Tennessee Term Royalty Deed

Description

How to fill out Term Royalty Deed?

You are able to devote hrs on the web trying to find the lawful papers web template that meets the state and federal requirements you require. US Legal Forms provides 1000s of lawful kinds which can be examined by experts. It is simple to obtain or print the Tennessee Term Royalty Deed from my assistance.

If you already have a US Legal Forms bank account, you are able to log in and click the Acquire switch. Next, you are able to complete, change, print, or sign the Tennessee Term Royalty Deed. Every lawful papers web template you buy is your own permanently. To get another duplicate associated with a purchased type, check out the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms web site the first time, keep to the basic recommendations beneath:

- Initial, be sure that you have selected the right papers web template to the state/area that you pick. Look at the type explanation to ensure you have picked out the right type. If readily available, use the Review switch to search throughout the papers web template at the same time.

- In order to locate another edition from the type, use the Lookup area to get the web template that suits you and requirements.

- When you have discovered the web template you desire, simply click Acquire now to continue.

- Select the rates program you desire, type your accreditations, and sign up for an account on US Legal Forms.

- Full the financial transaction. You may use your Visa or Mastercard or PayPal bank account to cover the lawful type.

- Select the formatting from the papers and obtain it to the gadget.

- Make changes to the papers if required. You are able to complete, change and sign and print Tennessee Term Royalty Deed.

Acquire and print 1000s of papers layouts using the US Legal Forms web site, that offers the largest assortment of lawful kinds. Use professional and express-specific layouts to deal with your organization or specific needs.

Form popularity

FAQ

How do I add (or remove) someone from my deed? To add, change, or remove a name on a property you will need to have a new document prepared and have it recorded in our office. A Quit Claim Deed or Warranty Deed will need to be completed. This document will replace your previous deed.

For example, if John sells his property to Jane, the derivation clause in the deed of trust would state that John was the previous grantor and the recording date of the deed. This information is important for future reference and to ensure that the title is clear and free of any encumbrances.

It's usually a very straightforward transaction, but it's possible for a quitclaim deed to be challenged. If a quitclaim deed is challenged in court, the issue becomes whether the property was legally transferred and if the grantor had the legal right to transfer the property.

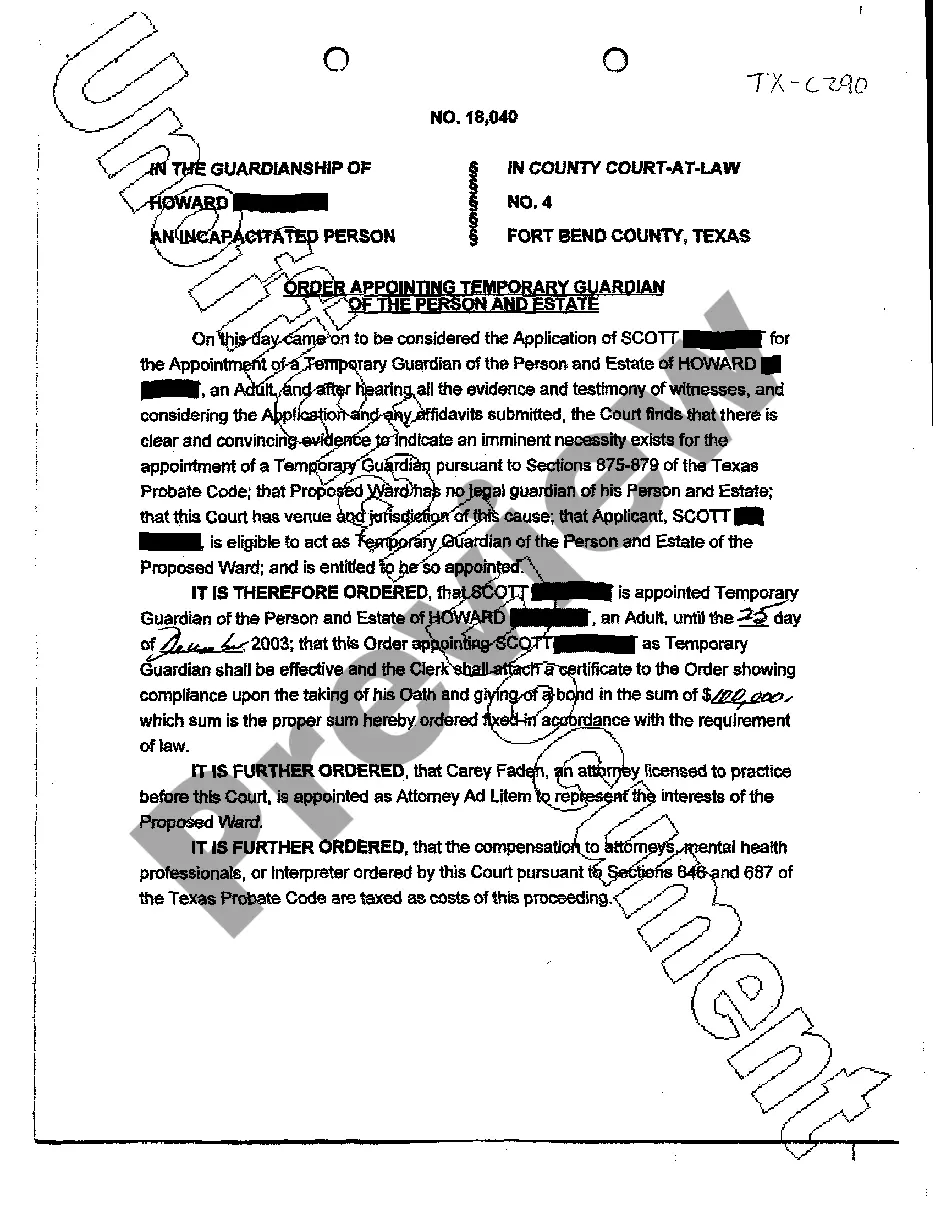

A royalty deed gives its holder the right to receive a percentage of the profits from the sale of the minerals, if and when they are actually produced. This kind of legal document does not convey all of the mineral rights to the holder, only the right to receive royalties.

A Tennessee deed must include a derivation clause identifying the deed or other instrument that is the source of the current owner's title. If the current owner received the property through a recorded deed, the derivation clause must identify the type of deed, book and page number, and recording office.

A Tennessee deed form conveys interest in property from one party (the ?grantor?) to another (the ?grantee?). The documents can be prepared by anyone as long as the required information is written in the deed as outlined in § 66-5-103.

Sole Ownership in Tennessee This means that spouses can buy, sell, or own property without the involvement of the non-owner spouse. The only exception to this is when using a deed of trust. A non-owner spouse would need to sign any deed of trust other than a purchase money deed of trust.

Laws & Requirements Signing Requirements § 66-24-101: A Tennessee quitclaim deed requires a written and signed grantor agreement. It must also include either two witnesses or acknowledgment by a notary or officials, especially when transferring property between unrelated parties.