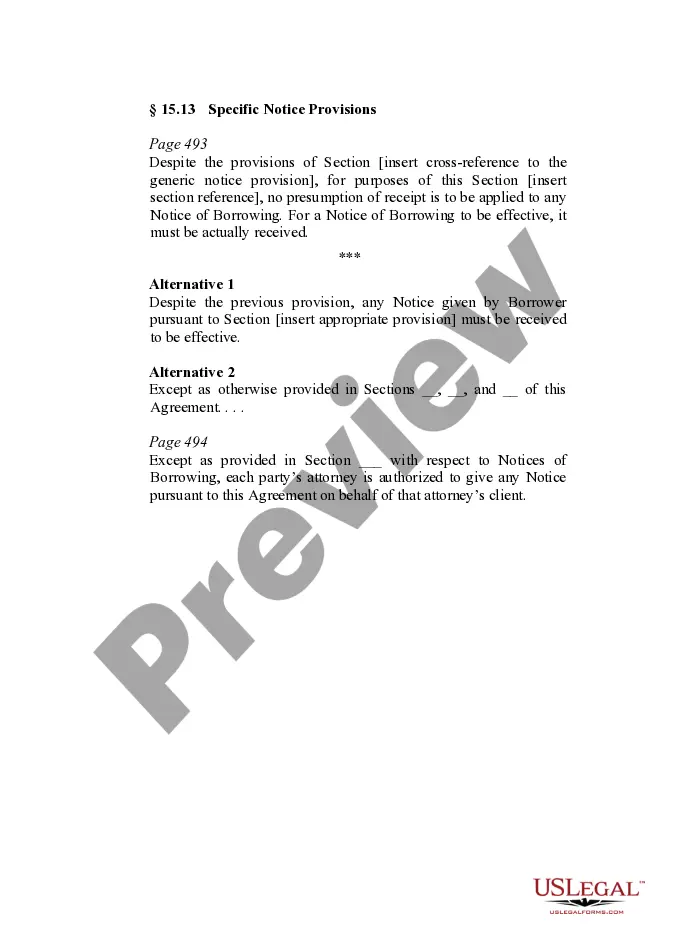

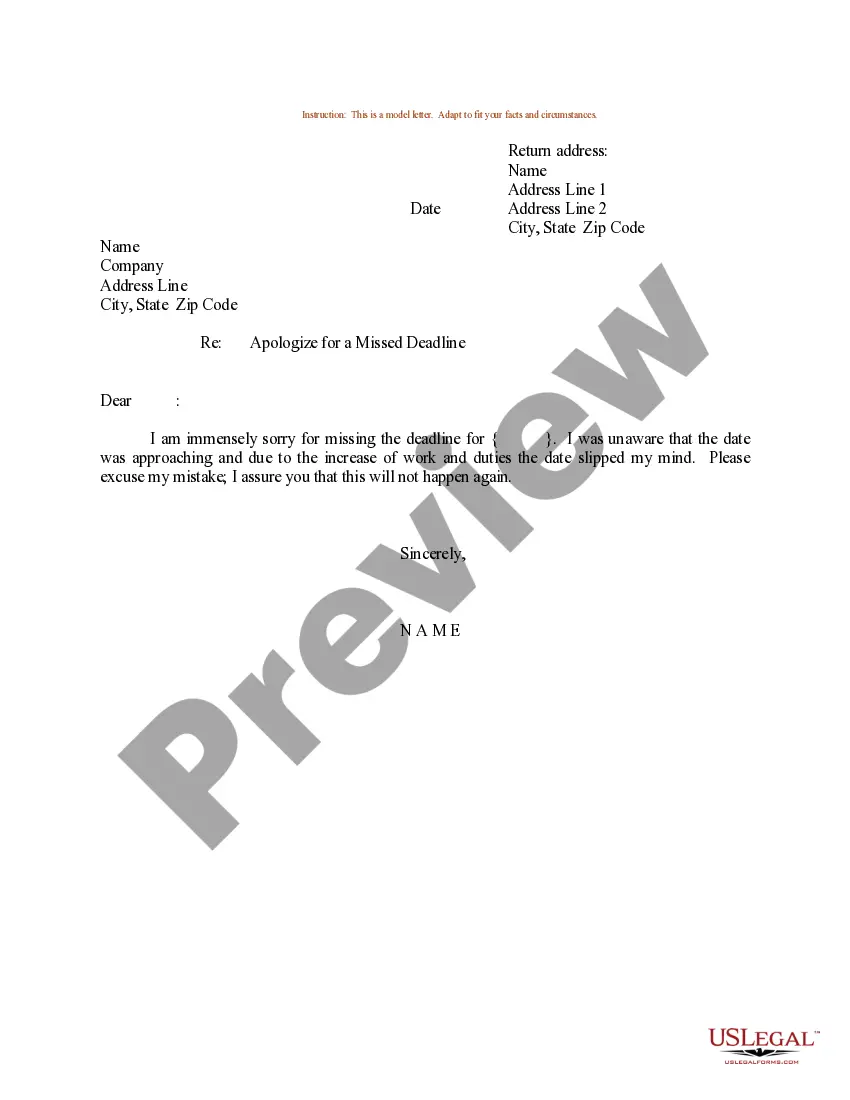

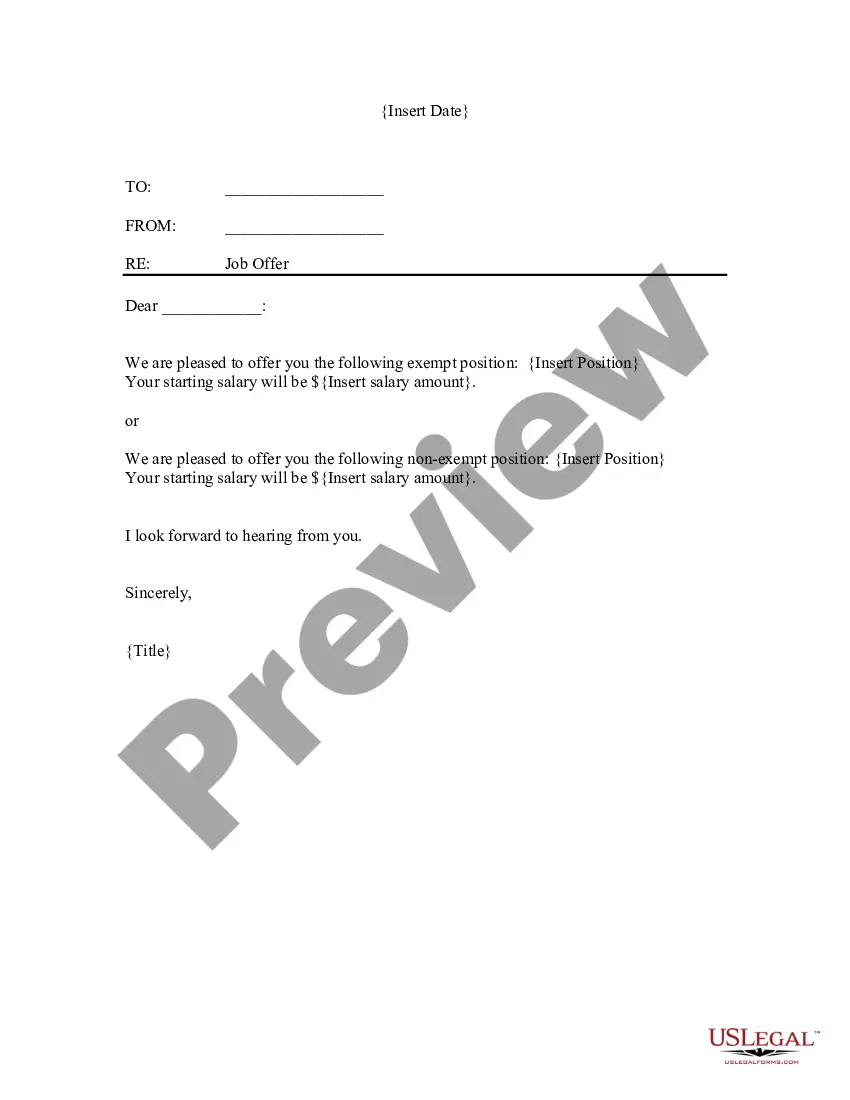

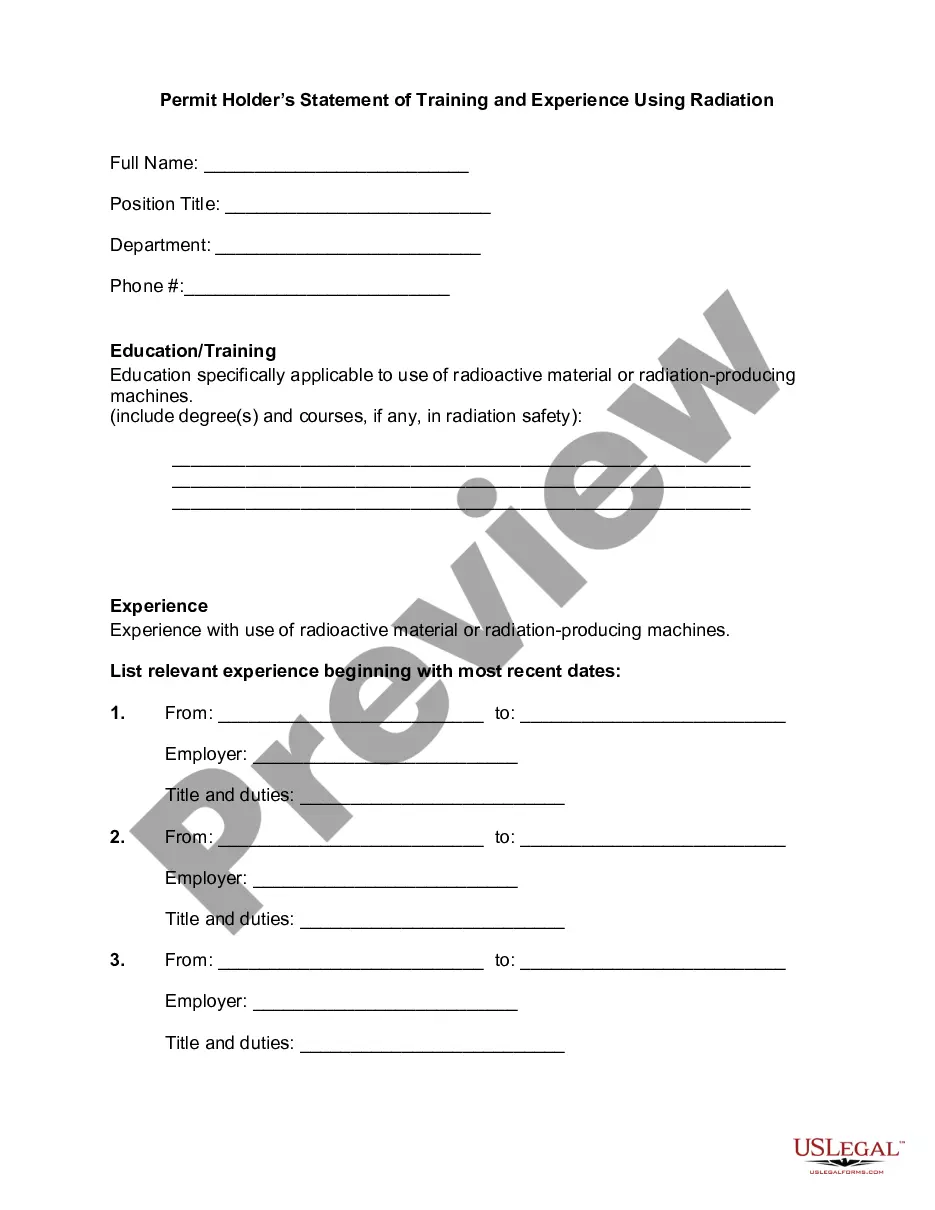

This form provides boilerplate contract clauses that disclaim or limit warranties under the contract. Several different language options are included to suit individual needs and circumstances.

Tennessee Warranty Provisions

Description

How to fill out Warranty Provisions?

US Legal Forms - one of many most significant libraries of lawful kinds in the States - provides a wide range of lawful papers themes you can acquire or print out. Using the site, you may get a large number of kinds for business and personal reasons, categorized by classes, suggests, or keywords and phrases.You can get the latest types of kinds just like the Tennessee Warranty Provisions within minutes.

If you already have a registration, log in and acquire Tennessee Warranty Provisions through the US Legal Forms collection. The Obtain key will appear on every form you see. You have accessibility to all in the past saved kinds from the My Forms tab of the account.

If you would like use US Legal Forms the first time, allow me to share basic recommendations to help you get began:

- Be sure to have picked out the correct form for your metropolis/state. Select the Review key to examine the form`s information. Browse the form explanation to actually have selected the correct form.

- In the event the form does not satisfy your demands, utilize the Lookup field at the top of the display to find the one who does.

- When you are happy with the form, validate your choice by simply clicking the Buy now key. Then, select the rates program you prefer and give your credentials to register for an account.

- Method the deal. Utilize your credit card or PayPal account to finish the deal.

- Select the structure and acquire the form on your own system.

- Make alterations. Load, modify and print out and indication the saved Tennessee Warranty Provisions.

Each web template you included with your bank account does not have an expiry day and is also the one you have for a long time. So, if you wish to acquire or print out one more duplicate, just proceed to the My Forms section and then click in the form you need.

Obtain access to the Tennessee Warranty Provisions with US Legal Forms, by far the most substantial collection of lawful papers themes. Use a large number of expert and status-distinct themes that satisfy your company or personal requirements and demands.

Form popularity

FAQ

Sole Ownership in Tennessee This means that spouses can buy, sell, or own property without the involvement of the non-owner spouse. The only exception to this is when using a deed of trust. A non-owner spouse would need to sign any deed of trust other than a purchase money deed of trust.

A warranty deed promises that the grantor holds good, clear title to a piece of real estate. It promises also that the grantor has the right and authority right to sell it to the grantee or buyer. A quitclaim deed, on the other hand, makes no promises about the quality of the title to the property.

The tax shall be levied on the sales price or purchase price of the warranty or service contract at a rate equal to the rate of tax levied on the sale of tangible personal property at retail by § 67-6-202.

A charge for labor performed on tangible personal property (e.g., car repair, lawn mower repair, etc.) is subject to sales tax. Reference: Tenn. Code Ann. § 67-6-102(85).

A lawful warranty deed includes the grantor's full name, mailing address, and marital status, the consideration given for the transfer, and the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property.

What's tax-free? General apparel that costs $100 or less per item, such as shirts, pants, socks, shoes, etc. School and art supplies that cost $100 or less per item, such as binders, backpacks, crayons, paper, pens, pencils and etc. ... Computers for personal use with a purchase price of $1,500 or less.

In Tennessee, services that are generally not subjected to either sales or use taxes include data processing, information services, and management consulting services. Businesses that offer management consulting or management services are required to pay a local gross receipts tax.

If your sale is taxable, the mandatory warranty is also taxable. The warranty is usually included in the price of the item sold, but you may show it as a separate charge on your invoice. If you do, that separate charge is taxable (provided the sale of the associated item is taxable).