Tennessee Sample Limited Partnership Agreement between DAH-IP Holdings, Inc. and DeCrane Aircraft Holdings, Inc.

Description

How to fill out Sample Limited Partnership Agreement Between DAH-IP Holdings, Inc. And DeCrane Aircraft Holdings, Inc.?

Have you been in the situation that you will need files for possibly company or personal reasons nearly every day time? There are plenty of legitimate document templates available on the net, but getting ones you can depend on isn`t simple. US Legal Forms delivers 1000s of type templates, just like the Tennessee Sample Limited Partnership Agreement between DAH-IP Holdings, Inc. and DeCrane Aircraft Holdings, Inc., which are composed in order to meet federal and state demands.

Should you be already informed about US Legal Forms internet site and possess your account, merely log in. Next, it is possible to obtain the Tennessee Sample Limited Partnership Agreement between DAH-IP Holdings, Inc. and DeCrane Aircraft Holdings, Inc. design.

Should you not offer an accounts and need to begin to use US Legal Forms, follow these steps:

- Find the type you want and ensure it is to the proper metropolis/region.

- Utilize the Preview option to check the shape.

- Browse the information to ensure that you have selected the correct type.

- In the event the type isn`t what you`re seeking, take advantage of the Look for industry to get the type that meets your needs and demands.

- Whenever you discover the proper type, just click Acquire now.

- Pick the costs strategy you need, submit the necessary details to make your bank account, and purchase an order utilizing your PayPal or credit card.

- Select a handy document file format and obtain your copy.

Locate each of the document templates you might have purchased in the My Forms food list. You can aquire a further copy of Tennessee Sample Limited Partnership Agreement between DAH-IP Holdings, Inc. and DeCrane Aircraft Holdings, Inc. anytime, if possible. Just click the required type to obtain or print out the document design.

Use US Legal Forms, one of the most substantial variety of legitimate forms, to save lots of some time and stay away from mistakes. The services delivers appropriately manufactured legitimate document templates which can be used for an array of reasons. Make your account on US Legal Forms and commence making your daily life a little easier.

Form popularity

FAQ

Your Limited Partnership Agreement can include details like: the name, address, and purpose of forming the partnership; whether limited partners have any voting rights regarding the day-to-day business decisions; how decisions will be made (by unanimous vote, majority vote, or majority vote based on percent ownership); ...

However, many aspiring business owners don't understand how to write a partnership agreement that will prevent issues down the road. The easiest way to write a valid agreement without mistakes is by creating a template using a contract management platform.

Use the following steps to draft a partnership agreement: Outline Partnership Purpose. ... Document Partner's Name and Business Address. ... Document Ownership Interest and Partner Shares. ... Outline Partner Responsibilities and Liabilities. ... Consult With a Lawyer.

How to Form a Tennessee Limited Partnership (in 6 Steps) Step One) Choose an LP Name. ... Step Two) Designate a Registered Agent. ... Step Three) File the Certificate of Limited Partnership. ... Step Four) Create a Limited Partnership Agreement. ... Step Five) Handle Taxation Requirements. ... Step Six) Obtain Business Licenses and Permits.

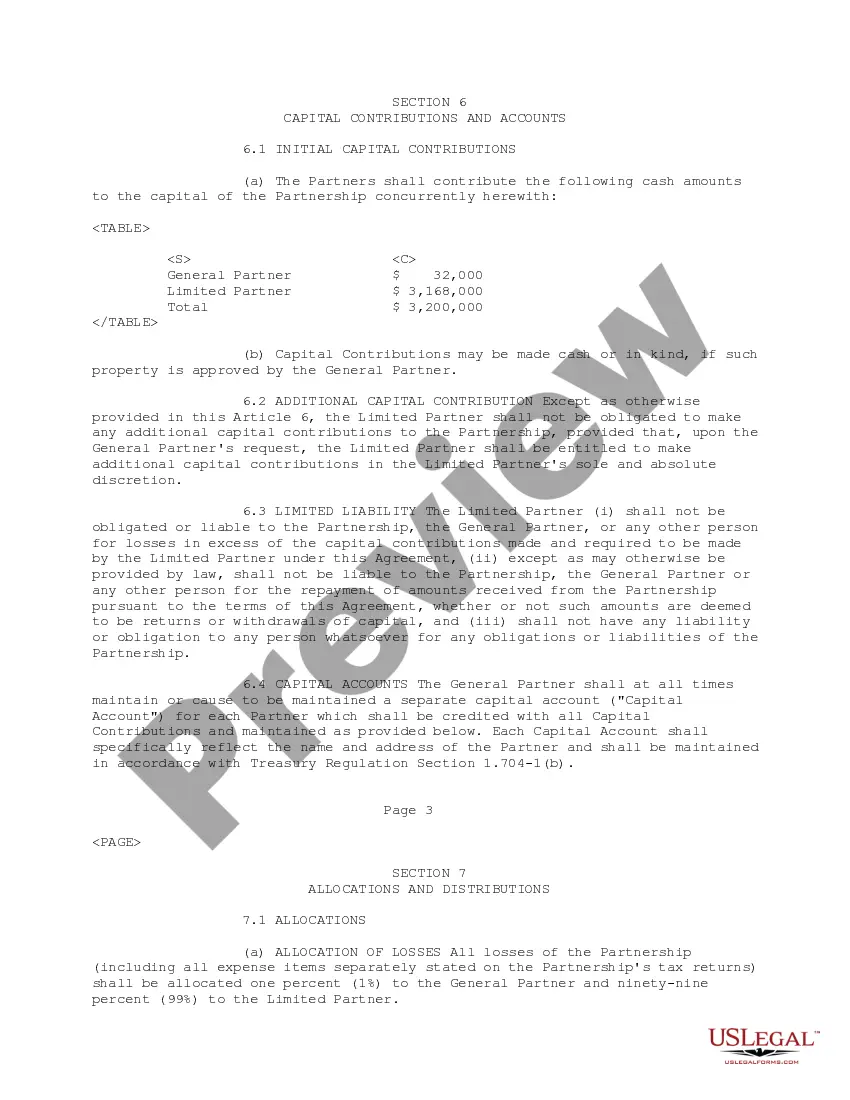

The Limited Partnership Agreement identifies what individual or other entity serves as the general partner. It also lists the ownership interests, profit percentage interest and any special rights of the general partner and limited partners.

Some examples of business ventures that commonly use the limited partnership structure include: Shopping malls, apartment complexes and other real estate businesses: With the limited partnership structure, businesses in the real estate industry can provide passive income from rent to the limited partners.

Creating a Limited Partnership The name of the limited partnership. The street address of the principal place of business. The name and street address of the partnership's registered agent. The name and street address of each general partner. The signature of each general partner acknowledging acceptance as such.