Tennessee Founders Collaboration Agreement

Description

How to fill out Founders Collaboration Agreement?

You are able to invest hours on-line looking for the legal record web template that fits the state and federal specifications you will need. US Legal Forms offers a large number of legal types which are reviewed by experts. It is possible to down load or print out the Tennessee Founders Collaboration Agreement from the services.

If you currently have a US Legal Forms account, you are able to log in and click on the Acquire key. Next, you are able to full, change, print out, or signal the Tennessee Founders Collaboration Agreement. Each legal record web template you buy is the one you have for a long time. To get one more duplicate of any obtained form, proceed to the My Forms tab and click on the related key.

If you use the US Legal Forms website for the first time, keep to the easy instructions beneath:

- Very first, make certain you have selected the correct record web template for that county/city of your liking. Browse the form information to ensure you have picked the right form. If offered, use the Review key to look with the record web template at the same time.

- In order to locate one more variation of your form, use the Lookup discipline to get the web template that meets your needs and specifications.

- Upon having discovered the web template you want, click Buy now to proceed.

- Pick the costs prepare you want, key in your credentials, and sign up for your account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal account to purchase the legal form.

- Pick the format of your record and down load it to the system.

- Make adjustments to the record if required. You are able to full, change and signal and print out Tennessee Founders Collaboration Agreement.

Acquire and print out a large number of record web templates utilizing the US Legal Forms Internet site, that provides the biggest selection of legal types. Use expert and state-particular web templates to tackle your business or specific needs.

Form popularity

FAQ

Also known as a co-founders agreement, this written legal document sets expectations for each founder so everyone's on the same page. It also regulates matters not covered by financial or operating agreements, such as intellectual property rights and equity vesting schedules. Founders Agreement: A Guide - HubSpot Blog HubSpot Blog ? the-hustle ? founders-agree... HubSpot Blog ? the-hustle ? founders-agree...

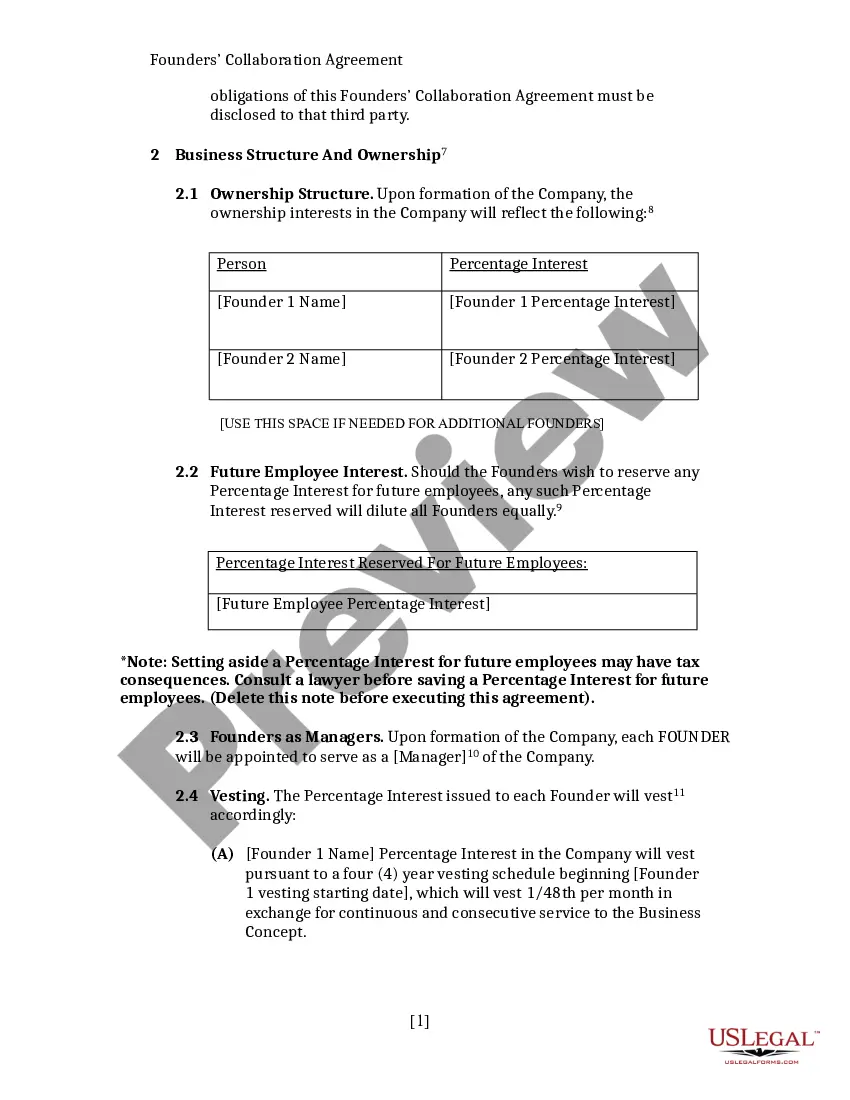

A Founders' Agreement is a legally binding contract between two or more people that sets out how their business will be run and what percentage each person will receive of ownership, as well as how the ownership will vest on the co-founders.

Contents of a Co-Founder Agreement Company Formation. Details on the formation of the company, including the company's name, location, and purpose. Ownership and Equity. ... Roles and Responsibilities. ... Capital Contributions. ... Intellectual Property. ... Confidentiality and Non-compete. ... Dispute Resolution. ... Termination.

A Founders' Agreement is a contract that a company's founders enter into that governs their business relationships. The Agreement lays out the rights, responsibilities, liabilities, and obligations of each founder. Founders' Agreement Overview - Penn Law School University of Pennsylvania Carey Law School ? clinic ? startupkit University of Pennsylvania Carey Law School ? clinic ? startupkit PDF

What Should be Included in a Founders Agreement? Names of Founders and Company. Ownership Structure. The Project. Initial Capital and Additional Contributions. Expenses and Budget. Taxes. Roles and Responsibilities. Management and Legal Decision-Making, Operating, and Approval Rights.

It should include sections such as the name and purpose of the startup, names and addresses of co-founders, equity allocation and valuation, vesting schedule and cliff period of equity, roles and responsibilities of co-founders, decision-making and dispute resolution process, confidentiality and intellectual property ... What are the steps to a fair co-founder agreement? - LinkedIn linkedin.com ? advice ? what-steps-fair-co-f... linkedin.com ? advice ? what-steps-fair-co-f...

4 Key Areas of a Founders' Agreement Define who does what and titles. Describe decision-making rights and rewards, such as who sits on the board. Stipulate provisions such as vesting. Key Terms to Include in a Founders' Agreement founders-journey.org ? starting ? key-terms-to-inc... founders-journey.org ? starting ? key-terms-to-inc...