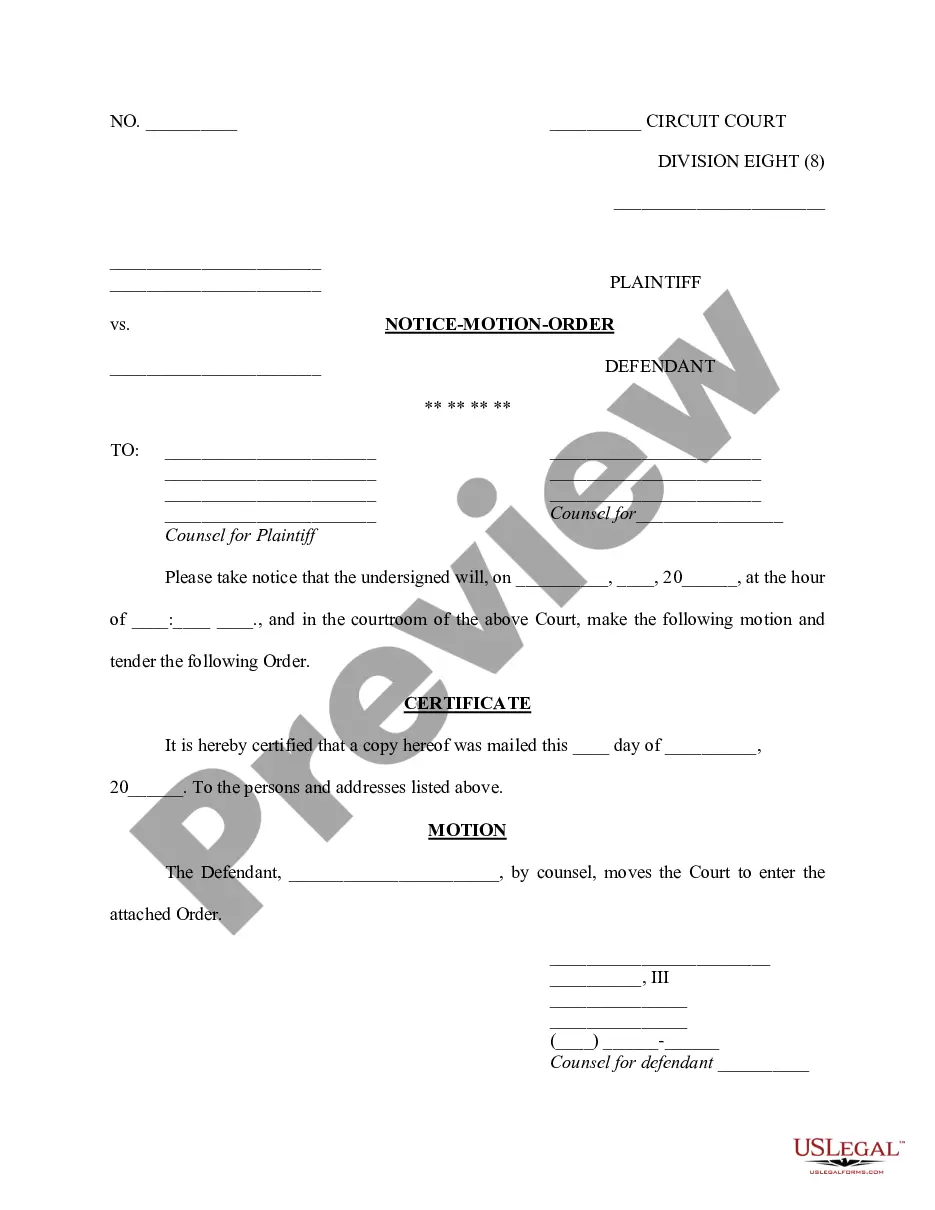

"Note Form and Variations" is a American Lawyer Media form. This form is for your note payments with different variations.

Tennessee Note Form and Variations

Description

How to fill out Note Form And Variations?

If you wish to full, obtain, or print out legal document web templates, use US Legal Forms, the largest assortment of legal varieties, that can be found on-line. Use the site`s easy and practical search to discover the documents you require. Various web templates for enterprise and individual uses are categorized by categories and claims, or keywords and phrases. Use US Legal Forms to discover the Tennessee Note Form and Variations within a couple of mouse clicks.

Should you be previously a US Legal Forms customer, log in in your accounts and click on the Obtain key to get the Tennessee Note Form and Variations. You may also gain access to varieties you formerly acquired from the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for your proper metropolis/country.

- Step 2. Utilize the Preview choice to look over the form`s articles. Don`t overlook to read through the description.

- Step 3. Should you be not satisfied using the develop, utilize the Search area on top of the screen to get other variations in the legal develop design.

- Step 4. When you have found the form you require, go through the Get now key. Opt for the costs program you like and put your qualifications to register for an accounts.

- Step 5. Approach the purchase. You may use your charge card or PayPal accounts to complete the purchase.

- Step 6. Select the format in the legal develop and obtain it on your own device.

- Step 7. Full, change and print out or signal the Tennessee Note Form and Variations.

Every single legal document design you purchase is yours permanently. You might have acces to each and every develop you acquired in your acccount. Go through the My Forms segment and choose a develop to print out or obtain once more.

Remain competitive and obtain, and print out the Tennessee Note Form and Variations with US Legal Forms. There are millions of professional and express-certain varieties you can utilize for your personal enterprise or individual requires.

Form popularity

FAQ

T.C.A. § 67-1-801 provides for the rate of interest to be charged on delinquent tax payments. This rate is called the ?formula rate of interest? and is determined and set annually by the Tennessee commissioner of revenue.

The gross proceeds derived from the sale in this state of livestock, nursery stock, poultry and other farm or nursery products, in any calendar year, directly from a farmer or nurseryman, are exempt from the tax levied by this chapter, if fifty percent (50%) or more of such products are grown or produced in the ...

Taxes and Licenses § 67-4-2108. (a)(1) The measure of the tax levied by this part shall in no case be less than the actual value of the real or tangible property owned or used in Tennessee, excluding exempt inventory and exempt required capital investments.

Overview. If you are a corporation, limited partnership, limited liability company, or business trust chartered, qualified, or registered in Tennessee or doing business in this state, then you must register for and pay franchise and excise taxes.

To receive a tax clearance certificate when shutting down a business, a business must file all returns to date and a final franchise and excise tax return through the date of liquidation or the date on which the business ceased operations in Tennessee.

Sales tax and local business tax are examples of taxes falling into this category. T.C.A. § 67-1-801 provides for the rate of interest to be charged on delinquent tax payments. This rate is called the ?formula rate of interest? and is determined and set annually by the Tennessee commissioner of revenue.

When any person fails to timely make any return or report or fails to timely pay any taxes shown to be due on the return or report, there shall be imposed against that person a penalty in the amount of five percent (5%) of the unpaid tax amount for each thirty (30) days or fraction thereof that the tax remains unpaid ...

Tennessee Code Annotated, Section 67-6-322(b) allows you to provide a copy of your 501 (c)(3) exemption document to Tennessee suppliers for exemption from sales and use tax. A separate Tennessee tax exemption certificate will not be issued to your organization.