Tennessee Instructions for Completing Request for Loan Modification and Affidavit RMA Form

Description

How to fill out Tennessee Instructions For Completing Request For Loan Modification And Affidavit RMA Form?

Are you inside a place that you will need files for either organization or person reasons just about every working day? There are plenty of legitimate file themes available on the net, but locating kinds you can rely on is not easy. US Legal Forms delivers a huge number of type themes, like the Tennessee Instructions for Completing Request for Loan Modification and Affidavit RMA Form, which are composed to fulfill federal and state specifications.

If you are presently informed about US Legal Forms website and get an account, basically log in. Following that, you are able to acquire the Tennessee Instructions for Completing Request for Loan Modification and Affidavit RMA Form design.

Should you not provide an accounts and want to start using US Legal Forms, abide by these steps:

- Obtain the type you require and make sure it is to the appropriate metropolis/region.

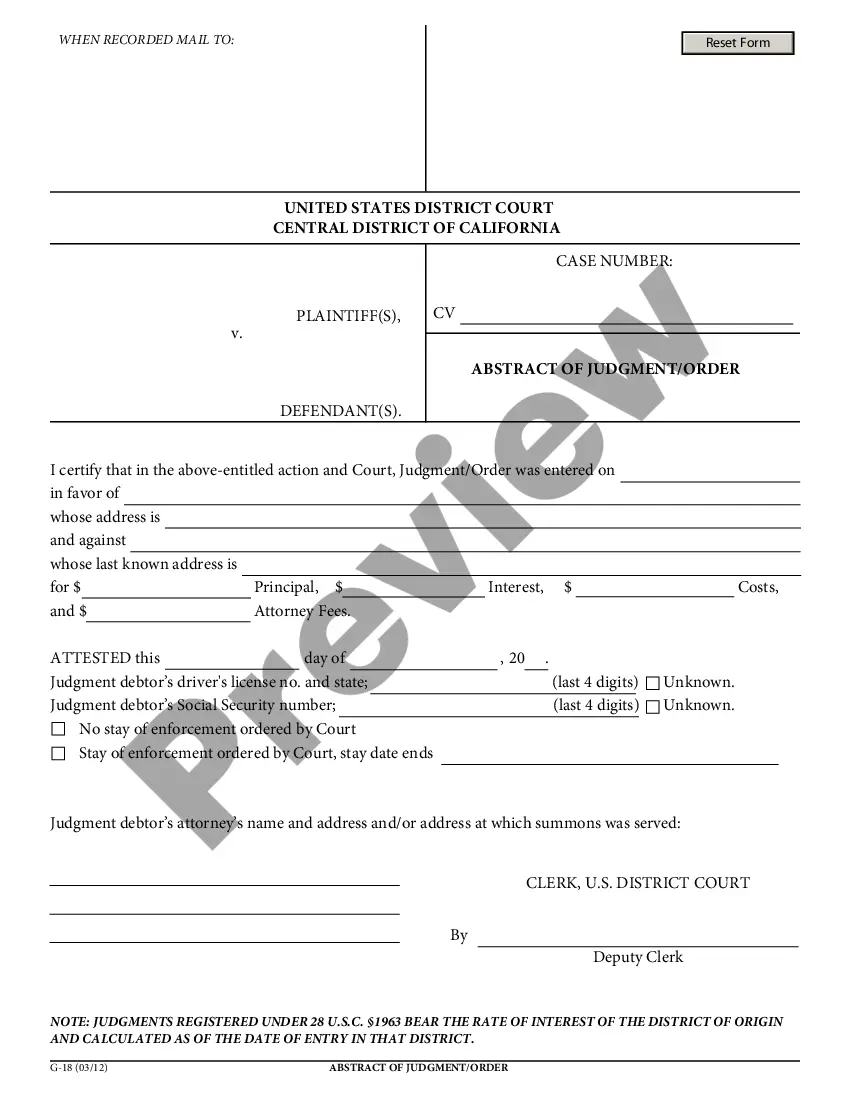

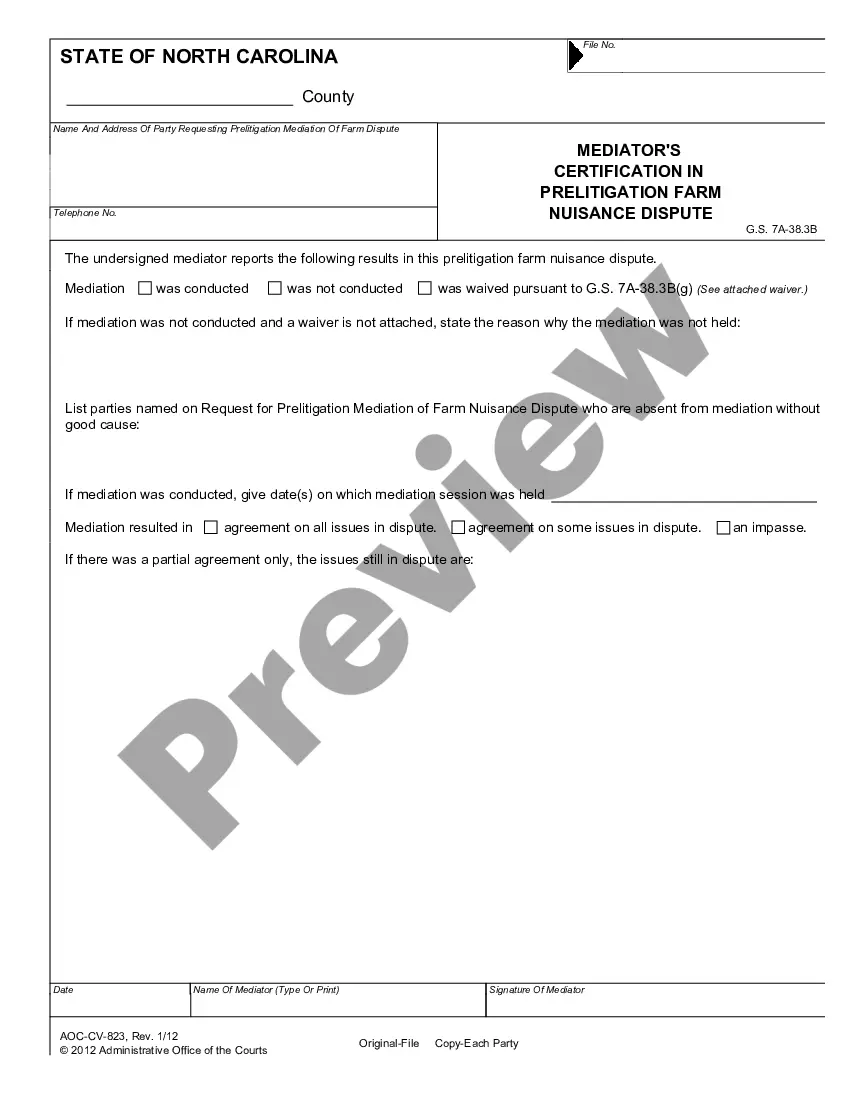

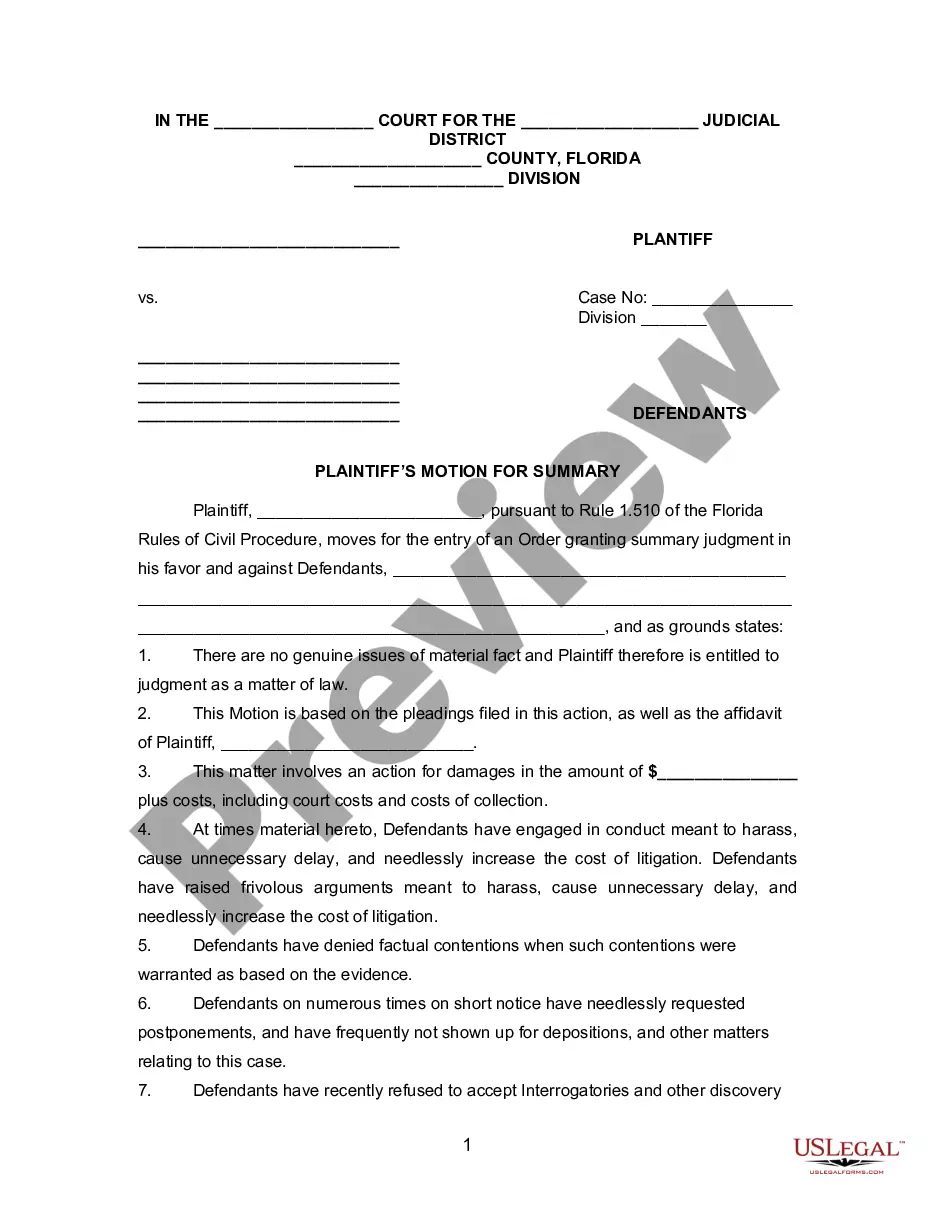

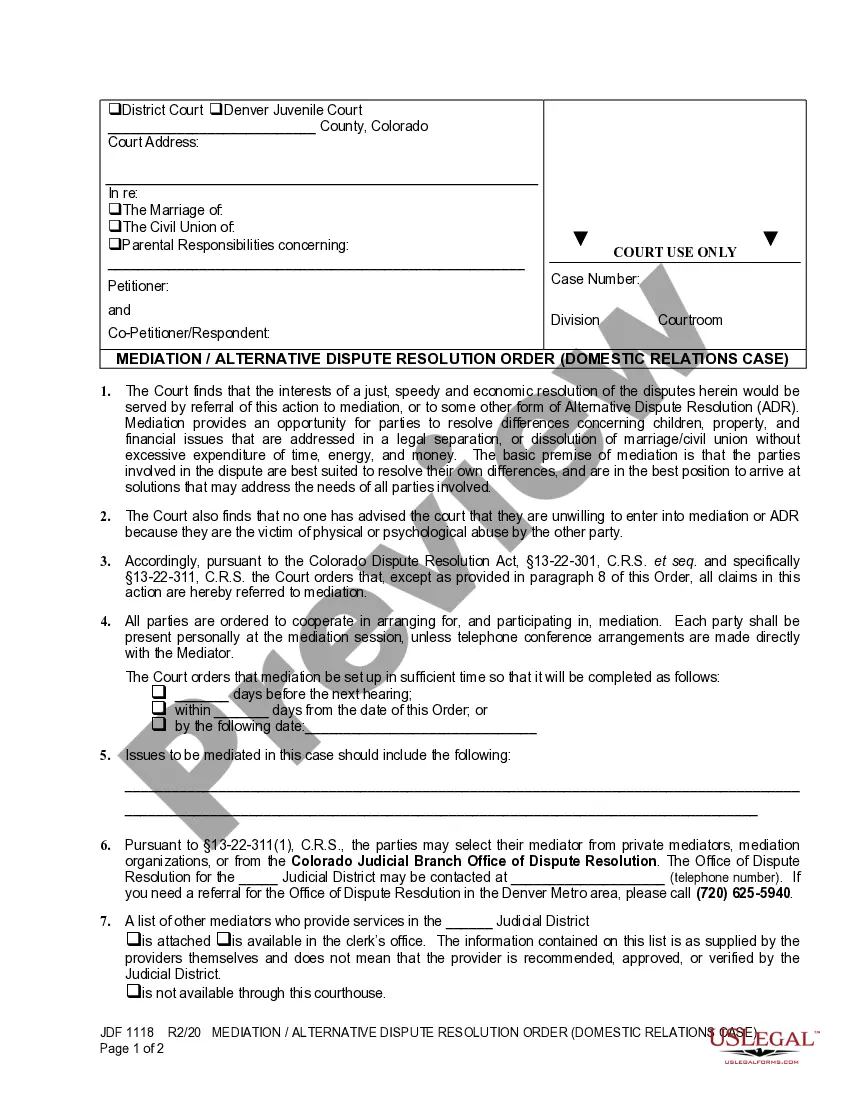

- Utilize the Preview key to analyze the shape.

- Browse the description to ensure that you have selected the proper type.

- If the type is not what you are searching for, utilize the Research industry to discover the type that meets your needs and specifications.

- When you find the appropriate type, simply click Buy now.

- Pick the costs prepare you want, fill in the required info to generate your money, and pay money for the order using your PayPal or credit card.

- Pick a handy document formatting and acquire your version.

Discover every one of the file themes you have bought in the My Forms menus. You can obtain a more version of Tennessee Instructions for Completing Request for Loan Modification and Affidavit RMA Form at any time, if required. Just select the necessary type to acquire or print the file design.

Use US Legal Forms, probably the most considerable selection of legitimate types, to save lots of time as well as steer clear of mistakes. The services delivers appropriately manufactured legitimate file themes that you can use for a selection of reasons. Make an account on US Legal Forms and initiate generating your daily life a little easier.

Form popularity

FAQ

Lenders will often report a loan modification to credit bureaus as a type of settlement or adjustment to the terms of the loan. If it shows up as not fulfilling the original terms of your loan, that can have a negative effect on your credit.

Under federal law, some but not all mortgages include a right of rescission, which gives the borrower 3 business days following the signing of a loan document package to review the terms of the transaction and cancel the transaction.

How to get a loan modificationGather information about your financial situation. You'll need to give your lender or servicer everything from tax returns to pay stubs to demonstrate you're experiencing financial hardship and are unable to make your monthly mortgage payments.Plan out your case.Contact your servicer.

Qualifying for a Loan ModificationYou have to be suffering a financial hardship.You have to show you cannot afford your current mortgage payments.You have to be able to show that you can stay current on a modified payment schedule.The property has to be your primary residence to qualify for a HAMP modification.

In most instances, a recorded modification will not be necessary. However, in some circumstances, a recorded modification may be required to ensure that the lender is protected.

You can only get a loan modification through your current lender because they must approve the terms. Some of the things a modification may adjust include: Loan term changes: If you're having trouble making your monthly payments, you may be able to modify your loan and extend your term.

Whether the mortgage loan modification agreement will need to be recorded in the public records after it is executed, and. an address to which the executed mortgage loan modification agreement should be returned.

The loan modification processTalk to your servicer. Communicate with your servicer.Utilize the 90-day right to cure If a servicer or lender claims you are in default, they must give you a written notice.Organize your documents.Understand what a modification can and cannot do.Reporting issues with mortgage servicers.

A loan modification agreement is a long-term solution. A loan modification may involve a reduced interest rate, a longer period to repay, a different type of loan, or any combination of these.

A loan modification is a change to the original terms of your mortgage loan. Unlike a refinance, a loan modification doesn't pay off your current mortgage and replace it with a new one. Instead, it directly changes the conditions of your loan.