Tennessee General Security Agreement granting secured party secured interest

Description

How to fill out General Security Agreement Granting Secured Party Secured Interest?

Have you been inside a situation the place you will need files for possibly company or individual uses nearly every working day? There are a lot of legitimate papers web templates available on the Internet, but locating versions you can rely on is not easy. US Legal Forms provides a large number of form web templates, like the Tennessee General Security Agreement granting secured party secured interest, which can be published in order to meet state and federal requirements.

If you are currently familiar with US Legal Forms internet site and possess your account, merely log in. Following that, it is possible to acquire the Tennessee General Security Agreement granting secured party secured interest design.

If you do not offer an profile and would like to begin to use US Legal Forms, abide by these steps:

- Discover the form you require and make sure it is for the appropriate city/county.

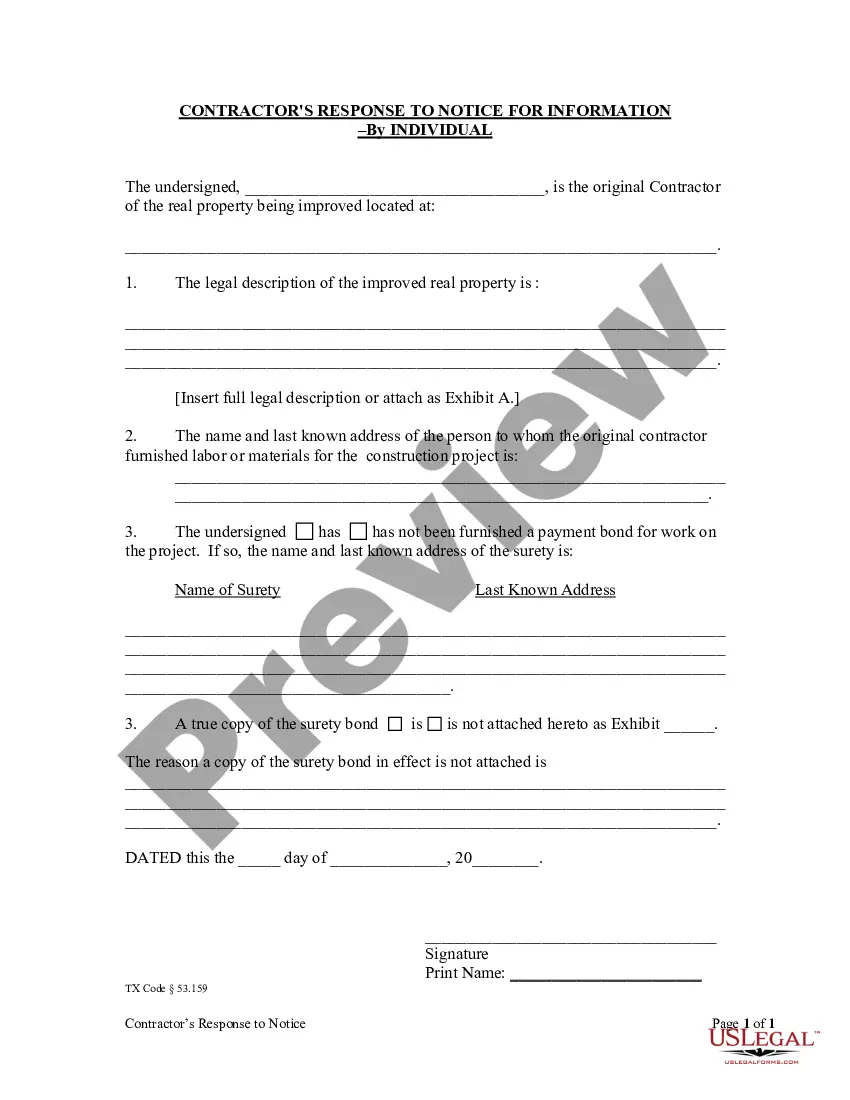

- Use the Review option to check the shape.

- Read the outline to actually have selected the proper form.

- In case the form is not what you are trying to find, use the Lookup field to find the form that meets your needs and requirements.

- If you obtain the appropriate form, simply click Buy now.

- Opt for the pricing strategy you desire, fill in the desired information to make your money, and pay for an order making use of your PayPal or bank card.

- Select a hassle-free file formatting and acquire your backup.

Find all the papers web templates you might have bought in the My Forms menus. You can get a extra backup of Tennessee General Security Agreement granting secured party secured interest any time, if required. Just go through the needed form to acquire or printing the papers design.

Use US Legal Forms, the most comprehensive assortment of legitimate types, to conserve time and prevent blunders. The service provides skillfully produced legitimate papers web templates that you can use for a range of uses. Generate your account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

(1) A security interest in chattel paper or negotiable documents may be perfected by filing. A security interest in the right to proceeds of a written letter of credit can be perfected only by the secured party's taking possession of the letter of credit.

What is a General Security Agreement? A GSA is a contract signed between two parties, a borrower and a lender. The GSA protects the lender by creating a security interest in all or some of the assets of the borrower. In sum, the GSA outlines the terms and conditions of the loan, and lists the assets used for security.

You give the lender this right when you sign your closing forms. The document granting the security interest can be called by different names, but the most common names are "Mortgage" or "Deed of Trust."

One of the most common examples of a security interest is a mortgage: a person borrows money from the bank to buy a house, and they grant a mortgage over the house so that if they default in repaying the loan, the bank can sell the house and apply the proceeds to the outstanding loan.

Secured Transaction Terminology Security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Secured party is a lender, seller, or other person in whose favor a security interest exists.

The term ?security interest? means an interest (including an interest established by a conditional sales contract, mortgage, equipment trust, or other lien or title retention contract, or lease) in a motor vehicle when the interest secures payment or performance of an obligation.

A secured party in UCC law is a person who has the favor of the security interest that is created or provided for under a security agreement, whether or not there is an obligation to be secured that is outstanding.