Tennessee Sports Surfaces Installation And Services Contract - Self-Employed

Description

How to fill out Tennessee Sports Surfaces Installation And Services Contract - Self-Employed?

It is possible to devote time on-line looking for the authorized papers design that suits the federal and state demands you will need. US Legal Forms offers 1000s of authorized kinds that are examined by professionals. It is simple to obtain or print out the Tennessee Sports Surfaces Installation And Services Contract - Self-Employed from the services.

If you already have a US Legal Forms bank account, it is possible to log in and then click the Obtain button. Following that, it is possible to total, edit, print out, or sign the Tennessee Sports Surfaces Installation And Services Contract - Self-Employed. Every authorized papers design you purchase is your own eternally. To obtain one more backup associated with a purchased kind, proceed to the My Forms tab and then click the related button.

If you use the US Legal Forms site for the first time, adhere to the easy guidelines below:

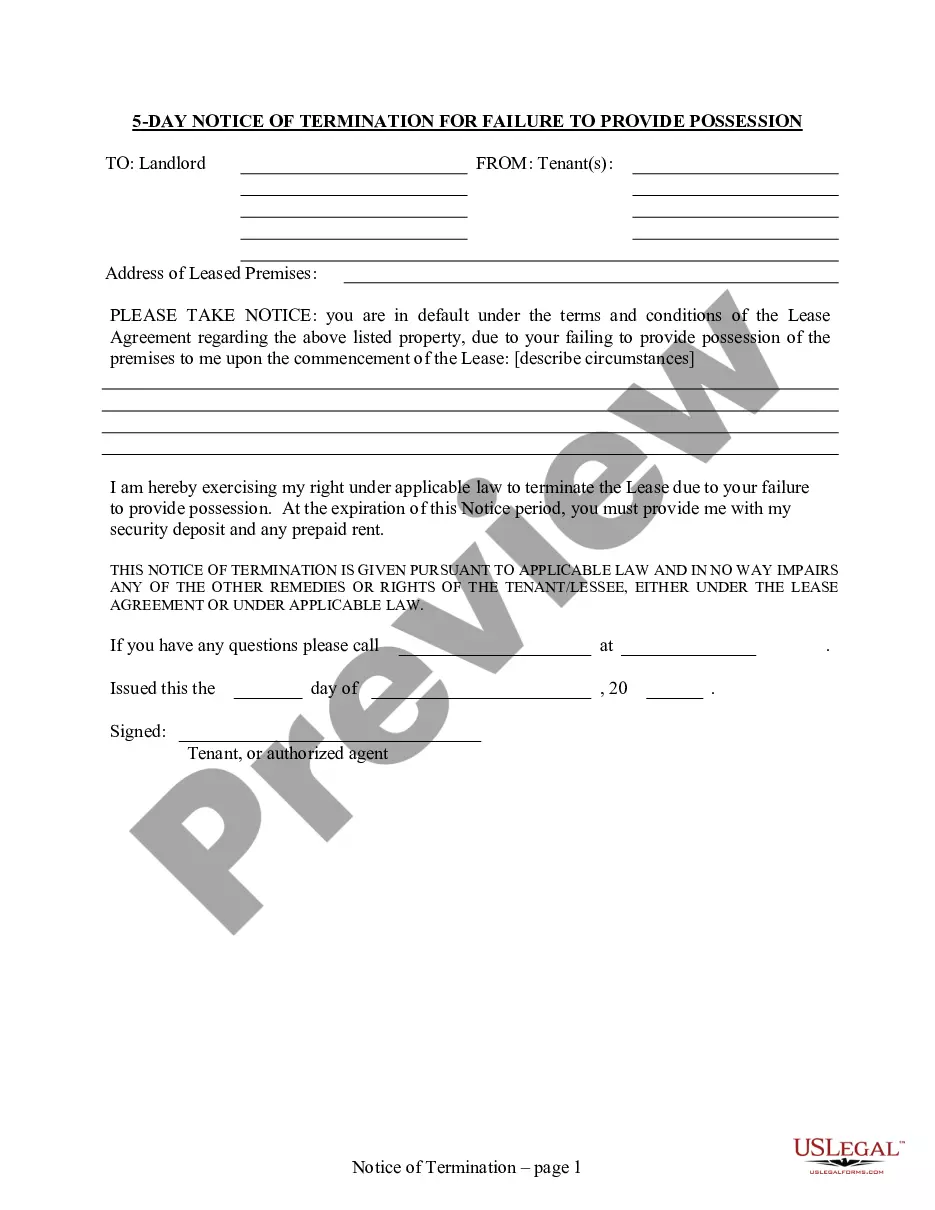

- First, make sure that you have chosen the best papers design for the state/metropolis of your choice. Browse the kind description to ensure you have selected the correct kind. If readily available, make use of the Review button to appear with the papers design also.

- If you wish to get one more version of your kind, make use of the Lookup industry to get the design that fits your needs and demands.

- When you have identified the design you need, click on Buy now to move forward.

- Pick the pricing program you need, type your accreditations, and register for your account on US Legal Forms.

- Comprehensive the purchase. You should use your Visa or Mastercard or PayPal bank account to cover the authorized kind.

- Pick the structure of your papers and obtain it to the gadget.

- Make alterations to the papers if possible. It is possible to total, edit and sign and print out Tennessee Sports Surfaces Installation And Services Contract - Self-Employed.

Obtain and print out 1000s of papers templates making use of the US Legal Forms website, which provides the most important selection of authorized kinds. Use expert and express-certain templates to tackle your company or specific needs.

Form popularity

FAQ

By Lisa Guerin, J.D. For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A contract that is used for appointing a genuinely self-employed individual such as a consultant (or a profession or business run by that individual) to carry out services for another party where the relationship between the parties is not that of employer and employee or worker.

Self-employed people are those who own their own businesses and work for themselves. According to the IRS, you are self-employed if you act as a sole proprietor or independent contractor, or if you own an unincorporated business.

A 1099 employee is a contractor rather than a full-time employee. These employees may also be referred to as freelancers, self-employed workers, or independent contractors. If you are a business that is contracting 1099 employees, determine what type of work this individual will do for your business.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

Why or why not? Perlman When dealing with independent contractors, companies shouldn't discipline them the same way they would an employee. Instead, the remedy for an independent contractor not complying with company expectations is to terminate or consider terminating the contract.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Don't discipline Your disciplinary procedure should not apply to contractors or self-employed consultants.