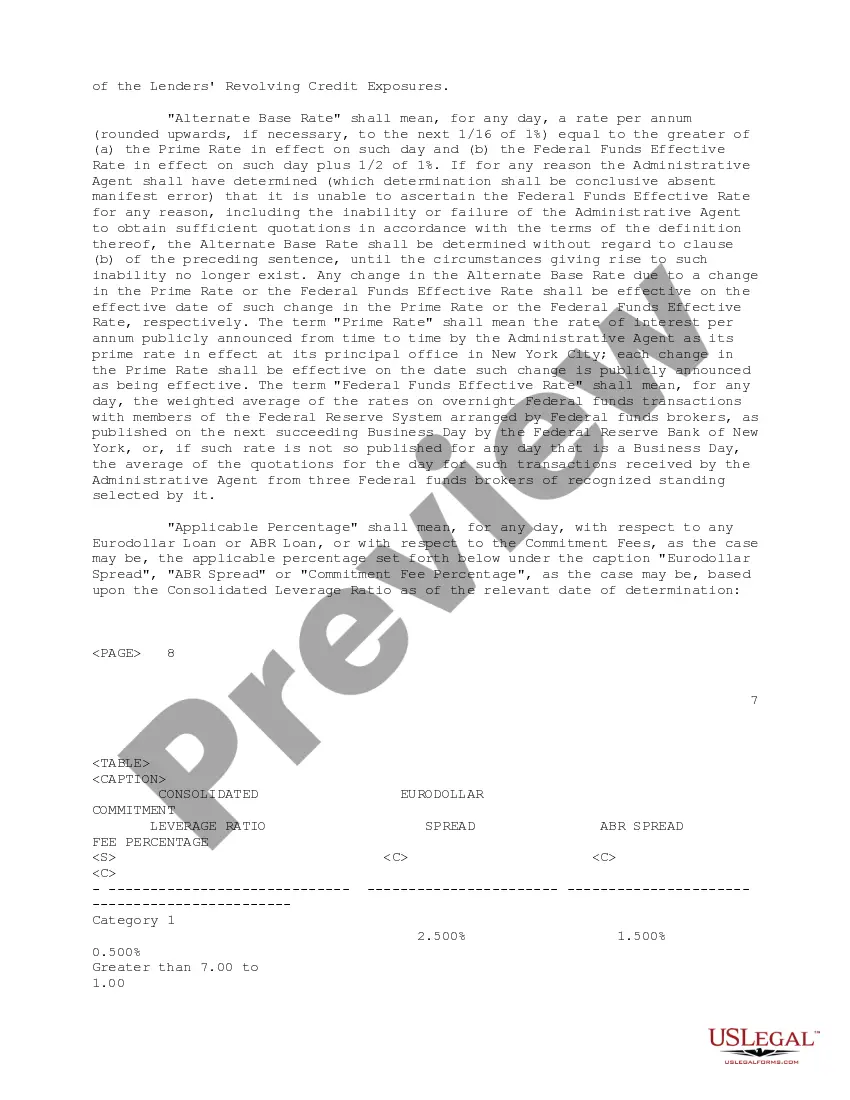

The Tennessee Credit Agreement regarding the extension of credit is a legal document that outlines the terms and conditions between a lender and a borrower for the provision of credit in the state of Tennessee. This agreement serves as a written contract and ensures that both parties are aware of their rights, responsibilities, and obligations in the credit relationship. The agreement typically includes key information such as the names and contact information of the lender and borrower, the agreed credit limit, the interest rate, repayment terms, and any applicable fees or penalties. It also specifies the purpose of the credit, whether it's for personal, business, or other specific uses. In Tennessee, there are various types of credit agreements that can be established, each tailored to specific circumstances or purposes. Some common credit agreements include: 1. Personal Credit Agreement: This type of agreement is used when an individual borrows money from a lender for personal use, such as buying a vehicle, funding education, or covering unexpected expenses. 2. Business Credit Agreement: Designed for businesses, this agreement allows companies to obtain credit for various purposes, like expanding operations, purchasing equipment, or managing cash flow fluctuations. 3. Revolving Credit Agreement: Under this agreement, a predetermined credit limit is established, and the borrower can access funds repeatedly up to that limit. It is commonly used for personal credit cards or business lines of credit. 4. Secured Credit Agreement: In this type of agreement, the borrower pledges collateral, such as real estate, vehicles, or other valuable assets, to secure the credit. If the borrower defaults on repayments, the lender has the right to seize the collateral to recover their losses. 5. Unsecured Credit Agreement: Unlike a secured credit agreement, an unsecured credit agreement does not require any collateral. Instead, the lender relies solely on the borrower's creditworthiness and trust to extend credit. Interest rates for unsecured credit agreements are typically higher to compensate for the increased risk to the lender. 6. Installment Credit Agreement: This agreement allows borrowers to repay the credit in regular installments over a specified period. Each installment consists of both principal and interest, ensuring a gradual reduction of the debt until it is fully repaid. It is essential for both borrowers and lenders to thoroughly review and understand all the terms and conditions stated in the Tennessee Credit Agreement regarding the extension of credit. If any concerns arise, seeking legal advice is recommended before signing the agreement.

Tennessee Credit Agreement regarding extension of credit

Description

How to fill out Tennessee Credit Agreement Regarding Extension Of Credit?

Choosing the right authorized papers design could be a have difficulties. Needless to say, there are plenty of web templates available online, but how will you discover the authorized develop you want? Utilize the US Legal Forms site. The services offers a huge number of web templates, including the Tennessee Credit Agreement regarding extension of credit, that you can use for organization and personal requires. Every one of the types are checked by specialists and fulfill federal and state requirements.

Should you be currently authorized, log in to your bank account and then click the Download key to obtain the Tennessee Credit Agreement regarding extension of credit. Make use of bank account to check from the authorized types you possess bought formerly. Visit the My Forms tab of your bank account and get yet another version from the papers you want.

Should you be a whole new customer of US Legal Forms, allow me to share easy instructions so that you can follow:

- Initially, be sure you have selected the proper develop for your personal area/state. You are able to look over the form using the Review key and look at the form explanation to make sure this is basically the right one for you.

- In the event the develop does not fulfill your expectations, utilize the Seach area to find the appropriate develop.

- Once you are sure that the form is suitable, go through the Purchase now key to obtain the develop.

- Opt for the costs strategy you need and enter the needed information and facts. Build your bank account and pay money for the transaction making use of your PayPal bank account or charge card.

- Select the file structure and acquire the authorized papers design to your gadget.

- Comprehensive, edit and print and signal the obtained Tennessee Credit Agreement regarding extension of credit.

US Legal Forms will be the most significant catalogue of authorized types for which you can find different papers web templates. Utilize the company to acquire professionally-created files that follow status requirements.