"

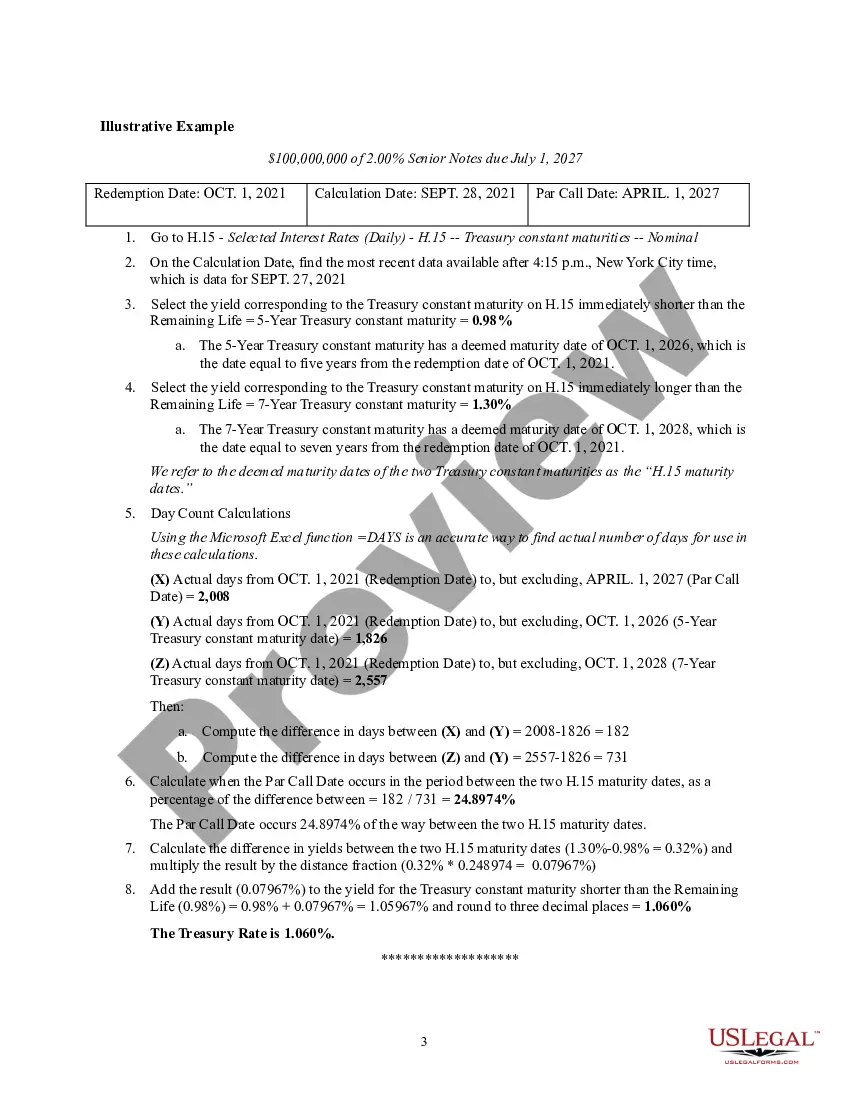

Tennessee Executive Summary Investment-Grade Bond Optional Redemption refers to a financial instrument offered by the state of Tennessee for investors seeking a secure and sustainable investment opportunity. This investment-grade bond provides attractive yields while ensuring a high level of safety for investors. The Tennessee Executive Summary Investment-Grade Bond Optional Redemption offers investors the flexibility to redeem their investment at their discretion, potentially before the bond's maturity date. This feature provides liquidity to investors, allowing them to access their funds whenever needed, making it an appealing choice for those requiring short-term investments. Investors can benefit from investing in the Tennessee Executive Summary Investment-Grade Bond Optional Redemption in multiple ways. Firstly, it offers a higher yield compared to traditional savings accounts or low-risk investments, making it an attractive option for those seeking better returns on their investment portfolio. Secondly, the investment-grade bond ensures the safety of the principal amount, protecting investors from potential financial losses. Different types of Tennessee Executive Summary Investment-Grade Bond Optional Redemption may exist depending on various factors, including maturity periods, interest rates, and redemption conditions. For instance, there could be bonds with different durations, such as short-term, medium-term, or long-term bonds, catering to investors with varying investment horizons. Moreover, the Tennessee Executive Summary Investment-Grade Bond Optional Redemption may offer different interest rates depending on prevailing market conditions and the specific bond series. These bonds could be structured with fixed interest rates, meaning the rate remains consistent throughout the bond's tenure, or they may have variable interest rates tied to market benchmarks such as treasury rates or inflation indices. Investors considering investing in Tennessee Executive Summary Investment-Grade Bond Optional Redemption should carefully analyze the bond's terms and conditions before making any investment decision. They should evaluate factors such as the bond's credit rating, interest rate, redemption provisions, and potential tax implications. Conducting thorough research and consulting with financial experts can help investors make informed decisions based on their financial goals and risk appetite. In conclusion, the Tennessee Executive Summary Investment-Grade Bond Optional Redemption offers investors a secure and attractive investment opportunity with the added benefit of optional redemption. This investment instrument provides a diverse range of bond options tailored to investors' preferences, such as varying maturity periods and interest rate structures. Overall, the Tennessee Executive Summary Investment-Grade Bond Optional Redemption can serve as a viable component of a well-diversified investment portfolio.