts to cover the legitimate type.

- Select the format of your file and download it in your system.

- Make alterations in your file if possible. You can complete, revise and indicator and print out Tennessee Distribution Agreement regarding the continuous offering of the Trust's transferable shares of beneficial interest.

Down load and print out thousands of file layouts making use of the US Legal Forms Internet site, which provides the biggest collection of legitimate types. Use specialist and state-particular layouts to handle your small business or person requirements.