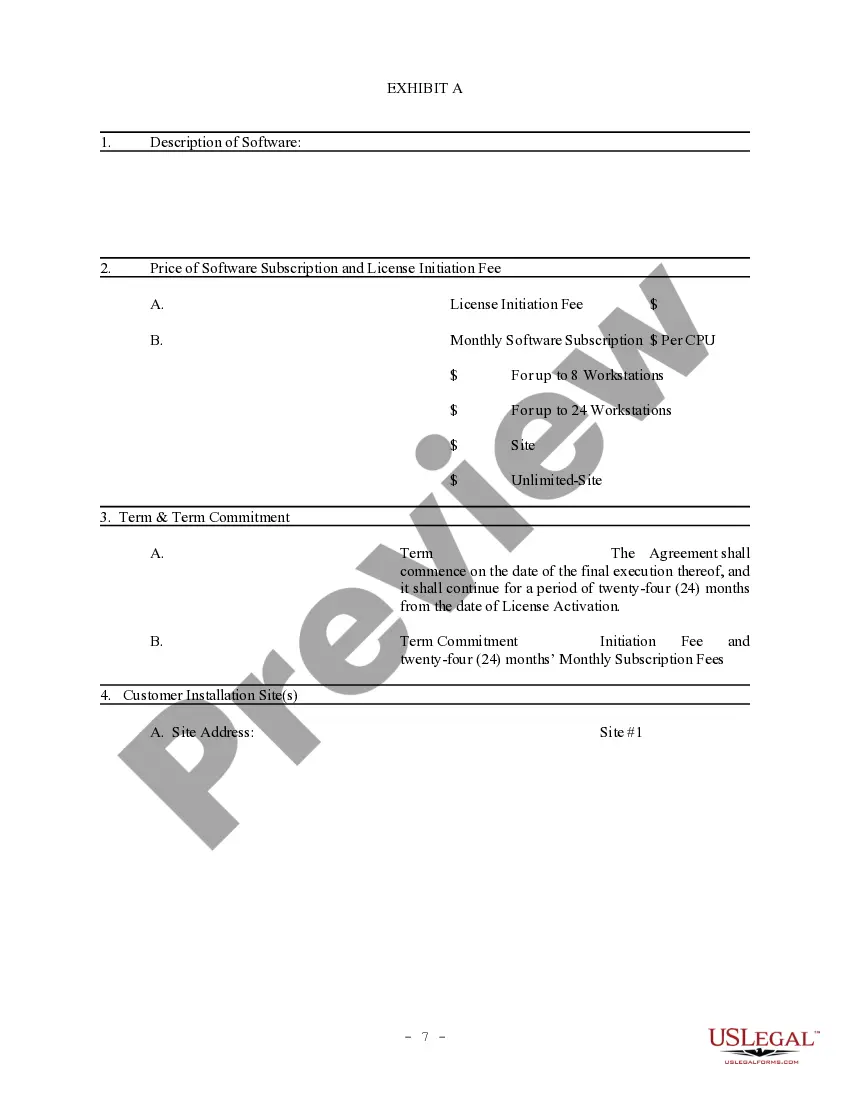

Tennessee Software License Subscription Agreement

Description

How to fill out Tennessee Software License Subscription Agreement?

You may spend time on-line attempting to find the legal document web template that suits the federal and state needs you want. US Legal Forms offers thousands of legal kinds that happen to be analyzed by professionals. You can actually down load or printing the Tennessee Software License Subscription Agreement from the service.

If you already have a US Legal Forms bank account, you are able to log in and click the Download switch. Next, you are able to complete, change, printing, or signal the Tennessee Software License Subscription Agreement. Every single legal document web template you purchase is your own property permanently. To have yet another duplicate of the acquired kind, visit the My Forms tab and click the corresponding switch.

If you use the US Legal Forms web site the first time, keep to the simple recommendations beneath:

- Initially, make sure that you have chosen the proper document web template for that area/metropolis of your liking. Browse the kind description to ensure you have picked the correct kind. If accessible, use the Review switch to appear through the document web template at the same time.

- If you would like find yet another edition in the kind, use the Search field to obtain the web template that suits you and needs.

- After you have identified the web template you need, simply click Acquire now to continue.

- Pick the costs program you need, type your qualifications, and sign up for an account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal bank account to fund the legal kind.

- Pick the formatting in the document and down load it to the product.

- Make changes to the document if needed. You may complete, change and signal and printing Tennessee Software License Subscription Agreement.

Download and printing thousands of document web templates using the US Legal Forms web site, which provides the largest variety of legal kinds. Use expert and express-particular web templates to tackle your small business or personal requirements.

Form popularity

FAQ

Software is commonly licensed under agreements that include taxable and nontaxable services. License agreements constitute a lease of tangible personal property under Tennessee law and the payments made pursuant to the license agreements are subject to sales and use tax.

Texas Sales Tax for Software as a Service: Texas is one of these states that considers SaaS as a taxable data processing service. Data processing is 20% exempt from sales tax.

The SSUTA defines canned software, whether delivered on a tangible format or electronically, as tangible personal property. Member states are allowed, but are not required, to exempt electronically delivered software from sales or use tax. California is not a member of the SSUTA.

First, the statute defines computer software as personal property only to the extent of the value of the uninstalled storage medium on or in which it is stored or transmitted. Next, the statute goes on to define all computer software as an intangible.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax.

Tangible personal property exists physically (i.e., you can touch it) and can be used or consumed. Clothing, vehicles, jewelry, and business equipment are examples of tangible personal property.

Key Takeaways. While software is not physical or tangible in the traditional sense, accounting rules allow businesses to capitalize software as if it were a tangible asset. Software that is purchased by a firm that meets certain criteria can be treated as if it were property, plant, & equipment (PP&E).

Is SaaS taxable in United Kingdom? Yes. You owe tax for the sale of cloud software subscriptions to customers in United Kingdom.

The SSUTA defines canned software, whether delivered on a tangible format or electronically, as tangible personal property.