Tennessee Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York

Description

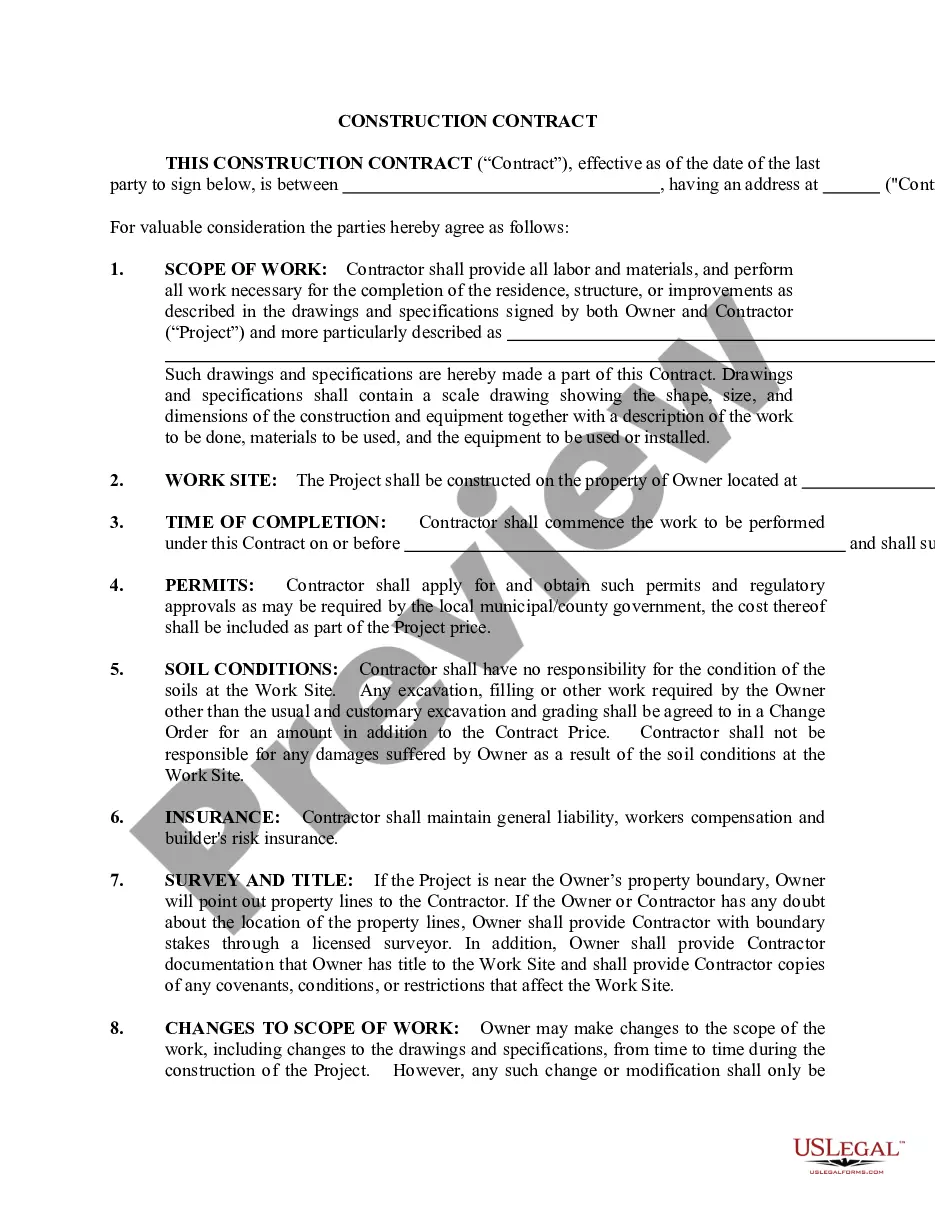

How to fill out Participation Agreement Between Variable Insurance Products Fund, III, Lincoln Life And Annuity Company Of New York?

Are you currently in the position that you will need papers for either organization or specific purposes almost every time? There are tons of legal record themes available on the Internet, but discovering versions you can trust is not easy. US Legal Forms offers thousands of type themes, much like the Tennessee Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York, that are published to satisfy state and federal needs.

If you are already familiar with US Legal Forms site and also have an account, merely log in. After that, you may download the Tennessee Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York template.

Should you not provide an bank account and wish to start using US Legal Forms, adopt these measures:

- Discover the type you need and ensure it is for that proper area/county.

- Take advantage of the Preview switch to analyze the shape.

- Browse the description to actually have selected the right type.

- If the type is not what you are looking for, make use of the Search discipline to get the type that suits you and needs.

- Whenever you get the proper type, click on Purchase now.

- Pick the prices plan you need, fill out the desired information and facts to produce your account, and pay money for an order making use of your PayPal or bank card.

- Pick a hassle-free file structure and download your backup.

Find each of the record themes you possess bought in the My Forms food selection. You can get a additional backup of Tennessee Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York at any time, if necessary. Just select the essential type to download or print the record template.

Use US Legal Forms, probably the most considerable selection of legal types, to save lots of time and stay away from blunders. The services offers expertly produced legal record themes that can be used for a range of purposes. Produce an account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

Lincoln Level Advantage® indexed-linked variable annuity is a long-term investment product designed for retirement purposes. There are no explicit fees associated with the indexed-linked account options available.

Variable annuities are essentially an insurance contract combined with an investment product. Through a professionally managed "subaccount" (similar to a mutual fund portfolio) within your variable annuity, you invest in stocks, bonds or money market funds or a combination thereof.

Lincoln Level Advantage® indexed variable annuity is a long-term investment product designed for retirement purposes. There are no explicit fees associated with the indexed-linked account options available.

Lincoln Financial Group - Lincoln National is rated ?A? by A.M. Best, was founded in 1905, and has over $123 billion in total assets.

Index variable annuities are designed to help you accumulate assets for retirement and provide some protection for a portion of your retirement assets. An index variable annuity may be a good choice if you're willing to take on some level of risk with the opportunity to grow your assets.

While all annuities are regulated by state insurance commissioners, variable annuities and RILAs are securities and therefore are also regulated by the SEC and FINRA. Annuities are often products investors consider when they plan for retirement. They're often marketed as tax-deferred savings products.