Tennessee Employee Shareholder Escrow Agreement

Description

How to fill out Employee Shareholder Escrow Agreement?

US Legal Forms - one of several largest libraries of lawful forms in the United States - provides an array of lawful record layouts you may download or print. Using the website, you can find 1000s of forms for organization and individual uses, sorted by classes, states, or search phrases.You can get the latest models of forms much like the Tennessee Employee Shareholder Escrow Agreement within minutes.

If you already have a monthly subscription, log in and download Tennessee Employee Shareholder Escrow Agreement in the US Legal Forms local library. The Down load switch can look on each and every kind you view. You gain access to all formerly delivered electronically forms inside the My Forms tab of your own accounts.

If you would like use US Legal Forms the first time, listed here are straightforward directions to obtain started off:

- Be sure you have chosen the correct kind for the city/area. Go through the Review switch to review the form`s content material. Read the kind description to actually have chosen the correct kind.

- In case the kind doesn`t suit your demands, take advantage of the Research field towards the top of the display to find the one who does.

- When you are content with the shape, verify your decision by clicking on the Purchase now switch. Then, select the prices program you favor and provide your qualifications to sign up on an accounts.

- Approach the transaction. Utilize your bank card or PayPal accounts to perform the transaction.

- Choose the structure and download the shape on your own device.

- Make alterations. Fill out, edit and print and signal the delivered electronically Tennessee Employee Shareholder Escrow Agreement.

Every web template you put into your account does not have an expiry particular date and it is the one you have permanently. So, in order to download or print an additional backup, just check out the My Forms area and then click in the kind you need.

Get access to the Tennessee Employee Shareholder Escrow Agreement with US Legal Forms, probably the most considerable local library of lawful record layouts. Use 1000s of expert and condition-distinct layouts that fulfill your company or individual needs and demands.

Form popularity

FAQ

In Tennessee, the buyer and seller will have designated their title/escrow companies at the time of executing their purchase agreement.

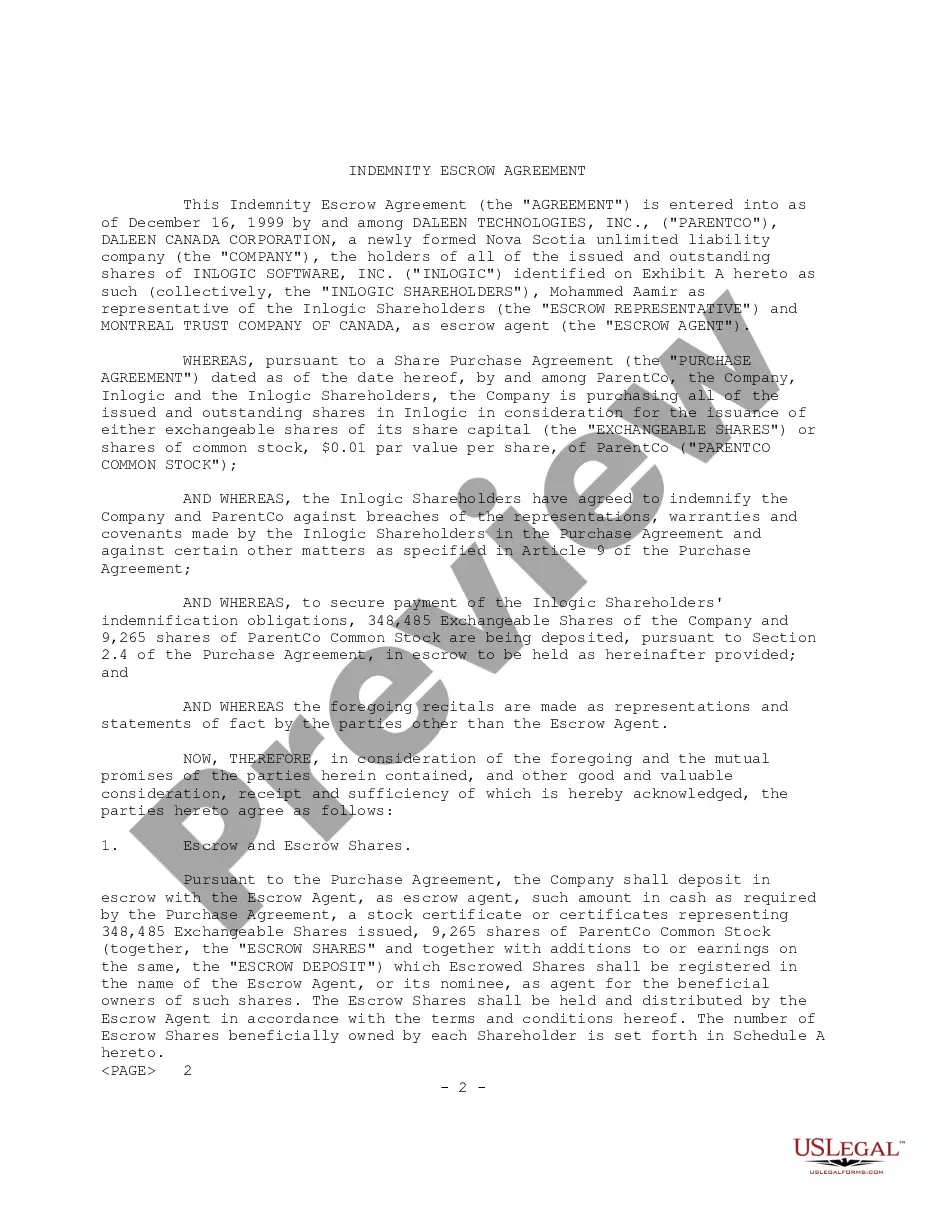

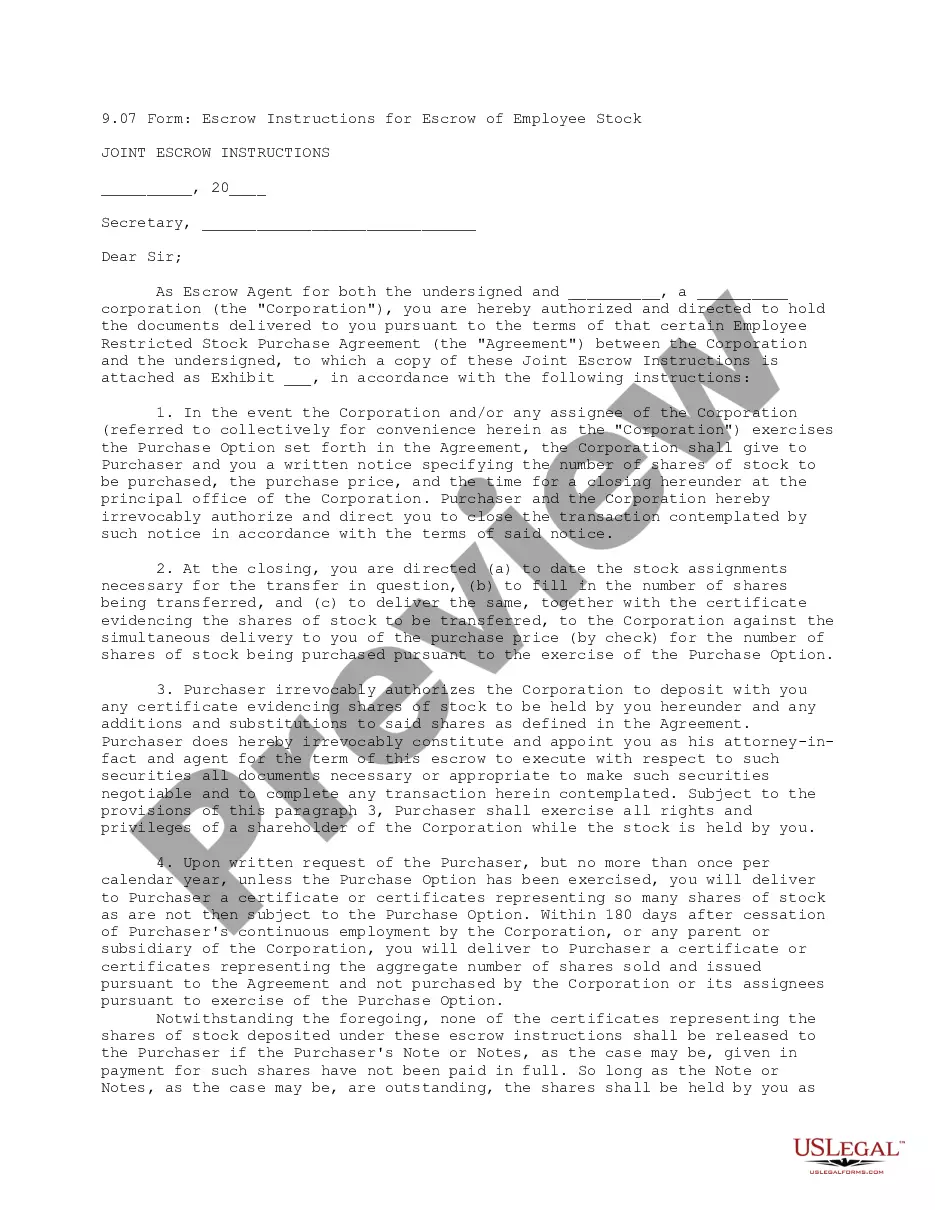

Understanding Escrowed Shares Escrow is a process whereby money or a financial asset is held by a third party on behalf of two other parties. The assets or funds that are held in escrow remain there and are not released until all of the obligations outlined in the agreement are fulfilled.

An escrow account, sometimes called a trust account, is an account that is used for the collection of earnest money deposits and holds the client's money until the transaction is closed or both parties agree to the terms of canceling the sales agreement.

An escrow agreement is a contract that outlines the terms and conditions between parties involved, and the responsibility of each. Escrow agreements generally involve an independent third party, called an escrow agent, who holds an asset of value until the specified conditions of the contract are met.

An escrow holdback agreement addendum is used to ?hold back? part of the sale price at closing until certain conditions are met by the seller. The document details the release conditions, the amount of money in escrow, and the third party who will be entrusted with the escrowed funds.

Armour Title, a Tennessee Title Company, is your source for title and escrow services in Tennessee and nationwide. We provide a variety of title services for realtors, lenders, homeowners, and borrowers. We're proud of our top notch customer service, flexibility, and timeliness.

When you purchase a home with the help of a lender, the lender will likely set up an escrow account for you as well. The lender collects the money from you on a monthly basis for property taxes and homeowner's insurance, holds it in the escrow account, and then pays those bills on your behalf when they come due.

The period that you are "in escrow" is often 30 days, but may be longer or shorter. During this time, each item specified in the contract must be completed satisfactorily. By the time you have opened escrow, you have come to an agreement with the seller on the closing date and the contingencies.