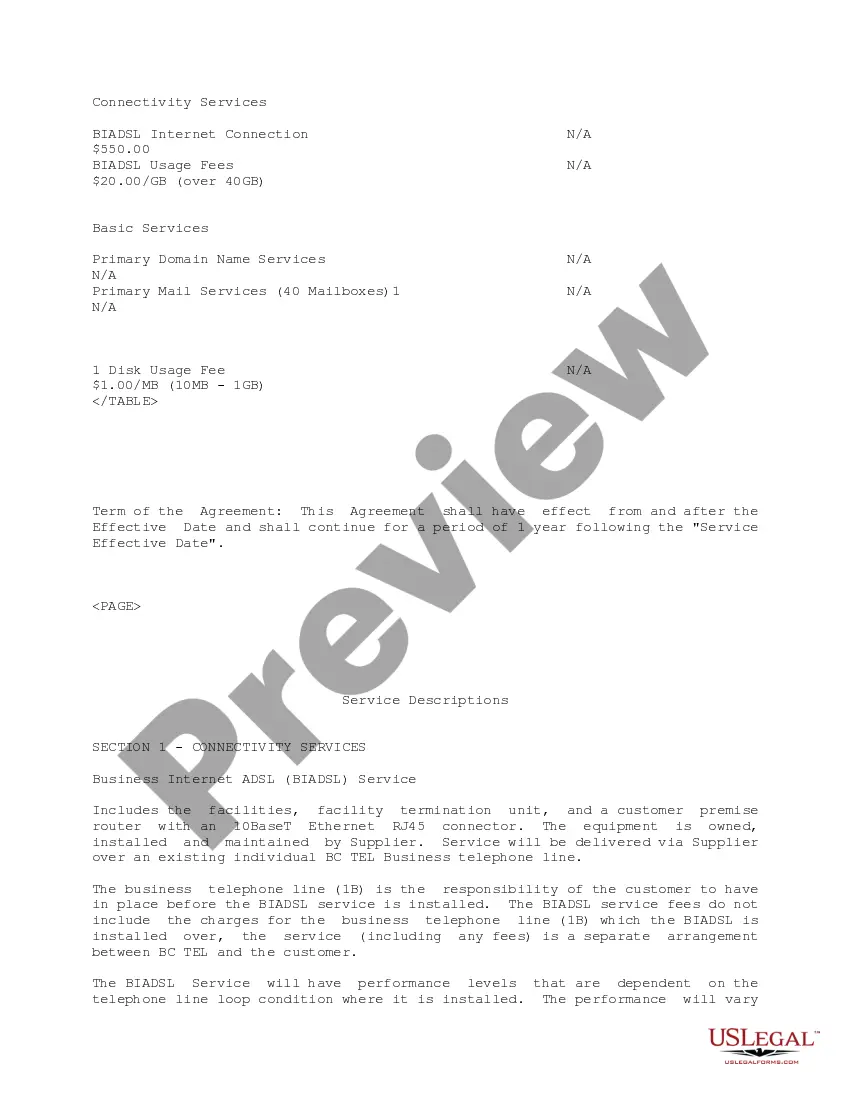

Tennessee Internet Business Services Agreement

Description

How to fill out Internet Business Services Agreement?

If you want to comprehensive, obtain, or print authorized file templates, use US Legal Forms, the most important assortment of authorized forms, that can be found on the web. Utilize the site`s simple and easy handy search to get the paperwork you require. Different templates for business and personal purposes are categorized by classes and states, or keywords. Use US Legal Forms to get the Tennessee Internet Business Services Agreement in a couple of mouse clicks.

In case you are presently a US Legal Forms client, log in in your account and click on the Down load option to find the Tennessee Internet Business Services Agreement. You may also accessibility forms you formerly downloaded from the My Forms tab of the account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the form to the correct metropolis/nation.

- Step 2. Utilize the Preview method to examine the form`s content material. Never forget to learn the explanation.

- Step 3. In case you are not satisfied using the type, utilize the Look for industry at the top of the display screen to get other variations of the authorized type template.

- Step 4. Upon having found the form you require, select the Get now option. Choose the costs prepare you choose and add your references to sign up to have an account.

- Step 5. Approach the transaction. You may use your charge card or PayPal account to finish the transaction.

- Step 6. Select the formatting of the authorized type and obtain it on the product.

- Step 7. Full, edit and print or indicator the Tennessee Internet Business Services Agreement.

Each authorized file template you purchase is yours permanently. You might have acces to every type you downloaded in your acccount. Go through the My Forms area and choose a type to print or obtain once more.

Remain competitive and obtain, and print the Tennessee Internet Business Services Agreement with US Legal Forms. There are millions of professional and condition-particular forms you can utilize for the business or personal requirements.

Form popularity

FAQ

LLCs taxed as C-corp C-corps will pay the 21% federal corporate income tax as well as Tennessee's 6.5% corporate income tax. Tennessee LLC Taxes - Northwest Registered Agent northwestregisteredagent.com ? llc ? taxes northwestregisteredagent.com ? llc ? taxes

Tennessee has a pro-business environment that features some of the lowest state and local tax burdens in the U.S. and no personal income tax. If you're wondering how to start an LLC in Tennessee, this guide will provide you with the basic information you'll need.

When a company has been inactive for over 12 months and there are no remaining assets, it can be legally dissolved. LLC Dissolution and What You Need to Know - MyCompanyWorks mycompanyworks.com ? llc-dissolution-and... mycompanyworks.com ? llc-dissolution-and...

A UCC financing statement is valid until it lapses. How much is the filing fee to file a UCC1? The filing fee is fifteen dollars ($15.00) per debtor. When there are multiple debtors listed on a single financing statement, a fifteen dollar ($15.00) fee is required for each debtor.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

You do need a DBA if you are using a business name other than your legal business name, or if you haven't registered your business and operate as a sole proprietorship or partnership.

Starting an LLC in Tennessee will include the following steps: #1: Choose a Name for Your Tennessee LLC. #2: Name a Registered Agent for Your Tennessee LLC. #3: File Articles of Organization for Your Tennessee LLC. #4: Secure an IRS Employer Identification Number. #5: Prepare Your Business for Operations. How to Start a Tennessee LLC in 2023 - MarketWatch marketwatch.com ? guides ? business ? start... marketwatch.com ? guides ? business ? start...

The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000. An officer is not listed. If the business is a Tennessee for-profit corporation, the corporation must list at least one officer. All Frequently Asked Questions for Businesses | Tennessee ... Tennessee Secretary of State (.gov) ? businesses ? faqs Tennessee Secretary of State (.gov) ? businesses ? faqs