Tennessee Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment)

Description

How to fill out Partial Assignment Of Oil And Gas Lease (Producing Lease. Reservation Of Production Payment)?

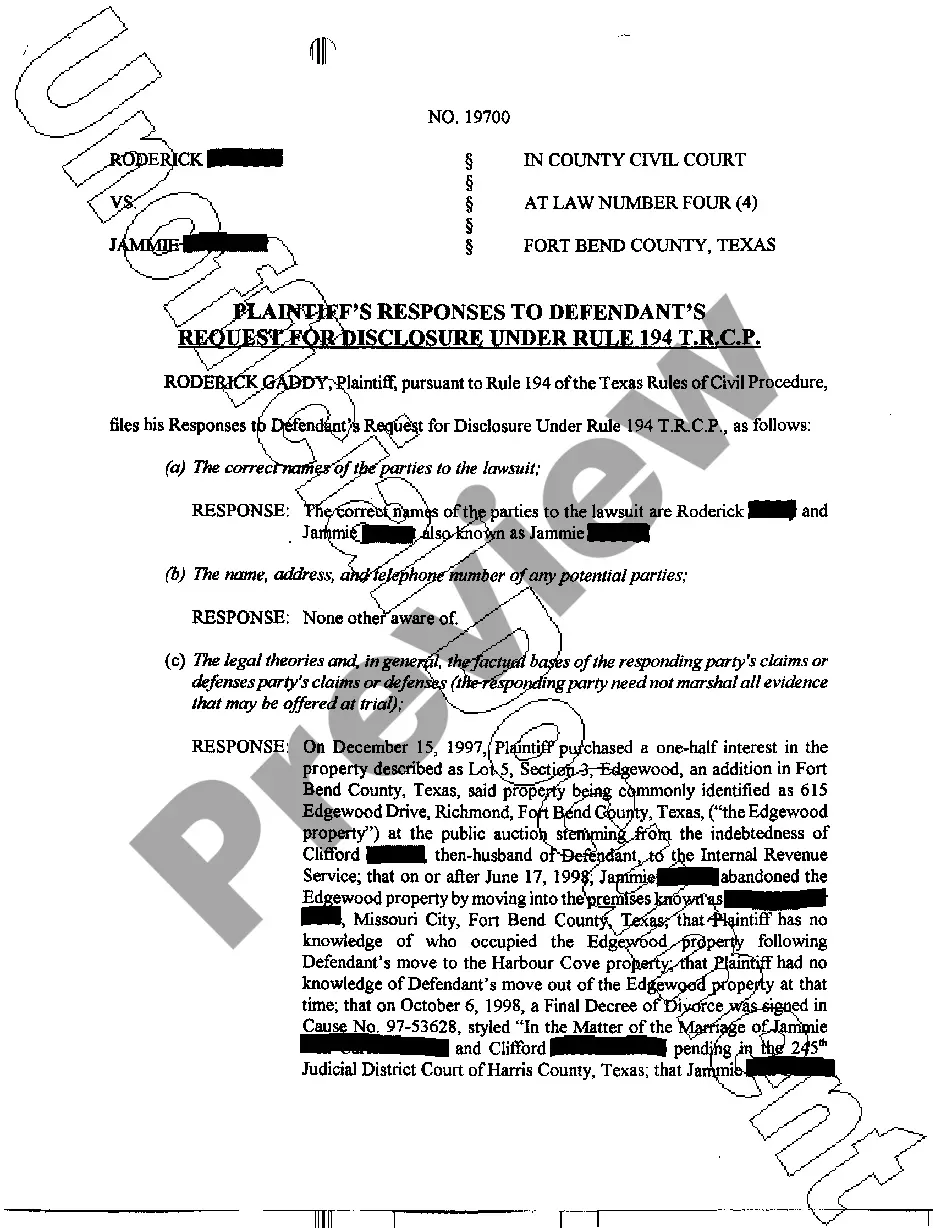

Choosing the best authorized file design can be quite a have difficulties. Of course, there are a variety of layouts available on the Internet, but how do you obtain the authorized kind you need? Utilize the US Legal Forms internet site. The assistance offers a huge number of layouts, such as the Tennessee Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment), that can be used for business and personal needs. Every one of the forms are checked out by pros and satisfy federal and state demands.

Should you be presently signed up, log in in your bank account and click on the Download switch to find the Tennessee Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment). Use your bank account to check throughout the authorized forms you might have purchased in the past. Visit the My Forms tab of your own bank account and acquire another backup of your file you need.

Should you be a fresh customer of US Legal Forms, listed below are basic instructions that you should comply with:

- Initially, make certain you have chosen the correct kind for your city/area. It is possible to look over the shape using the Preview switch and look at the shape description to make certain this is basically the right one for you.

- In case the kind will not satisfy your needs, take advantage of the Seach industry to obtain the correct kind.

- Once you are sure that the shape is acceptable, go through the Get now switch to find the kind.

- Opt for the costs strategy you would like and enter the necessary information. Design your bank account and pay for the order with your PayPal bank account or credit card.

- Opt for the submit formatting and down load the authorized file design in your product.

- Comprehensive, change and printing and indication the acquired Tennessee Partial Assignment of Oil and Gas Lease (Producing Lease. Reservation of Production Payment).

US Legal Forms is definitely the biggest library of authorized forms for which you can see different file layouts. Utilize the company to down load expertly-made paperwork that comply with status demands.

Form popularity

FAQ

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

ASSIGNMENT: The legal instrument whereby Oil and Gas Leases or Overriding Royalty interests are assigned or conveyed. ASSIGNMENT CLAUSE: A clause in any legal instrument that allows either party to the contract to assign all or part of his or her interest to others.

Is there more than one type of oil and gas lease? Yes, there are three types: a surface use lease, a non-surface use lease, and a dual purpose lease.

Partial Assignments: When an assignor conveys 100% record title interest in a portion of the lands in a lease, it creates a partial assignment. Partial assignments segregate the lease into two separate leases. Normally we assign a new lease number to the conveyed portion of the lease.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

Negotiating an oil and gas lease will require some research upfront. If you're a landowner interested in working with an oil and gas company, you should explore their history and experience. You'll want to work with a reputable company that works in your best interests, holds a high standard, and maintains insurance.

What is a Held-By-Production Clause? "Held by production" is a provision in an oil or natural gas property lease that allows the lessee, generally an energy company, to continue drilling activities on the property as long as it is economically producing a minimum amount of oil or gas.