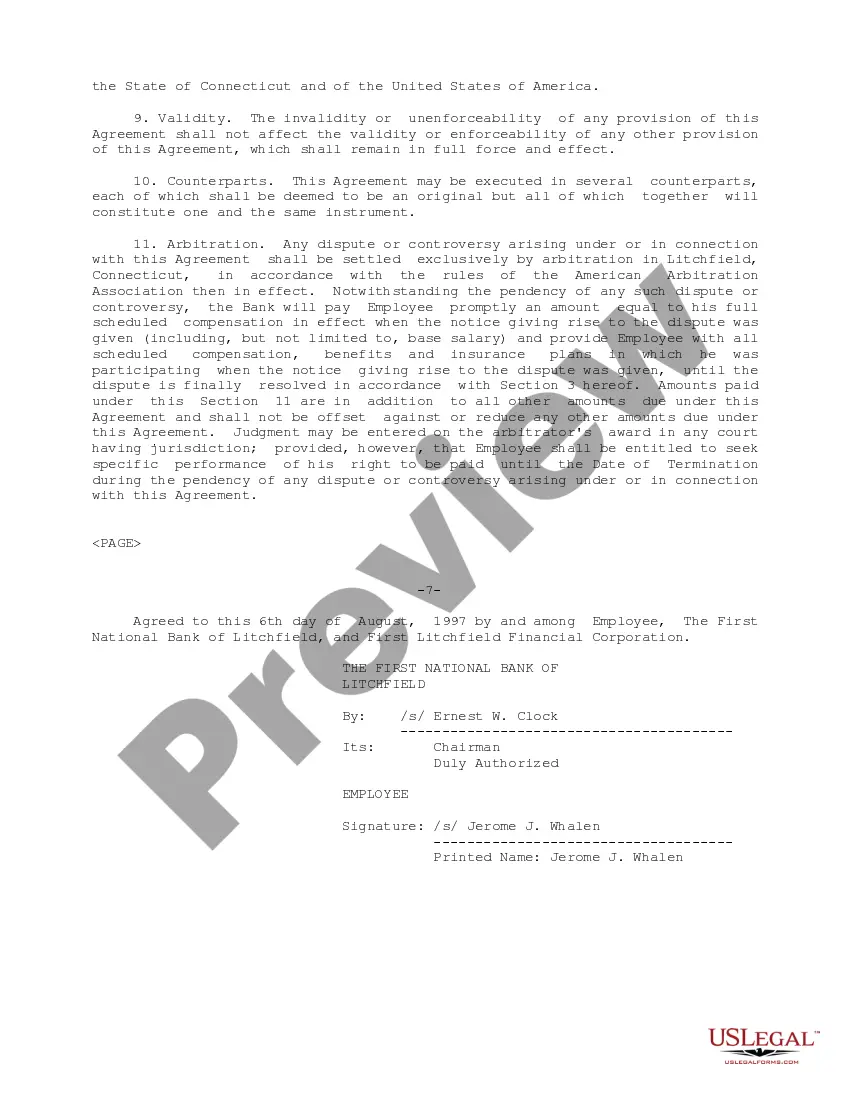

Tennessee Executive Change in Control Agreement for The First National Bank of Litchfield

Description

How to fill out Executive Change In Control Agreement For The First National Bank Of Litchfield?

Discovering the right lawful file format might be a have a problem. Naturally, there are a variety of templates accessible on the Internet, but how will you discover the lawful form you want? Take advantage of the US Legal Forms internet site. The services delivers 1000s of templates, such as the Tennessee Executive Change in Control Agreement for The First National Bank of Litchfield, which you can use for company and private needs. All the varieties are checked out by pros and meet up with state and federal requirements.

If you are previously signed up, log in to the profile and then click the Acquire button to find the Tennessee Executive Change in Control Agreement for The First National Bank of Litchfield. Use your profile to search through the lawful varieties you possess purchased previously. Proceed to the My Forms tab of your respective profile and obtain one more version in the file you want.

If you are a new end user of US Legal Forms, listed here are straightforward directions for you to comply with:

- Very first, make sure you have selected the appropriate form to your city/state. It is possible to look through the form utilizing the Review button and study the form explanation to make sure it will be the best for you.

- If the form does not meet up with your needs, use the Seach discipline to discover the appropriate form.

- When you are positive that the form would work, click the Acquire now button to find the form.

- Pick the pricing prepare you want and enter in the needed info. Design your profile and purchase your order using your PayPal profile or charge card.

- Choose the document file format and download the lawful file format to the device.

- Comprehensive, modify and print and indicator the acquired Tennessee Executive Change in Control Agreement for The First National Bank of Litchfield.

US Legal Forms is the greatest collection of lawful varieties in which you will find different file templates. Take advantage of the service to download professionally-made papers that comply with express requirements.