The Tennessee Stock Option Agreement of Interwar, Inc. is an important legal document that outlines the terms and conditions associated with stock options granted by Interwar, Inc. to its employees or individuals who provide services to the company. Interwar, Inc. is a Tennessee-based corporation specializing in software development and distribution. The company may offer various types of stock option agreements to its employees, such as Incentive Stock Options (SOS) and Non-Qualified Stock Options (SOS). An Incentive Stock Option (ISO) is a stock option agreement that provides favorable tax treatment to the employee. It allows the option holder to purchase company stock at a predetermined price (the exercise price) within a specific time frame. The ISO typically has specific requirements and limitations under the Internal Revenue Code, ensuring compliance with applicable tax regulations. On the other hand, a Non-Qualified Stock Option (NO) is a stock option agreement that does not meet all the requirements for favorable tax treatment. SOS are generally offered to employees who do not fulfill the ISO eligibility criteria or to non-employee service providers, consultants, or contractors. SOS provide more flexibility in terms of exercise price and vesting schedule, but they are subject to standard income tax rules. The Tennessee Stock Option Agreement of Interwar, Inc. includes various essential components such as the grant date, vesting schedule, exercise price, expiration date, and the total number of options granted. It also specifies any conditions or restrictions associated with the stock options like performance milestones, employment terms, or non-disclosure agreements. This agreement outlines the rights and responsibilities of both the company and the option holder. It addresses issues like transferability, exercise procedures, taxes, and any potential termination provisions. Additionally, it may also include provisions related to events like mergers, acquisitions, or changes in control that could affect the stock options. In summary, the Tennessee Stock Option Agreement of Interwar, Inc. is a crucial legal document that governs the granting and exercise of stock options in the company. It ensures clarity and consistency in the stock option program, enabling employees and service providers to understand and benefit from their equity-based compensation.

Tennessee Stock Option Agreement of Intraware, Inc.

Description

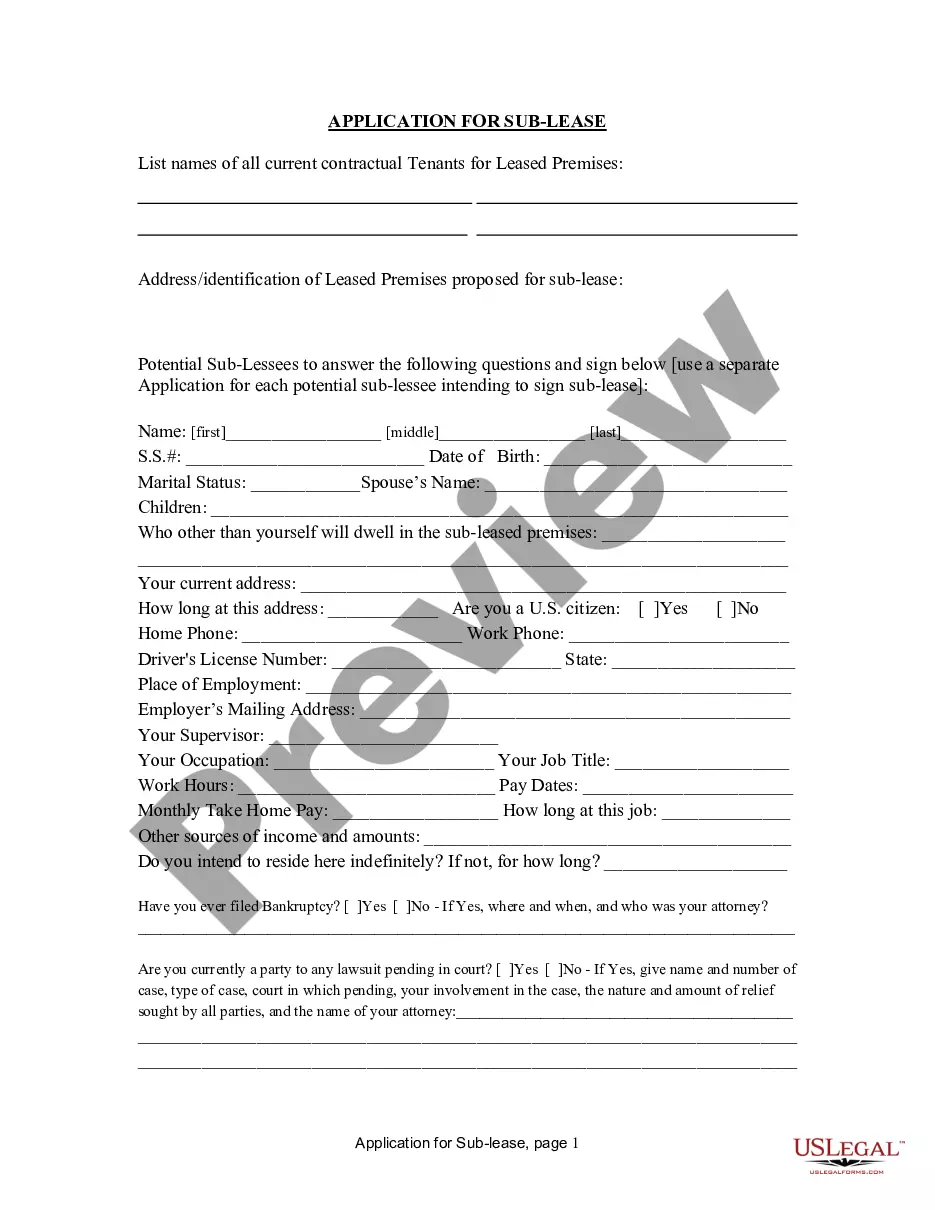

How to fill out Tennessee Stock Option Agreement Of Intraware, Inc.?

If you want to comprehensive, download, or printing legal record web templates, use US Legal Forms, the most important collection of legal varieties, that can be found online. Utilize the site`s simple and easy practical look for to obtain the papers you need. Numerous web templates for company and specific uses are sorted by classes and claims, or search phrases. Use US Legal Forms to obtain the Tennessee Stock Option Agreement of Intraware, Inc. within a handful of clicks.

In case you are currently a US Legal Forms client, log in in your bank account and click on the Down load key to get the Tennessee Stock Option Agreement of Intraware, Inc.. You can also access varieties you earlier saved from the My Forms tab of your own bank account.

If you work with US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have selected the form for that correct town/land.

- Step 2. Take advantage of the Preview choice to look over the form`s information. Never forget to see the explanation.

- Step 3. In case you are unhappy using the type, take advantage of the Lookup industry towards the top of the display to find other models of the legal type web template.

- Step 4. Once you have discovered the form you need, select the Acquire now key. Choose the pricing plan you prefer and put your credentials to sign up for an bank account.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the deal.

- Step 6. Select the file format of the legal type and download it on your own product.

- Step 7. Total, change and printing or indication the Tennessee Stock Option Agreement of Intraware, Inc..

Each legal record web template you buy is yours forever. You might have acces to each and every type you saved in your acccount. Go through the My Forms segment and choose a type to printing or download once more.

Be competitive and download, and printing the Tennessee Stock Option Agreement of Intraware, Inc. with US Legal Forms. There are thousands of specialist and state-certain varieties you can use for your personal company or specific requires.