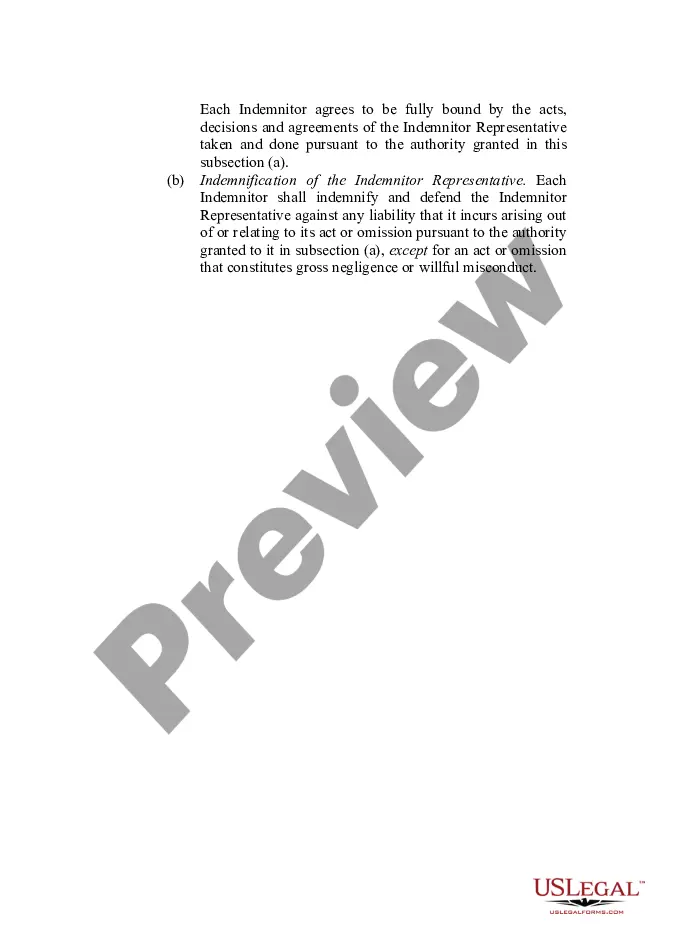

This form provides boilerplate contract clauses that designate the rights of parties to appoint an Indemnitor Representative and outlines such representative's powers and obligations under the contract.

Tennessee Indemnity Provisions — Parties to the Indemnity refer to a legal agreement or clause established in Tennessee law that outlines the parties involved in an indemnity arrangement. This provision is a key component in managing liability and risk in various contractual agreements. Now, let's explore some relevant content discussing these provisions and their types: 1. Understanding Tennessee Indemnity Provisions — Parties to the Indemnity: Tennessee Indemnity Provisions — Parties to the Indemnity determine the individuals or entities responsible for bearing the costs or compensating for any losses incurred during a specified contractual arrangement. These provisions are crucial for safeguarding parties from potential financial or legal liabilities. 2. Types of Tennessee Indemnity Provisions — Parties to the Indemnity: a. First Party Indemnity: This type of provision involves indemnification provided by a contracting party for their own actions, typically protecting themselves against any claims or losses arising solely from their actions or omissions. b. Third Party Indemnity: In this arrangement, the indemnity promises to protect the indemnity from the claims or losses of a third party. The indemnity assumes financial responsibility for any damages or costs incurred by the indemnity caused by the third party's actions. c. Limited Indemnity: Under limited indemnity, one party agrees to indemnify another party but only up to a certain predetermined limit or cap. This provision helps to allocate the risk and limit potential financial exposure. d. Joint Indemnity: In joint indemnity, multiple parties mutually agree to indemnify each other against any claims or losses arising from their collective actions, sharing the responsibility for potential liabilities. e. Broad Form Indemnity: Broad form indemnity provides a comprehensive level of protection to the indemnity, as the indemnity assumes significant liability for all potential losses, claims, or damages arising from the contract. 3. Significance and Application of Tennessee Indemnity Provisions: Tennessee Indemnity Provisions — Parties to the Indemnity play a vital role in contractual agreements across various industries. These provisions allocate responsibility, risk, and potential losses, providing a mechanism for protecting parties involved. Whether in construction contracts, lease agreements, or business partnerships, understanding and incorporating these provisions correctly is essential to safeguarding the interests of all involved parties. In conclusion, Tennessee Indemnity Provisions — Parties to the Indemnity establish the framework for managing liability and risk in contractual agreements. Various types of indemnity provisions exist, such as first party, third party, limited, joint, or broad form indemnity, each serving a distinct purpose. Comprehending these provisions and their applicability empowers businesses and individuals to navigate contractual obligations while mitigating potential financial and legal liabilities.Tennessee Indemnity Provisions — Parties to the Indemnity refer to a legal agreement or clause established in Tennessee law that outlines the parties involved in an indemnity arrangement. This provision is a key component in managing liability and risk in various contractual agreements. Now, let's explore some relevant content discussing these provisions and their types: 1. Understanding Tennessee Indemnity Provisions — Parties to the Indemnity: Tennessee Indemnity Provisions — Parties to the Indemnity determine the individuals or entities responsible for bearing the costs or compensating for any losses incurred during a specified contractual arrangement. These provisions are crucial for safeguarding parties from potential financial or legal liabilities. 2. Types of Tennessee Indemnity Provisions — Parties to the Indemnity: a. First Party Indemnity: This type of provision involves indemnification provided by a contracting party for their own actions, typically protecting themselves against any claims or losses arising solely from their actions or omissions. b. Third Party Indemnity: In this arrangement, the indemnity promises to protect the indemnity from the claims or losses of a third party. The indemnity assumes financial responsibility for any damages or costs incurred by the indemnity caused by the third party's actions. c. Limited Indemnity: Under limited indemnity, one party agrees to indemnify another party but only up to a certain predetermined limit or cap. This provision helps to allocate the risk and limit potential financial exposure. d. Joint Indemnity: In joint indemnity, multiple parties mutually agree to indemnify each other against any claims or losses arising from their collective actions, sharing the responsibility for potential liabilities. e. Broad Form Indemnity: Broad form indemnity provides a comprehensive level of protection to the indemnity, as the indemnity assumes significant liability for all potential losses, claims, or damages arising from the contract. 3. Significance and Application of Tennessee Indemnity Provisions: Tennessee Indemnity Provisions — Parties to the Indemnity play a vital role in contractual agreements across various industries. These provisions allocate responsibility, risk, and potential losses, providing a mechanism for protecting parties involved. Whether in construction contracts, lease agreements, or business partnerships, understanding and incorporating these provisions correctly is essential to safeguarding the interests of all involved parties. In conclusion, Tennessee Indemnity Provisions — Parties to the Indemnity establish the framework for managing liability and risk in contractual agreements. Various types of indemnity provisions exist, such as first party, third party, limited, joint, or broad form indemnity, each serving a distinct purpose. Comprehending these provisions and their applicability empowers businesses and individuals to navigate contractual obligations while mitigating potential financial and legal liabilities.