Title: Tennessee: A Comprehensive Summary of Your Rights Under the Fair Credit Reporting Act Introduction: The Fair Credit Reporting Act (FCRA) is a federal law designed to protect consumers' rights when it comes to their credit information. Tennessee's residents can benefit from these provisions, which help maintain fair and accurate credit reporting practices. This article provides an in-depth description of Tennessee residents' rights under the FCRA and touches upon different types of summary variations to be aware of. 1. Access to Your Credit Report: Under the FCRA, Tennessee residents have the right to request a free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once every 12 months. This allows individuals to review their credit history and identify any potential errors or fraudulent activities. 2. Accuracy of the Credit Report: The FCRA ensures that credit reporting agencies maintain accurate and up-to-date information regarding individuals' credit history. Tennessee's residents have the right to dispute any inaccurate or incomplete information on their credit report and request investigations by the credit reporting agencies. 3. Notification of Negative Information: If a credit reporting agency includes negative information on a person's credit report—such as late payments, defaults, or bankruptcies—they must provide written notice to the individual within a reasonable time frame. 4. Consent Requirements: Any time a Tennessee resident applies for credit, the FCRA requires that the individual provides written consent for the credit inquiry to proceed. This ensures that consumers are aware of who has access to their credit history and can monitor any inquiries made into their credit reports. 5. Disclosure of Credit Scores: Tennessee residents have the right to request and receive their credit scores from the credit reporting agencies. These scores reflect individuals' creditworthiness and are essential when applying for credit. 6. Identity Theft and Fraud Protection: The FCRA provides protections for Tennessee residents in cases of identity theft and fraud. Consumers can request the inclusion of a fraud alert or credit freeze on their credit reports to prevent unauthorized access and mitigate the risk of further fraud or identity theft. Types of Tennessee A Summary of Your Rights Under the Fair Credit Reporting Act: 1. Basic Summary: This version of the summary provides a general overview of the rights and protections granted to Tennessee residents under the FCRA. It covers the fundamental elements mentioned above without delving into specific details. 2. Detailed Summary: The detailed summary delves into each of the rights and provisions outlined in the FCRA more comprehensively. It offers thorough explanations and examples to help Tennessee residents understand their rights and how to exercise them effectively. 3. FCRA for Specific Industries: These summaries cater to specific industries or parties involved in credit reporting. Examples include summaries targeted towards employers conducting background checks, landlords reviewing tenant applications, or lenders assessing creditworthiness. Conclusion: Understanding your rights under the Fair Credit Reporting Act is vital for Tennessee residents to protect and manage their credit history effectively. By familiarizing themselves with the FCRA, individuals can remain vigilant, address any inaccuracies, and ensure fair treatment regarding their credit reports.

Tennessee A Summary of Your Rights Under the Fair Credit Reporting Act

Description

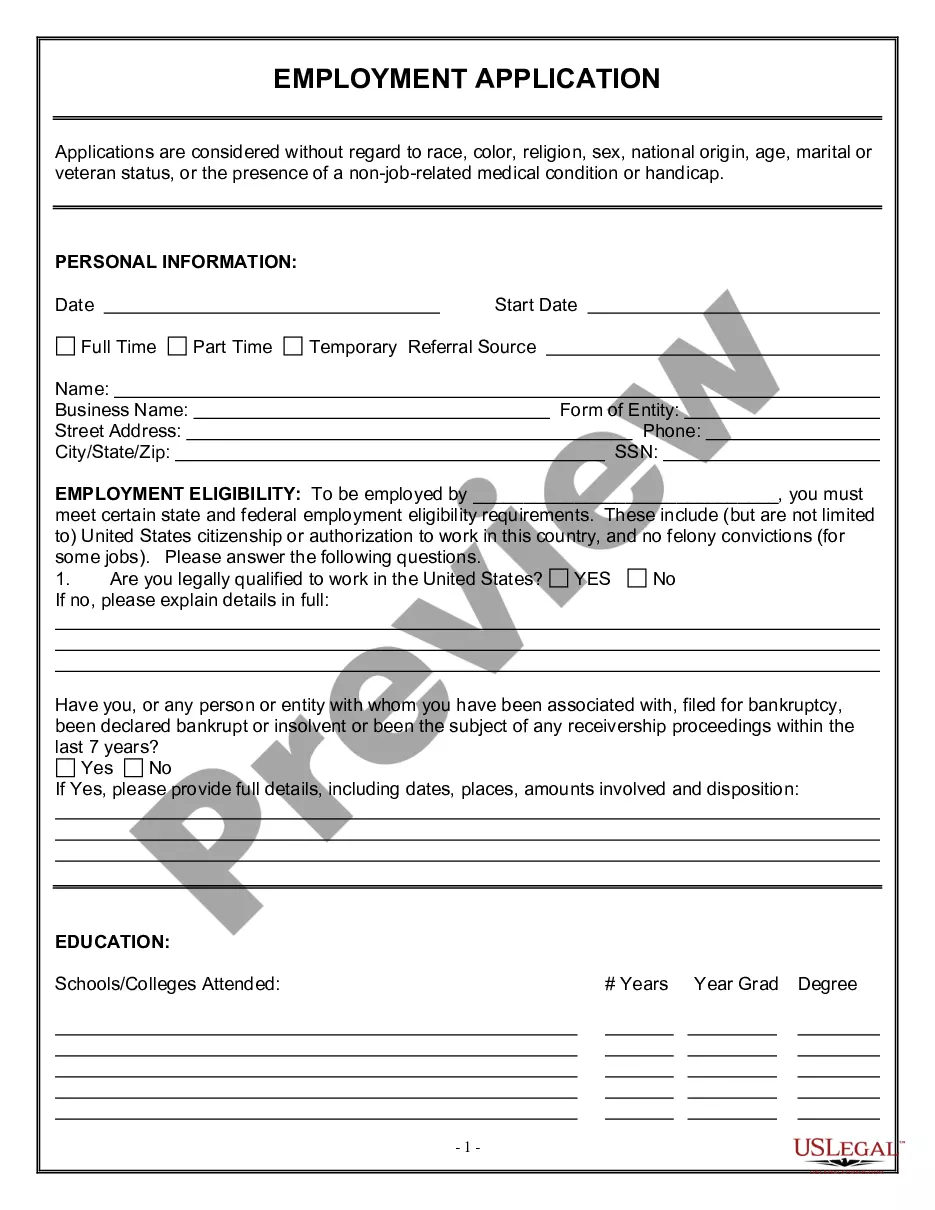

How to fill out Tennessee A Summary Of Your Rights Under The Fair Credit Reporting Act?

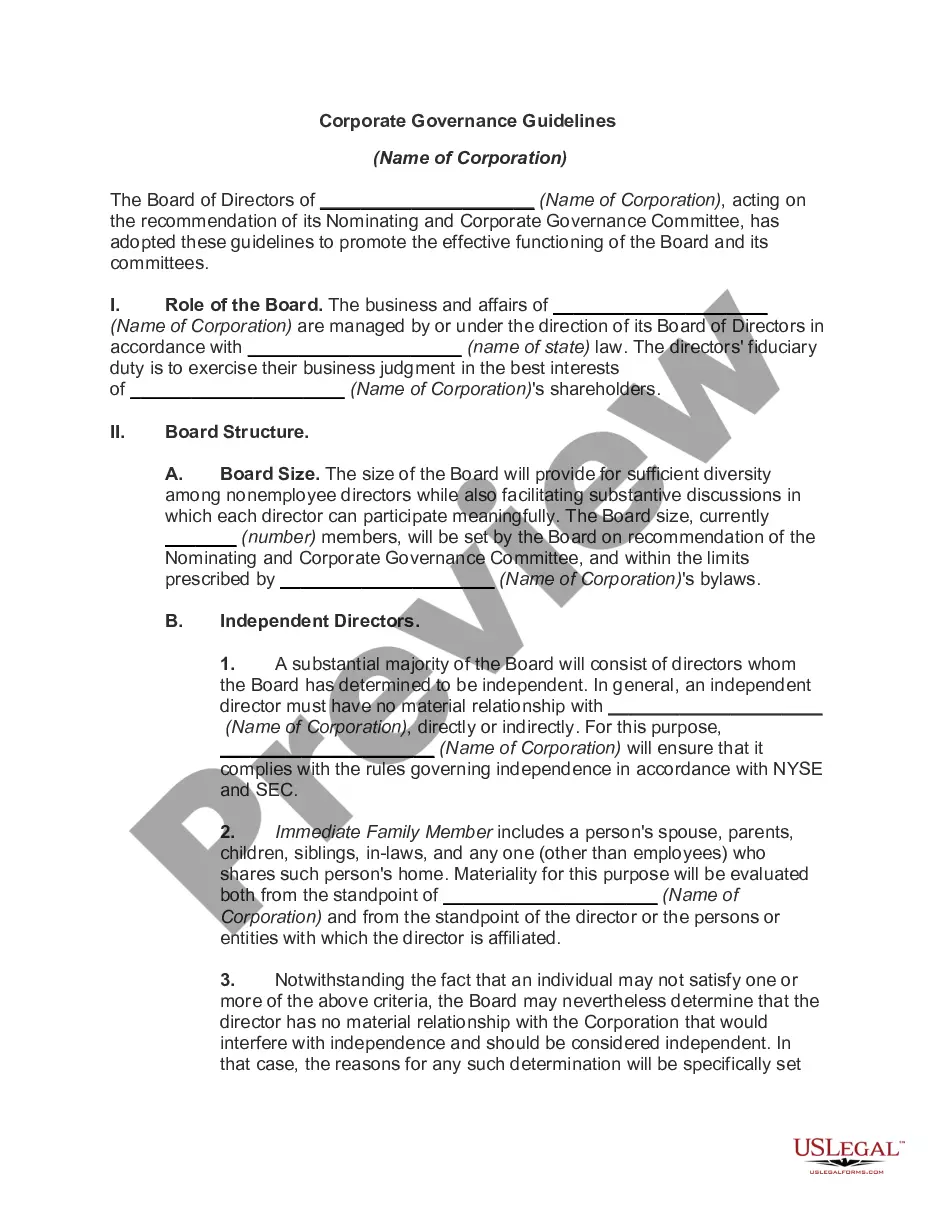

If you need to total, down load, or print out legal document templates, use US Legal Forms, the most important selection of legal types, that can be found on the web. Take advantage of the site`s simple and practical research to find the documents you want. Numerous templates for enterprise and personal functions are categorized by types and says, or key phrases. Use US Legal Forms to find the Tennessee A Summary of Your Rights Under the Fair Credit Reporting Act in just a handful of click throughs.

When you are previously a US Legal Forms buyer, log in for your bank account and click on the Down load key to have the Tennessee A Summary of Your Rights Under the Fair Credit Reporting Act. You can also access types you in the past downloaded inside the My Forms tab of your bank account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Make sure you have selected the form for the correct metropolis/nation.

- Step 2. Use the Preview solution to examine the form`s content. Don`t forget about to read through the explanation.

- Step 3. When you are not happy with all the type, use the Lookup discipline at the top of the display to discover other versions from the legal type design.

- Step 4. After you have found the form you want, select the Purchase now key. Opt for the pricing strategy you prefer and add your credentials to register for the bank account.

- Step 5. Process the deal. You can use your bank card or PayPal bank account to complete the deal.

- Step 6. Pick the formatting from the legal type and down load it in your device.

- Step 7. Complete, revise and print out or indicator the Tennessee A Summary of Your Rights Under the Fair Credit Reporting Act.

Every legal document design you get is your own property forever. You have acces to every single type you downloaded in your acccount. Select the My Forms area and pick a type to print out or down load once more.

Compete and down load, and print out the Tennessee A Summary of Your Rights Under the Fair Credit Reporting Act with US Legal Forms. There are many skilled and status-specific types you can utilize to your enterprise or personal requires.