A Tennessee Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage is a legal instrument that allows an individual or entity to transfer their overriding royalty interest to another party, who holds the working interest in a single lease in the state of Tennessee. This assignment is typically done in exchange for a stated percentage of the production or revenues generated from the lease. Keywords: Tennessee, Assignment, Overriding Royalty Interest, Working Interest Owner, Single Lease, Stated Percentage Different types of Tennessee Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage can include: 1. Absolute Assignment: This type of assignment involves the complete transfer of overriding royalty interest to a new owner, with no conditions or limitations attached. The working interest owner relinquishes all rights and benefits associated with their overriding royalty interest. 2. Partial Assignment: In this scenario, the working interest owner transfers only a portion or specified percentage of their overriding royalty interest to the assignee. The assignee will then receive a corresponding percentage of the production or revenues generated from the lease. 3. Assignment with Reserved Interest: This type of assignment allows the working interest owner to transfer a portion of their overriding royalty interest while reserving the right to receive a specific percentage or share of future production or revenues. The assignee will receive the remaining percentage. 4. Assignment with Diversionary Interest: In this case, the working interest owner transfers their overriding royalty interest to the assignee but retains the right to reclaim or regain the interest after a specified period or event occurs, such as the expiration of the lease or the fulfillment of certain conditions. 5. Assignment with Restrictions or Conditions: This type of assignment involves the transfer of the overriding royalty interest to the assignee, but with certain restrictions or conditions attached. These restrictions can include limitations on the use, transfer, or assignment of the interest, or requirements for reporting and consent from the working interest owner. It is important to carefully review and understand the terms and conditions of any Tennessee Assignment of Overriding Royalty Interest in Working Interest Owner, Single Lease, Stated Percentage before entering into an agreement. Consulting with legal professionals knowledgeable in Tennessee oil and gas laws can ensure a thorough understanding of the assignment and its implications for both parties involved.

Tennessee Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage

Description

How to fill out Tennessee Assignment Of Overriding Royalty Interest By Working Interest Owner, Single Lease, Stated Percentage?

Choosing the right legitimate papers template can be quite a have difficulties. Needless to say, there are a variety of web templates accessible on the Internet, but how would you get the legitimate form you require? Utilize the US Legal Forms website. The support offers thousands of web templates, like the Tennessee Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage, which you can use for company and private needs. Each of the types are inspected by experts and satisfy state and federal needs.

When you are currently registered, log in to the account and click the Obtain switch to get the Tennessee Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage. Use your account to search throughout the legitimate types you might have ordered formerly. Proceed to the My Forms tab of your own account and acquire one more copy of your papers you require.

When you are a brand new consumer of US Legal Forms, here are basic recommendations so that you can adhere to:

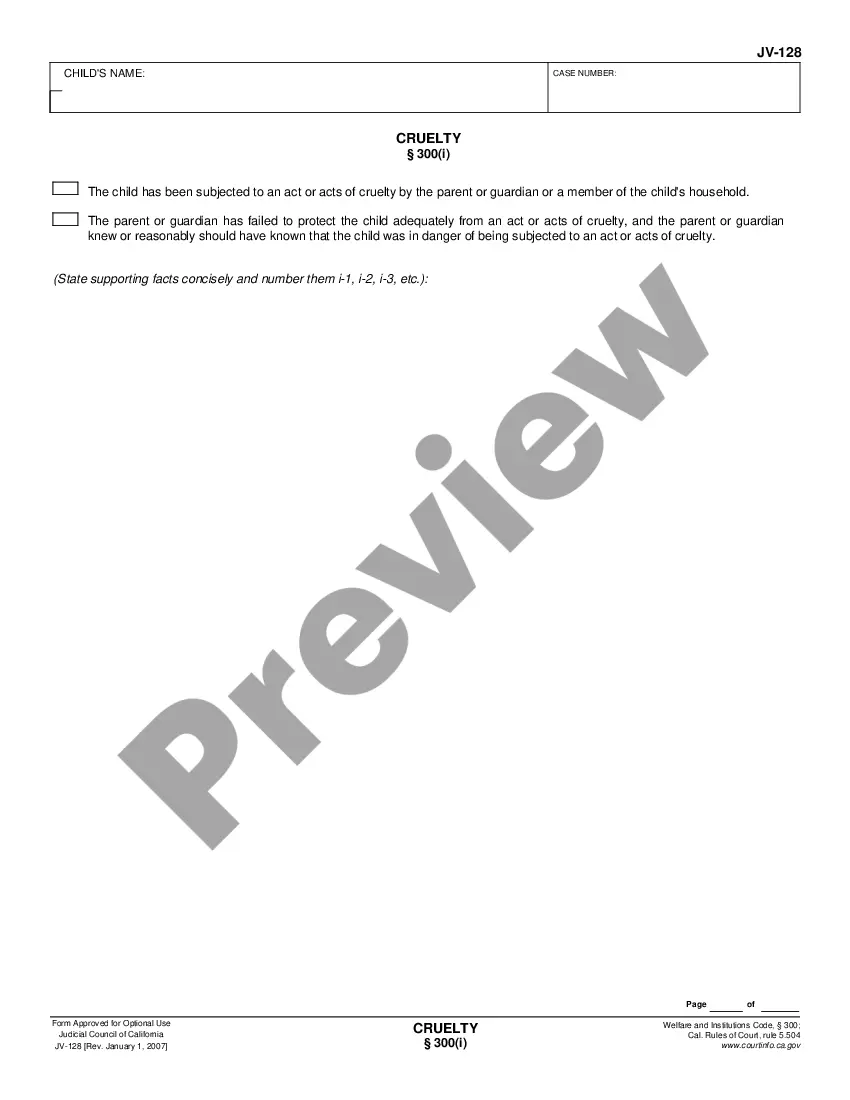

- Initially, ensure you have selected the right form to your area/region. You are able to check out the form utilizing the Review switch and study the form outline to guarantee it will be the best for you.

- If the form does not satisfy your requirements, take advantage of the Seach discipline to obtain the proper form.

- When you are positive that the form would work, select the Get now switch to get the form.

- Select the costs strategy you want and enter in the essential details. Make your account and pay for the transaction using your PayPal account or Visa or Mastercard.

- Pick the submit formatting and download the legitimate papers template to the product.

- Total, edit and print out and indicator the received Tennessee Assignment of Overriding Royalty Interest by Working Interest Owner, Single Lease, Stated Percentage.

US Legal Forms is the greatest library of legitimate types for which you can find various papers web templates. Utilize the service to download appropriately-manufactured paperwork that adhere to state needs.