Tennessee Certificate of Incorporation

Description

(It is a legal document serving as a formal record of a company's formation.)"

How to fill out Certificate Of Incorporation?

It is possible to commit hrs on the Internet looking for the legal record design that fits the federal and state demands you need. US Legal Forms supplies 1000s of legal varieties which are examined by specialists. It is possible to down load or print the Tennessee Certificate of Incorporation from my service.

If you currently have a US Legal Forms account, you may log in and click on the Download key. Afterward, you may complete, revise, print, or signal the Tennessee Certificate of Incorporation. Every single legal record design you get is your own property permanently. To have one more duplicate for any acquired kind, go to the My Forms tab and click on the related key.

If you use the US Legal Forms site initially, follow the simple directions listed below:

- First, ensure that you have chosen the proper record design for your county/town of your choosing. Read the kind information to make sure you have picked out the correct kind. If available, take advantage of the Review key to appear from the record design too.

- If you want to find one more variation from the kind, take advantage of the Search area to find the design that suits you and demands.

- Upon having found the design you would like, click on Acquire now to move forward.

- Pick the prices program you would like, type your credentials, and sign up for your account on US Legal Forms.

- Comprehensive the transaction. You can utilize your charge card or PayPal account to cover the legal kind.

- Pick the formatting from the record and down load it in your device.

- Make adjustments in your record if necessary. It is possible to complete, revise and signal and print Tennessee Certificate of Incorporation.

Download and print 1000s of record themes utilizing the US Legal Forms Internet site, which offers the biggest assortment of legal varieties. Use specialist and status-particular themes to handle your small business or specific needs.

Form popularity

FAQ

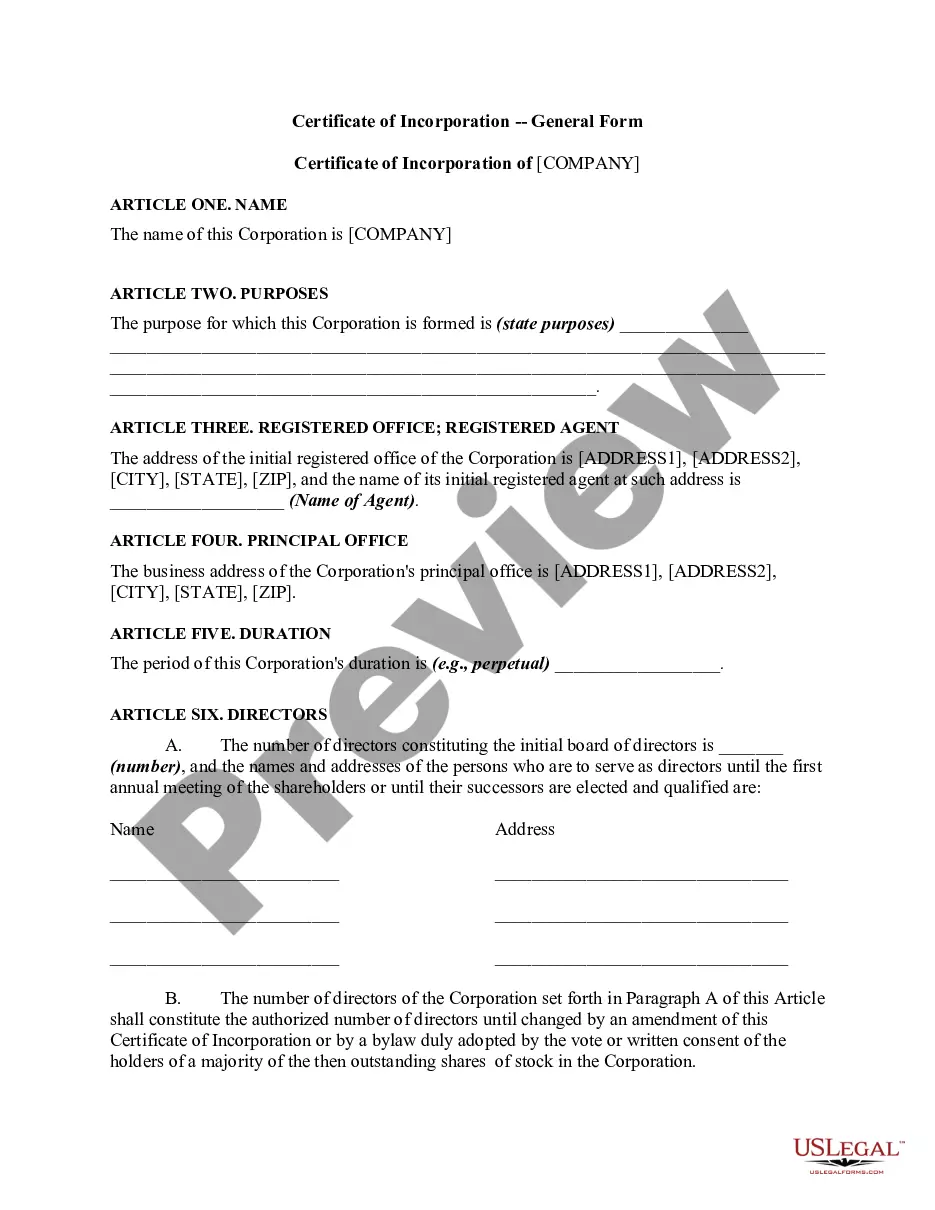

To prepare your articles, you'll usually need the following information: Your LLC name. An additional designation for the LLC's name?if it is a professional LLC, series LLC, or banks. A name consent if the LLC's name is similar to an existing name in Tennessee.

When a company has been inactive for over 12 months and there are no remaining assets, it can be legally dissolved. LLC Dissolution and What You Need to Know - MyCompanyWorks mycompanyworks.com ? llc-dissolution-and... mycompanyworks.com ? llc-dissolution-and...

How to Start an LLC in Tennessee in 5 Easy Steps Step One: Choose a Name for Your Tennessee LLC. ... Step Two: Name a Registered Agent for Your Tennessee LLC. ... Step Three: File Articles of Organization for Your Tennessee LLC. ... Step Four: Secure an IRS Employer Identification Number. ... Step Five: Prepare Your Business for Operations.

Tennessee requires LLCs to file an annual report and pay a franchise tax. The annual report is due on or before the first day of the fourth month following the close of the LLC's fiscal year. The filing fee is $50 per member, with a minimum fee of $300 and a maximum fee of $3000.

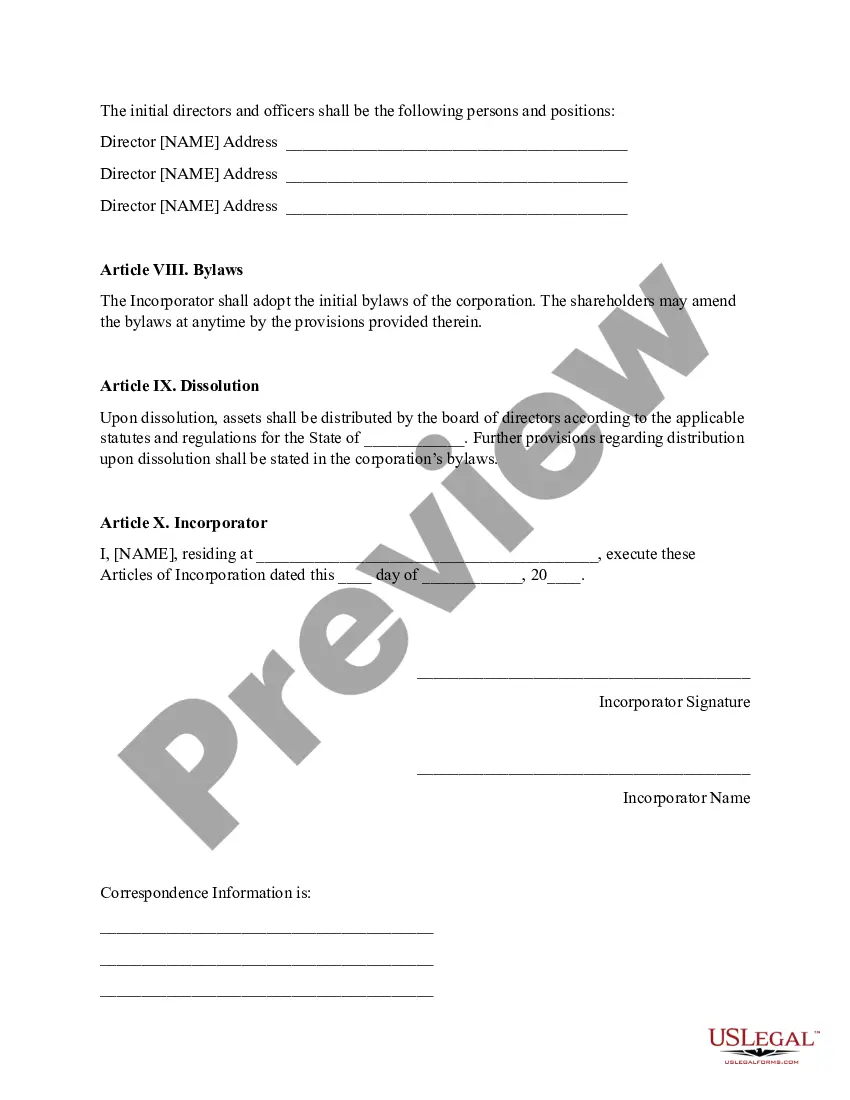

Immediately in-person. Choose a Corporate Structure. Incorporating means starting a corporation. ... Check Name Availability. ... Appoint a Registered Agent. ... File Tennessee Articles of Incorporation. ... Establish Bylaws & Corporate Records. ... Appoint Initial Directors. ... Hold Organizational Meeting. ... Issue Stock Certificates.

Tennessee requires an initial LLC filing fee of $300. This fee grants you the privilege of officially establishing your limited liability company. Additionally, Tennessee mandates an annual report filing, accompanied by a $50 fee.

One main difference is that C-corp owners pay a corporate tax to the federal, and sometimes state, governments, while S-corps don't. S-corps owners are limited to 100 shareholders and must file a special form with the IRS to elect S-corp status.

The annual report fee for LLCs is $300 minimum up to a maximum of $3000. The fee increases by an additional $50 per member for every member over 6 members up to a maximum of $3,000. An officer is not listed. If the business is a Tennessee for-profit corporation, the corporation must list at least one officer. All Frequently Asked Questions for Businesses | Tennessee ... Tennessee Secretary of State (.gov) ? businesses ? faqs Tennessee Secretary of State (.gov) ? businesses ? faqs

LLCs taxed as C-corp C-corps will pay the 21% federal corporate income tax as well as Tennessee's 6.5% corporate income tax. Tennessee LLC Taxes - Northwest Registered Agent northwestregisteredagent.com ? llc ? taxes northwestregisteredagent.com ? llc ? taxes

You can file the document online, by mail or in person. The Articles of Organization cost $300 to file for up to six members. Beyond that there is a $50 per member charge, and add 2.35% to pay online with your credit card and $0.95 to file with an eCheck.